Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The bears' influence is still relevant, according to CoinStats.

BTC/USD

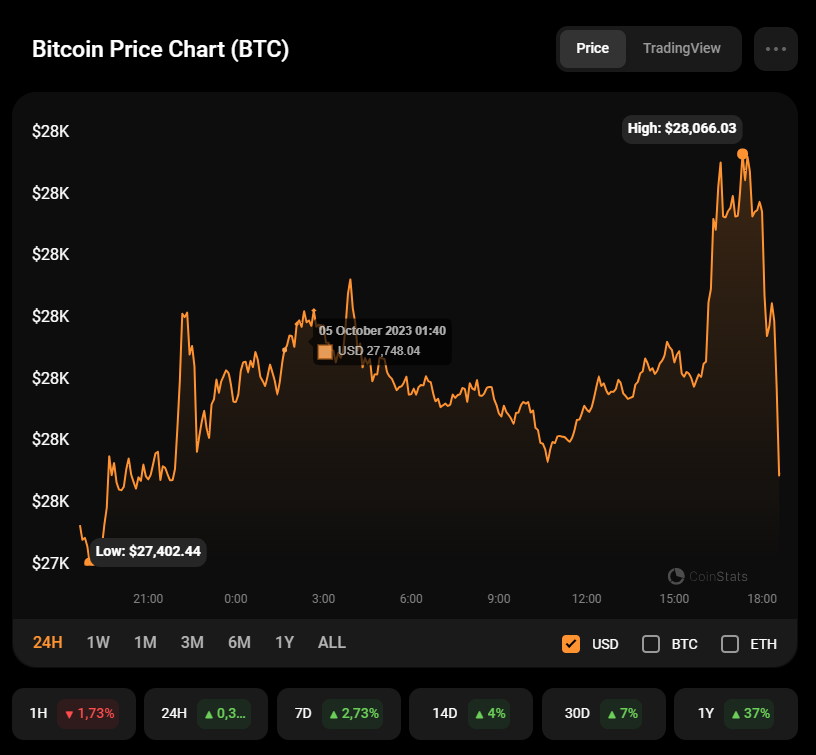

The rate of Bitcoin (BTC) has increased by 0.24% over the last 24 hours.

Despite today's rise, BTC is looking bearish on the hourly time frame. The price has broken the recently formed support level of $27,560. If the daily bar closes below it, the drop is likely to continue to the $27,000 area.

Bulls have once again failed to keep the rise going after a bullish candle closure. However, none of the sides has seized the initiative yet.

In this case, sideways trading in the area of $27,000-$28,000 is the more likely scenario until the end of the week.

A similar picture can be seen on the weekly time frame. The volume is low, which means that there are high chances of seeing a consolidation of BTC with no sharp moves. Buyers may start thinking about a possible midterm reversal only if the rate gets back to the $29,000 area and fixes above it.

Bitcoin is trading at $27,593 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin