Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

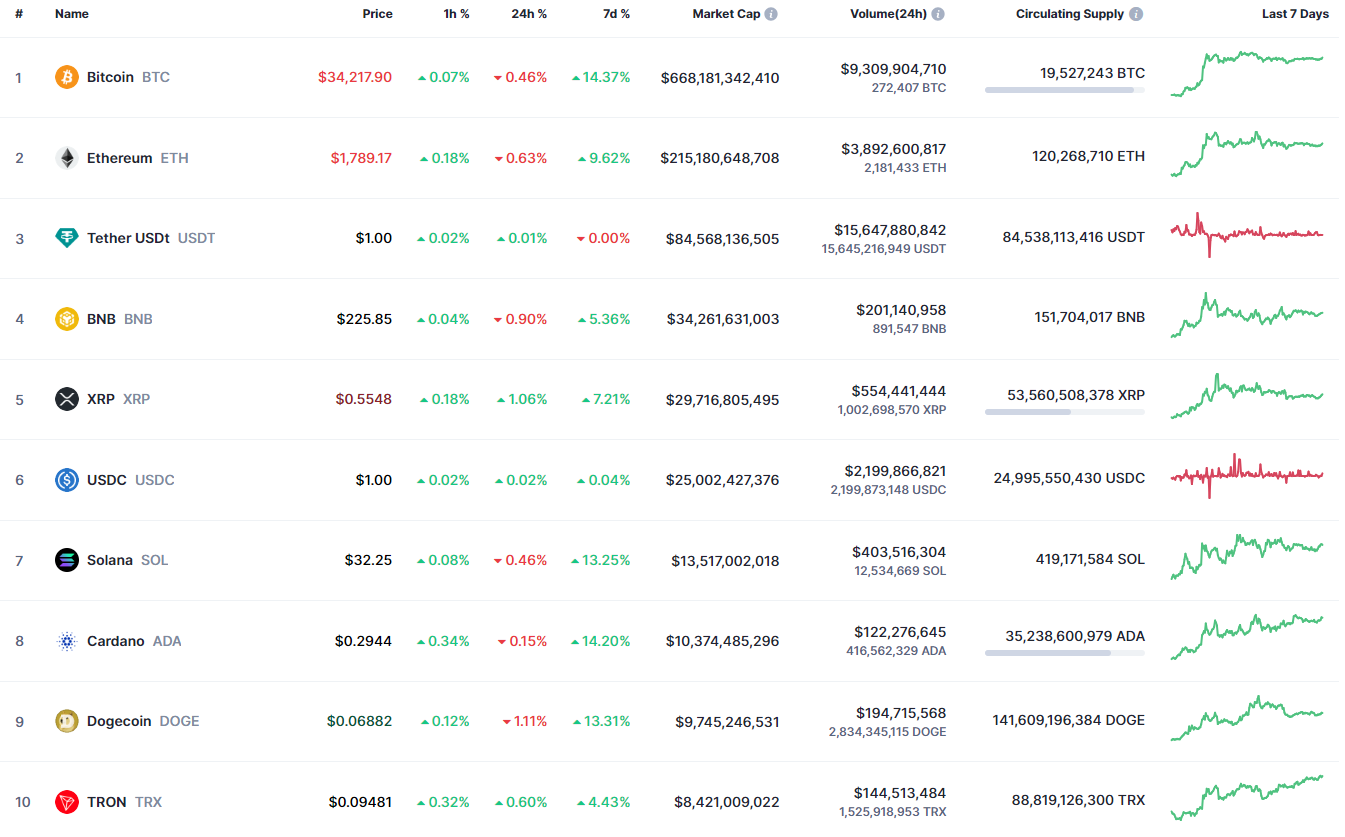

The cryptocurrency market is mainly trading neutrally on the last day of the week.

BTC/USD

The rate of Bitcoin (BTC) has fallen by 0.46% since yesterday. Over the last week, the price has risen by 14.37%.

Despite today's slight fall, the price of BTC is looking bullish on the hourly chart. The rate is trying to fix above the local resistance of $34,279. If that happens, the upward move may continue to the $34,500 zone soon.

A different picture is on the daily time frame. The price of BTC keeps rising after a false breakout of the support level of $33,686. However, it remains far from the resistance.

If today's bar closes near $34,500, there is a chance to see a test of the $35,000 zone within the next few days.

On the weekly chart, the bar is about to close in the bullish zone. While the rate remains above the $31,500 level, buyers are more powerful than sellers. In this case, traders are likely to see a test of $36,000 next month.

Bitcoin is trading at $34,297 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov