Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

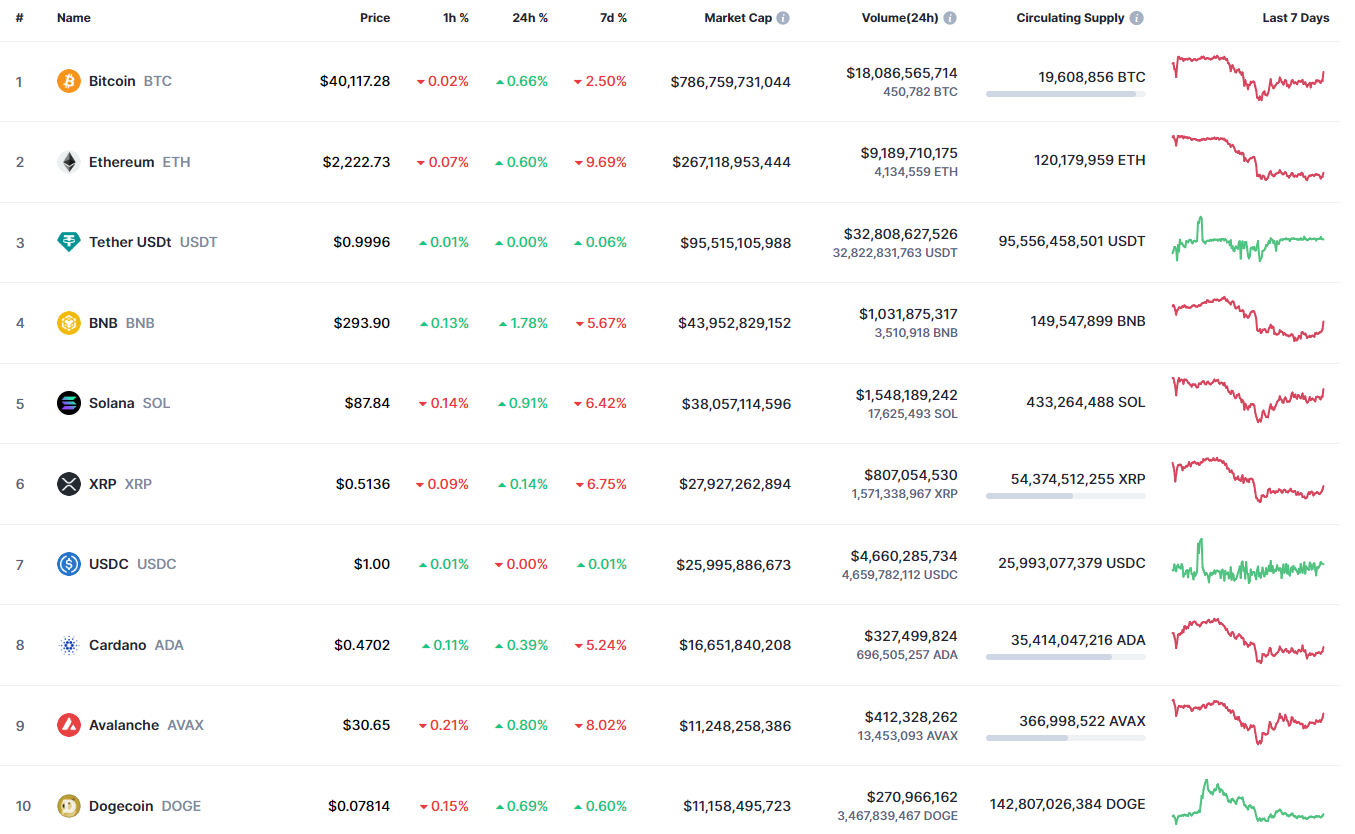

Most of the coins have come back to the green zone, according to CoinMarketCap.

BTC/USD

The rate of Bitcoin (BTC) has increased by 0.66% over the last 24 hours.

On the hourly chart, one should pay attention to the local resistance level of $41,257. If the daily candle closes around it, there is a chance to see a breakout, followed by a further rise to the $42,000 zone.

On the bigger time frame, the rate of BTC keeps rising after a false breakout of the support level of $39,437. However, there low chances of seeing a further rise, as the main crypto has not accumulated enough energy yet.

In this case, sideways trading in the area of $41,000-$43,000 is the more likely scenario for the next few days.

From the midterm point of view, traders should pay attention to the bar closure in terms of the previous candle low. If it happens far from it, the upward move is likely to continue to the $45,000 range.

Bitcoin is trading at $41,105 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin