While the crypto fund complex just printed its first weekly outflow in four weeks, one line stayed green and even got bigger: XRP.

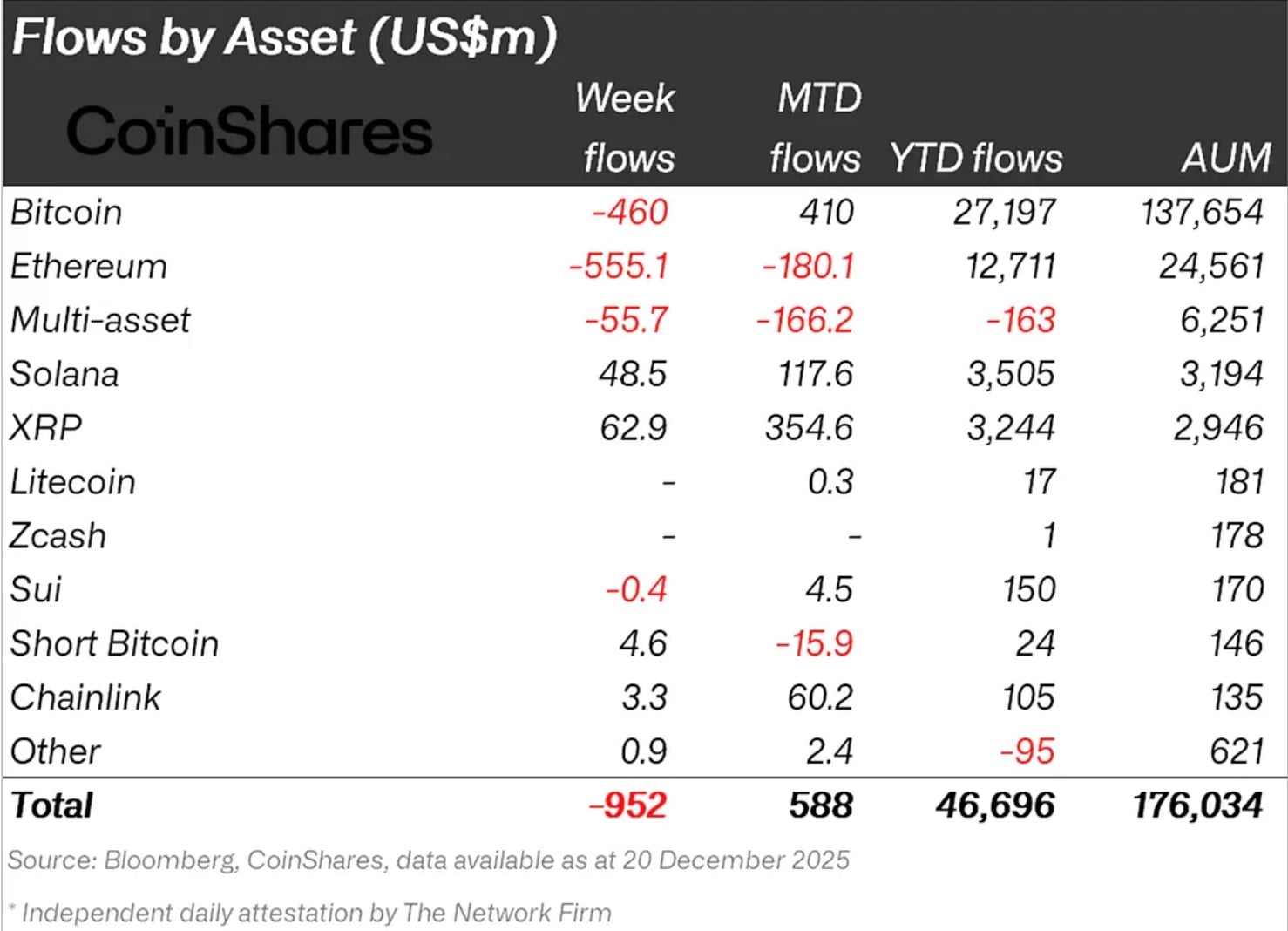

Fresh CoinShares' data for the week available shows digital-asset investment products losing $952 million, with Bitcoin taking $460 million of that hit, and Ethereum led the exits with $555.1 million, a pattern CoinShares ties to Clarity Act delays and the return of "whale selling" anxiety.

Inside that red week, XRP pulled in $62.9 million. That is a 34% jump from the prior week’s $46.9 million and the largest positive figure on the table, ahead of Solana’s $48.5 million. Month-to-date, XRP is sitting at $354.6 million of inflows, with $3.244 billion year-to-date and about $2.946 billion in assets under management.

U.S. spot ETF figures, as of Friday, tell a similar story in a different wrapper: total XRP spot ETFs logged $13.21 million in daily net inflow on Dec. 19, pushing cumulative net inflow to $1.07 billion, with total net assets at $1.21 billion and $58.90 million traded on the day. On the weekly view, Dec. 19 shows $82.04 million of net inflow, with $213.86 million in value traded.

How does XRP price react?

The price is not screaming yet, as XRP is drifting around $1.93 on Monday afternoon, after printing a $1.9381 high on the hourly chart.

The bigger tell is positioning: when the market is pulling money from Bitcoin and Ethereum, but still allocating fresh capital to XRP, institutions are signaling where they think regulatory time is being spent — and which coins they want exposure to while Washington keeps the calendar open.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov