Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

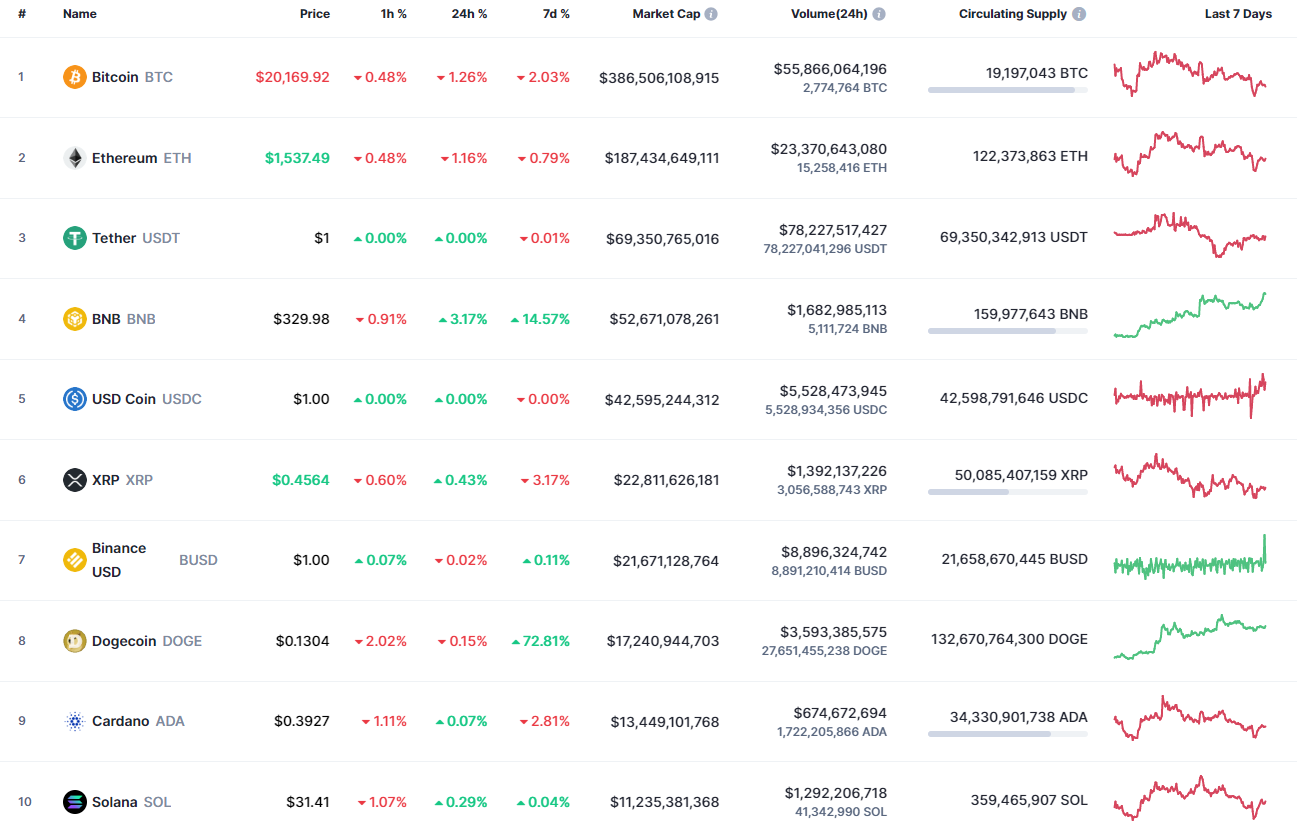

The cryptocurrency market is trading sideways after yesterday's FED decision to increase the interest rate by 0.75%.

BTC/USD

The rate of Bitcoin (BTC) has dropped by 1.33% over the last 24 hours.

On the daily chart, Bitcoin (BTC) keeps falling after a false attempt to fix above the $21,000 mark. At the moment, one should pay attention to the zone around $20,000.

If bulls lose it, there are chances to see a return to the midterm bearish trend. Such a scenario is relevant until the end of the week.

Bitcoin is trading at $20,123 at press time.

ETH/USD

Ethereum (ETH) could not withstand the fall of Bitcoin (BTC), going down by 1.49%.

Ethereum (ETH) has lost the $1,550 mark, which means that bears have locally seized the initiative. If the daily candle closes near yesterday's low at $1,503, the fall may may lead to the $1,450 area within the next few days. In addition, the volume is declining, confirming bulls' weakness.

Ethereum is trading at $1,527 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov