Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

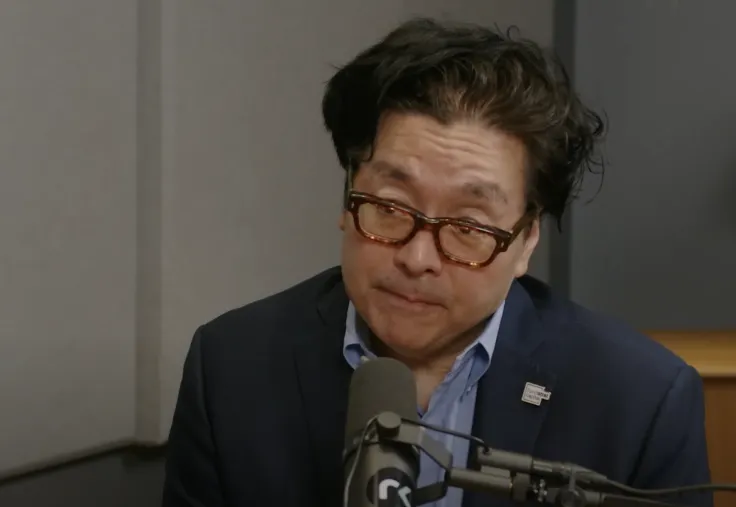

Permabull Tom Lee believes that the diffusing trade tensions between the US and China will benefit Bitcoin, Ethereum, as well as US equities.

Bitcoin reached an intraday high of $113,851 earlier this Sunday, according to CoinGecko data.

In the meantime, the Ether price came awfully close to reclaiming the $4,100 level.

Is a full-fledged US-China trade deal happening?

Earlier this month, risk assets took a severe beating after the White House announced 100% tariffs on the world's second-largest economy. The total amount of liquidated crypto briefly surpassed $19 billion within just 24 hours, which was the largest cryptocurrency wipeout ever.

However, some recent reports show that there are clear signs of de-escalation following high-level talks during the ASEAN summit in Malaysia.

The Washington Post reported earlier today that the US had agreed to postpone 100 tariffs, citing a recent interview with Treasury Secretary Scott Bessent.

In turn, China has agreed to delay controversial curbs on rare earth metals by a year.

There is renewed optimism that a full-fledged trade deal between the two superpowers could happen in the near future.

Renewed bullishness

According to 10x Research, there is renewed optimism around potential Federal Reserve rate cuts after a recent CPI report indicated weaker-than-expected inflation.

However, the fact that Bitcoin remains below the 30-day moving average is viewed as a rather bearish sign.

The cryptocurrency is still down roughly 10% from the all-time peak of $126,080 that was logged earlier this month.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin