No more than 15 hours ago, 277,731,894 Dogecoin (DOGE) worth over $29.48 million were transferred to one of the biggest U.S. brokerage platforms, Robinhood, as DOGE battles to stay above its multiweek support level of $0.106.

At first, the transfer appeared to originate from an unidentified "whale" wallet with no recent transaction history. Of course, the transaction was immediately flagged by Whale Alert due to its scale and destination — Robinhood, one of the largest DOGE custodians globally.

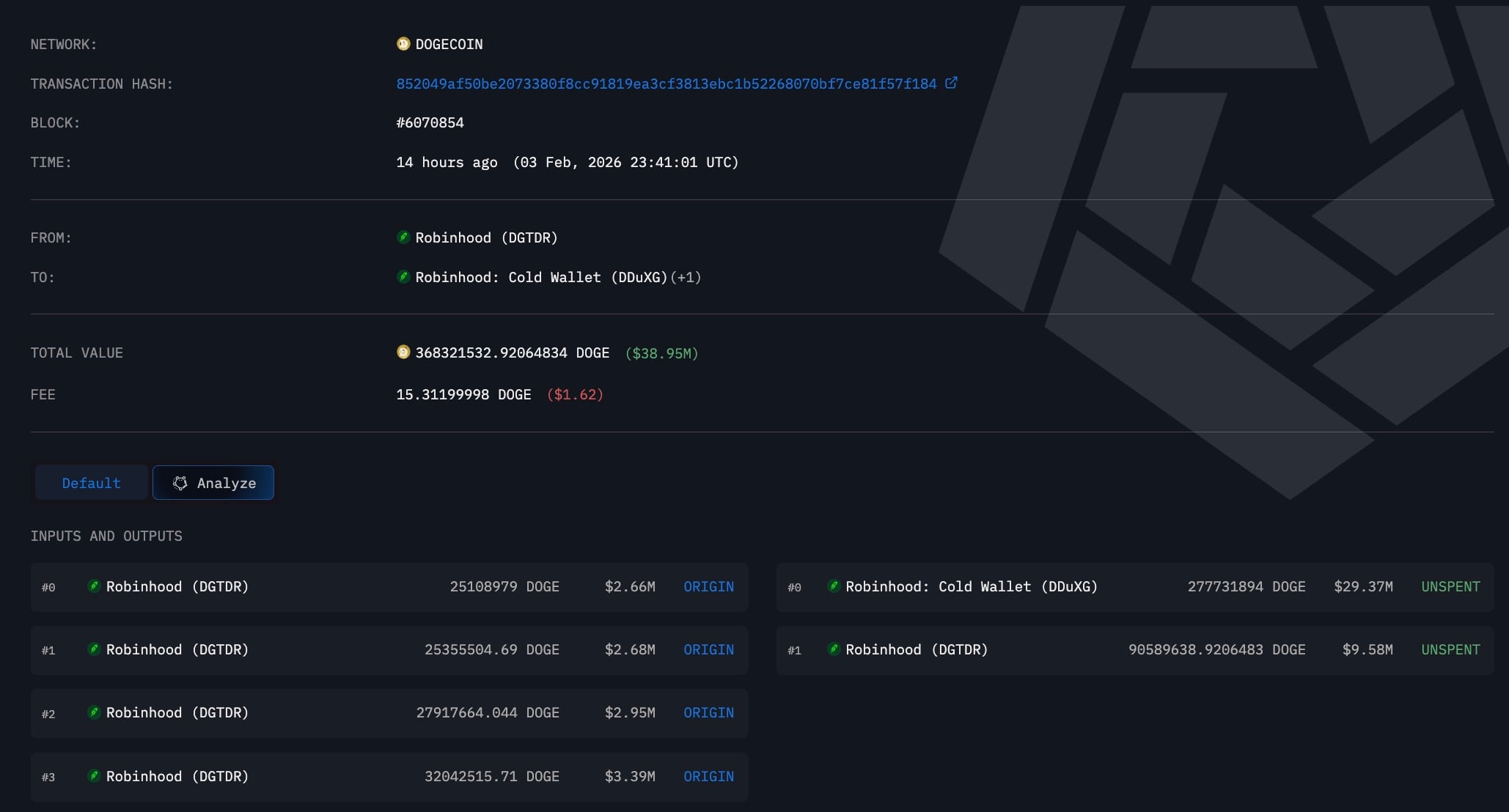

However, deeper blockchain analysis, through Arkham, revealed a more complex situation. Not only did the sender address (DGTDR) hold over 865 million DOGE prior to the transaction, but it also engaged in a series of mirrored transfers, including a 90.5 million DOGE move and multiple round trip transactions between itself and the wallet that received the $29 million.

This behavioral pattern, along with transaction cluster data, strongly suggests that both wallets are part of Robinhood’s internal infrastructure.

What's brewing for Dogecoin on Robinhood?

Further supporting evidence includes a separate transaction logged 13 hours earlier showing 36.8 million DOGE valued at $38.95 million moving from the same source into Robinhood’s labeled cold wallet, all under the same cluster.

While these movements now appear to be internal, they still have real market impact. Large transfers between custodial wallets often precede system-wide rebalancing or front-running expected user flows, both of which can trigger turbulence on the Dogecoin price chart.

With Elon Musk reentering the DOGE narrative and speculation heating up, observers are treating every major on-chain movement as a signal. Shifting 277 million DOGE to a high-velocity trading venue like Robinhood sends a message: someone’s preparing for action.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov