Coinbase, an $8 bln crypto startup, is enjoying hegemony on the US market with more than 8.5 mln of its users coming from the US. For comparison, Binance, a major competitor of the Brian Armstrong-led exchange, has only 3.3 mln users.

Coinbase asserting its dominance

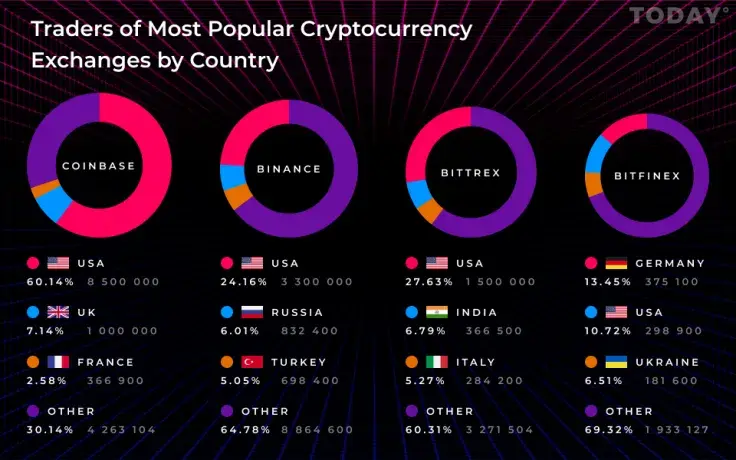

A brand-new DataLight study highlights the major markets of four most popular cryptocurrency exchanges (Coinbase, Binance, Bittrex, and Bitfinex). Not surprisingly, Coinbase rules the roost when it comes to the Anglosphere (60.14 percent of its users come from the US and 7.14 percent come from the UK).

Earlier, U.Today revealed that the San Francisco-based exchange leads the pack by both desktop and mobile users.

Beyond the US

Binance has a sizably smaller share of US users – 24.16 percent, but it excels in other markets, such as Russia (6.01 percent) and Turkey (5.05 percent).

When it comes to Bitfinex, the US is not even its largest market – Germany takes first place with 13.45 percent. Meanwhile, Bittrex has plenty of traders from India despite the infamous RBI crypto ban.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin