Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

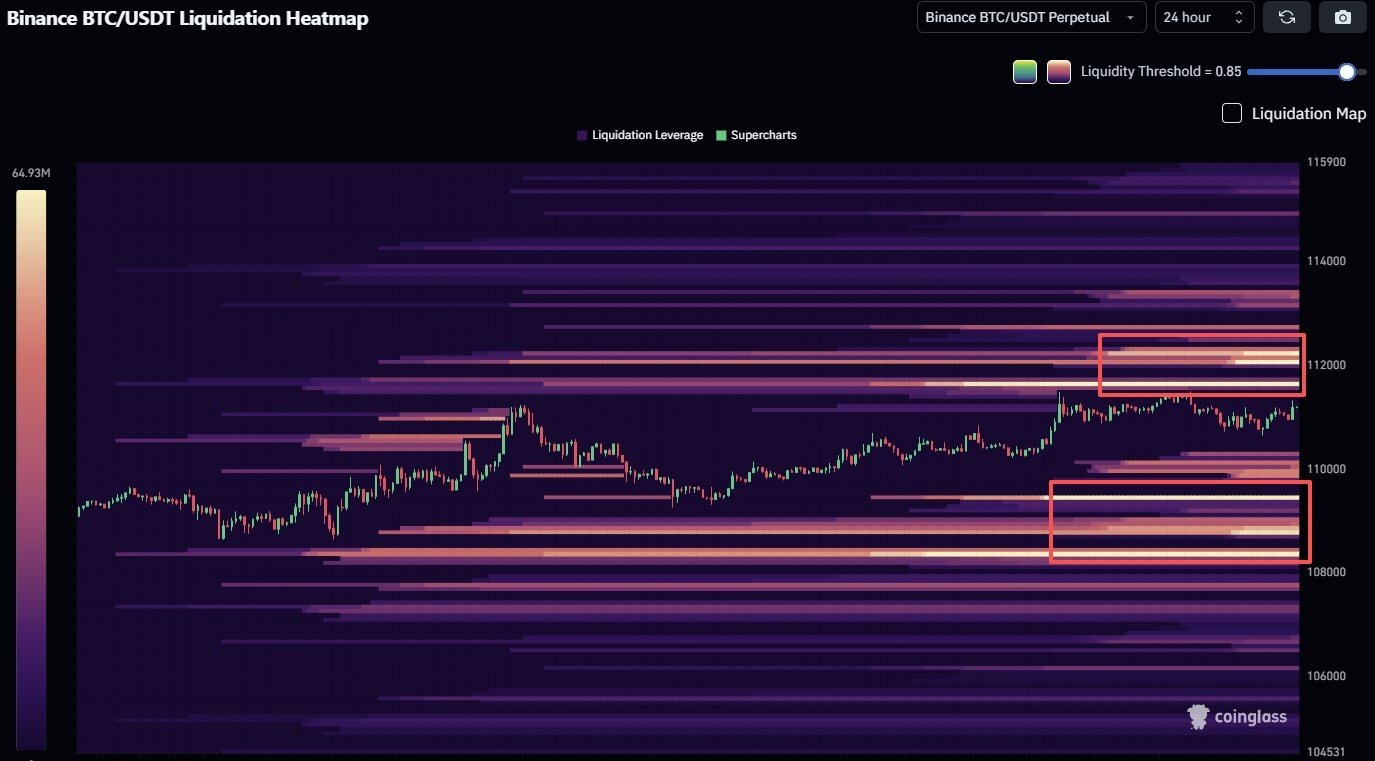

The price of Bitcoin has been settling in the $111,000 range, but as the weekend draws near and liquidity is predicted to diminish, volatility may increase significantly. Bitcoin could easily fluctuate between these critical liquidation levels during low-volume hours, so traders should closely monitor them, according to data from CoinGlass.

Key zones to track

Five major price zones that could serve as volatility magnets are highlighted on the liquidation heatmap.

The Major Downside Liquidity Pool is worth between $108,000 and $108,500. This is the most prominent cluster of long liquidations. A series of lengthy liquidations could quickly drive Bitcoin toward $108,000 if it falls below that level. It is an important area of support that has recently shielded Bitcoin several times. A clean break below it could cause temporary anxiety.

$110,000 (Weekend Pivot/Neutral Zone): This level has been used as a liquidity balancing zone and a midpoint. If Bitcoin remains above $110,000, stability is indicated. But if it falls below that level, there could be a liquidity sweep into the $108,000 range.

Advertisement

The short liquidation zone is between $111,500 and $112,000. Short positions are moderately concentrated just above this level. A surge of short liquidations may push the price of Bitcoin toward the next significant resistance level if it breaches $112,000 again.

$113,000 to $113,500 (Area of Resistance to Target): The next pocket of liquidity above the current price is indicated by this range. This is where you should anticipate possible profit-taking or significant short pressure, particularly if weekend volatility spikes quickly.

$114,500-$115,000 (Short Cluster at High Risk): The longest short liquidation zone that is visible. Forcible liquidations may drive a sharp increase in price toward $118,000 to $120,000 if Bitcoin is able to break through this range.

Advertisement

Given that Bitcoin is trading closely between moving averages, and the market is generally cautious, traders should anticipate steep, liquidity-driven wicks over the weekend. Because the Saturday and Sunday sessions usually have thin order books, these areas could be flashpoints for both short squeezes and liquidation cascades, which means the next move could be harder and faster than anticipated.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov