While Ethereum (ETH) is taking a breath before the next leg of its rally, one level of resistance has turned into support. Bulls managed to protect $4,250 from massive seller pressure over the last two weeks.

Ethereum (ETH) price: Support at $4,250 looks strong

Ethereum (ETH), the second-largest cryptocurrency, is down by a negligible 0.2% in the last 24 hours. As the performance of all major crypto assets becomes apathetic, Ethereum (ETH) follows suit.

The Ethereum (ETH) price is sitting at $4,419 as of press time, with 24 hour trading volume dropping to $36.15 billion in equivalent.

In the last 14 days, Ethereum (ETH) bulls managed to establish $4,250 as a strong support level for the ETH price. Since reaching it on Aug. 22, 2025, bulls have not allowed sellers to push the Ethereum (ETH) price lower.

Ethereum (ETH) support at $4,250 survived seven stress tests in 14 days. Most likely, this is an indicator of persistent interest from buyers. As such, Ethereum (ETH) might continue its rally in Q4, 2025.

Ethereum (ETH) reached a new ATH on Aug. 24, 2025 at $4,953.

Ether tops Bitcoin in trading volume for the first time in seven years

In August, a super-rare event was observed on cryptocurrency spot trading platforms. Ethereum (ETH) exceeded Bitcoin (BTC) by trading volume on the monthly time frame (with the seven-day moving average) for the first time in seven years.

In August 2025, Ethereum (ETH), the biggest programmable blockchain, logged $408 billion equivalent in trading volume, while Bitcoin (BTC) only hit $400 billion.

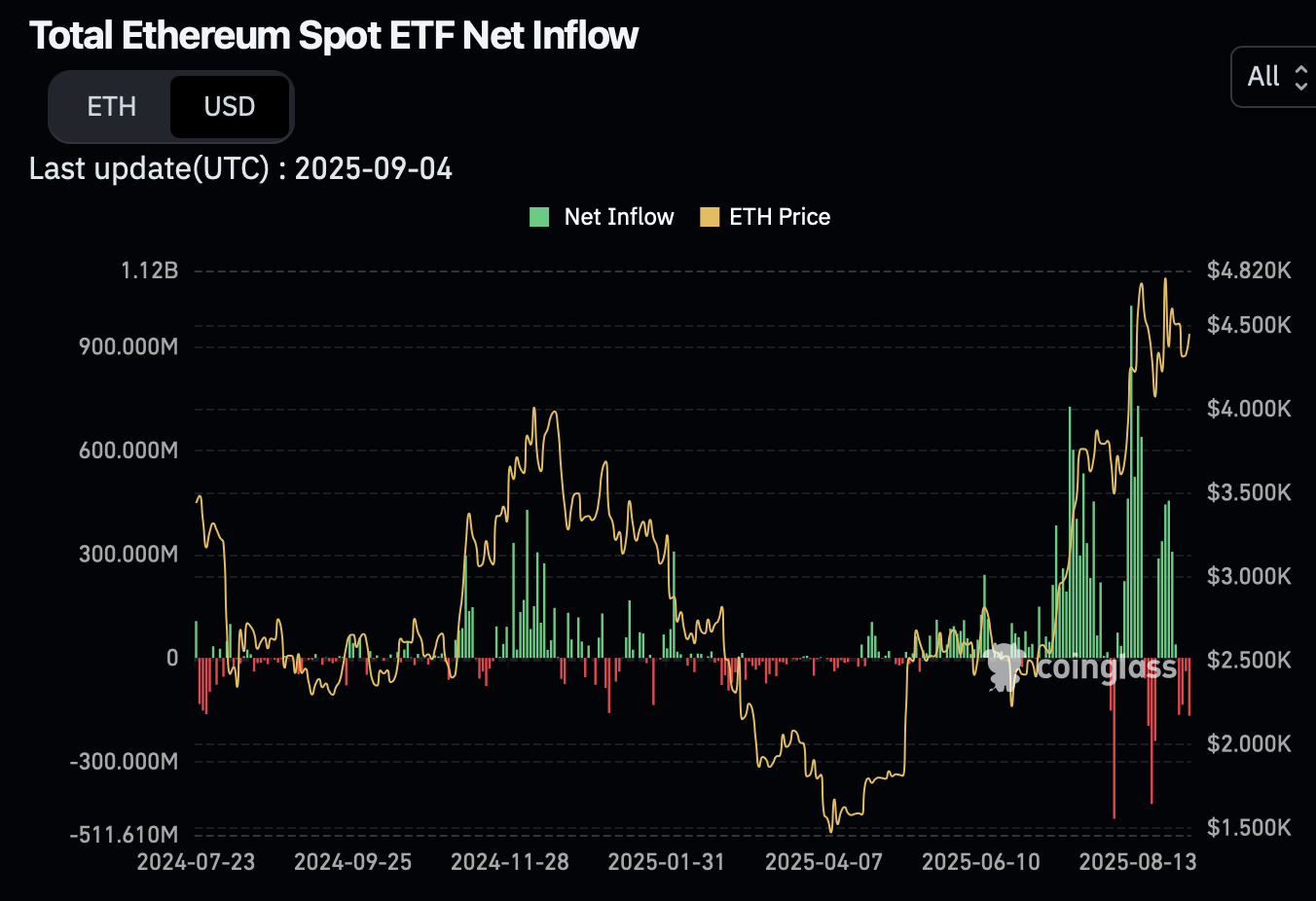

Such an imbalance might be triggered by the "altcoin season" narrative dominating cryptocurrency sentiment. Based on ETF inflows statistics, traders and investors are actively moving funds from the Bitcoin (BTC) to the Ethereum (ETH) ecosystem, as the local peak for Bitcoin (BTC) might be in.

As covered by U.Today previously, Bitcoin Spot ETFs have registered the plummeting inflows since mid-July 2025. By contrast, Ethereum Spot ETFs witnessed a new daily inflow record with $1.02 billion injected on Aug. 11.

Malefactors hide malicious links in Ethereum (ETH) software

As unveiled by security researchers from Reversing Labs, hackers injected malicious code into Node Package Manager, the default package manager for JavaScript runtime environment Node.js. Simply put, this is software used to develop and run smart contracts on the Ethereum (ETH) blockchain and other Ethereum Virtual Machine networks.

As the victim downloads the NPM open-source "patches," it might make their smart contract call a website with malicious commands.

The same tactics were used by the attackers who infiltrated the Solana (SOL) dApps templates available for downloading. For instance, one popular repository with the Solana trading bot code was also infected by such links.

As covered by U.Today previously, as cryptocurrency prices surge, new attacks and hacks take place several times a week. Losses from August 2025 hacks only exceed $168 million in equivalent.

WLFI blacklisted Justin Sun's wallets, here's response

The distribution of WLFI, a hotly anticipated token by World Liberty Financial group, ended with a scandal. Tron founder Justin Sun, one of the most prominent cryptocurrency entrepreneurs in the world, saw his allocation frozen by the organizers of the distribution.

Allegedly, the WLFI team accused Justin Sun of potentially dumping the token, pushing its price lower.

In his response, Justin Sun stated that he was one of the earliest major investors in World Liberty Finance, devoted to building a strong and healthy WLF ecosystem.

He asked the team to immediately unblock his wallets with all WLFI tokens he received.

The WLFI price dropped to $0.19, down 19% since launch. Still, crypto is in the top 30 by market capitalization, with FDV exceeding a whopping $19 billion.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov