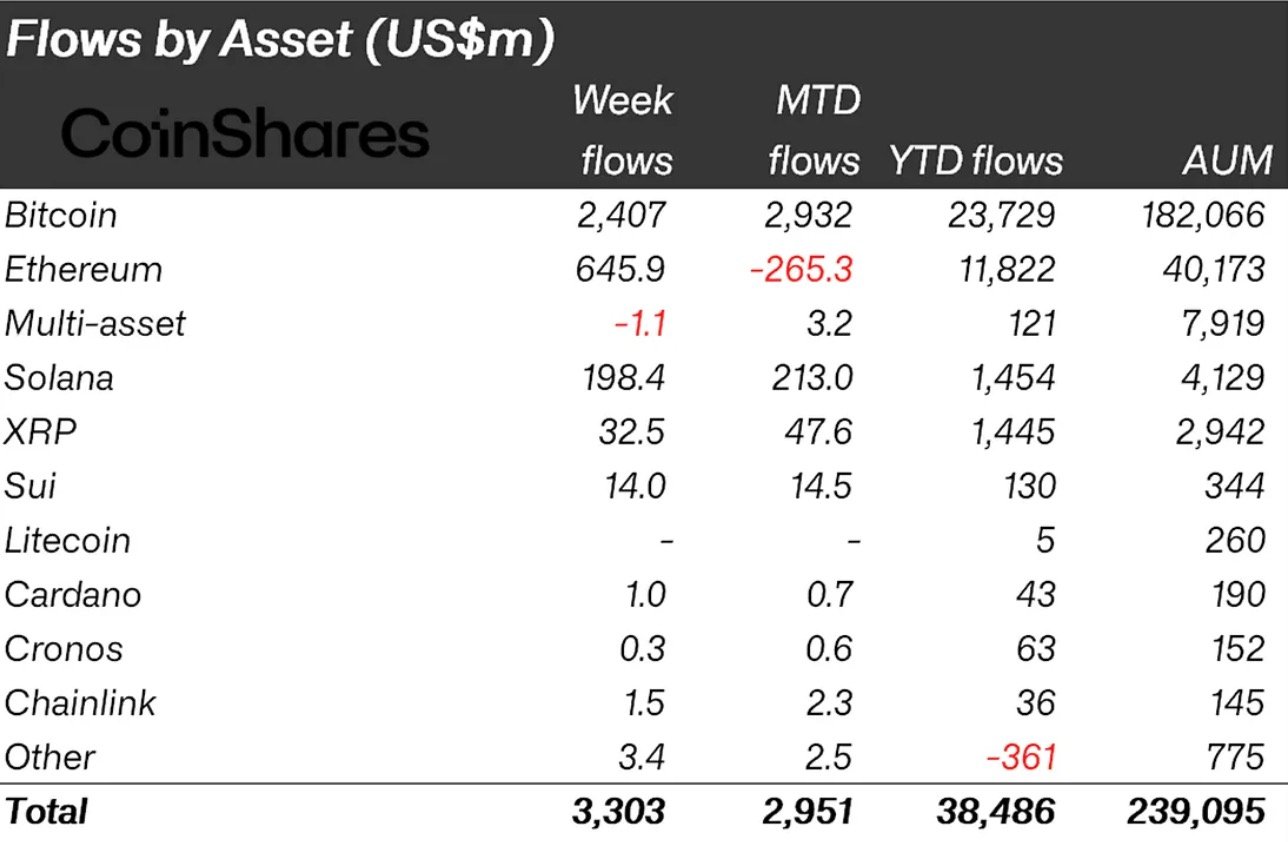

XRP investment products pulled in $32.5 million last week, more than double the $14.7 million recorded a week earlier, according to CoinShares. That 221% rise makes it one of the standout performers among digital assets, especially as fund inflows across the market picked up again after a quiet start to the month.

Bitcoin products continue to be the most popular crypto-tied investment opportunity, with $2.4 billion in new money, and Ethereum managed to stop losing funds by adding $645 million. Solana also made $198 million.

In the cut, XRP's rise looks smaller in dollar terms, but it has a higher growth rate than other currencies.

In September alone, XRP products attracted almost $48 million, taking the total for the year to date to $1.45 billion. The total value of assets under management that are linked to XRP is now $2.94 billion.

When XRP ETF?

The background is important. The SEC is expected to make a decision about several XRP ETF applications at the end of October. These include applications from Grayscale, 21Shares, Bitwise, CoinShares, Canary Capital and WisdomTree.

Traders are already expecting at least one approval, which could lead to much larger amounts of money being invested.

Nate Geraci, president of the ETF Store, said that spot XRP ETFs could attract as much as $5 billion in their first month of trading. He added that most people have not realized how big that number could be.

With those decisions only weeks away, the latest inflows into XRP funds may be a sign that institutional buyers are preparing early.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov