Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

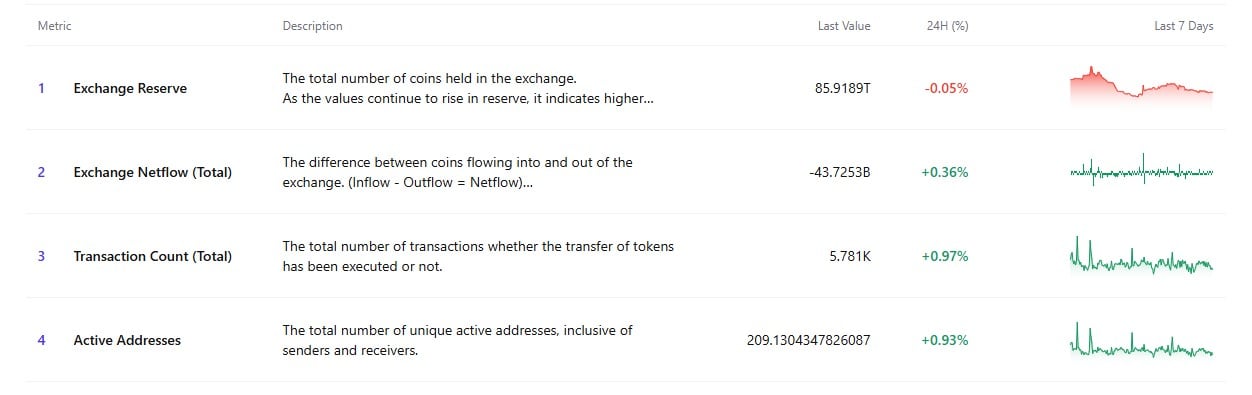

The data behind Shiba Inu's recent surge in exchange activity — nearly 54 billion tokens moved in a single day — could be the last bullish signal left for the asset. On-chain metrics reveal a significant drop in exchange reserves, which have dropped by 0.05% to 85 trillion SHIB, while netflow is negative at -43 trillion. Because more tokens are leaving exchanges than entering, there is less pressure on the open market to sell.

Exchanges stay volatile

Generally speaking, these outflow periods correspond with lower downside volatility and, more significantly, accumulation stages that come before rallies. In addition, the number of transactions increased by almost 1% in a 24-hour period, and the number of active addresses increased by 0.93%, indicating that network activity is increasing.

This is important because SHIB has been stagnating for the past few weeks, forming a big symmetrical triangle pattern. At this point, rising activity indicates that traders are getting ready for a bigger move.

SHIB market performance

SHIB is still confined, technically speaking, between the rising support trendline below and its 200-day EMA above. The recent loss of $0.000013 reduced short-term bullish momentum, but strong buyer defense was demonstrated by the bounce from the $0.0000128 zone. SHIB might generate enough demand to confront the $0.000014 resistance zone, which also coincides with the descending trendline, if the negative exchange netflows continue.

SHIB might move toward $0.000016-$0.000017 if there is a breakout there. The downside risk, on the other hand, consists of a decline back toward $0.0000117 and possibly adding another zero if selling pressure suddenly increases and volumes decline, and SHIB loses support at $0.0000125. However, for the time being, the combination of increasing activity, decreasing exchange supply and improving network metrics raises the possibility that investors are subtly setting up for an upside breakout.

Since SHIB is at a pivotal point, it will probably be decided in the coming sessions whether or not this accumulation actually leads to a rally.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin