Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

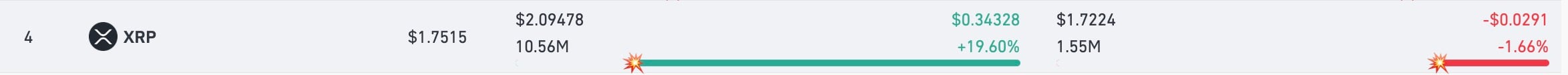

After a wild week, XRP is now really close to a full long leverage reset, but the bear side of the market seems to have missed this detail amid all the turbulence of the "crypto winter" in January. As CoinGlass data proves, with a current price of about $1.74, XRP is just 2.14% away from hitting its "max pain" threshold of $1.7224.

On the other side is a 20.13% climb toward the max pain of the short sellers right at the "sweet" spot of $2.09478 per XRP. Considering the essence of the $2 threshold for XRP, and crypto marker's old prophecy — "the most entertaining outcome is the most likely" — stage seems to be set for the altcoin to trigger millions worth of bears' margin calls in February.

As a matter of fact, short positions are now almost 10 times larger than longs, creating a powder keg under any upside impulse.

XRP may be behind Solana, Ethereum and Bitcoin in terms of net pain metrics but has one of the tightest long proximity triggers on the chart. While bears are getting comfortable, the danger is not from a collapse; it is from a grind higher that resets everything.

Bear euphoria meets XRP price math

XRP lost the $1.89 structural level this week and rejected twice below $1.93. But instead of collapsing, the chart is accumulating around the $1.72-$1.76 liquidity band, refusing to flush further. Squeeze rallies tend to start with a stall, followed by a sharp breach once fuel accumulates. In this case, "fuel" means short margin exposure.

If the XRP price hits $2 in February, it'll be the highest number for bears in a month. If the price even taps $2.0947 again, it will unwind 20.13% of the short-side pressure in a single wave.

The only thing missing is a stable funding rate and optimism on the market. Once these conditions are set, the bears' lead may quickly get recalculated in max pain math.

Godfrey Benjamin

Godfrey Benjamin Denys Serhiichuk

Denys Serhiichuk Tomiwabold Olajide

Tomiwabold Olajide Dan Burgin

Dan Burgin