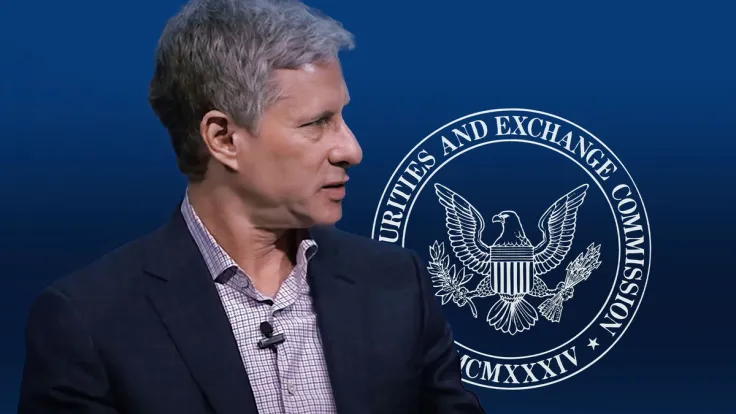

In a recent interview with Bloomberg, Chris Larsen, cofounder and current CEO of Ripple, shared his insights into the state of cryptocurrency regulation in the United States, with a particular focus on the ongoing XRP case.

Larsen expressed his concerns about recent federal decisions, which he believes have adversely affected San Francisco's role as a hub for blockchain innovation. He highlighted that the U.S. has lost its status as the global blockchain leader to cities like London, Singapore and Dubai.

Ripple and XRP v. SEC

Discussing the XRP case, Larsen stated that the SEC lost on everything that was important to them and important to the regulation of the industry. While acknowledging the ongoing appeals process, he characterized the case outcome as significant for Ripple and the cryptocurrency sector, suggesting that it marked a pivotal moment for the industry.

Larsen also criticized Gary Gensler, the head of the SEC, for what he viewed as a regulatory approach driven by enforcement rather than clear legislative guidelines. He argued that regulatory decisions as with Ripple, XRP or Bitcoin Spot ETF should be the purview of Congress.

We should have clear rules from the legislatures, not through the side of unelected power-hungry and really missed placed decision makers, as you see in Gary Gensler.

Advertisement

Responding to questions about alternative jurisdictions for crypto businesses, Larsen noted that many entrepreneurs were exploring options outside the U.S., citing countries like the UK, Singapore and the UAE. These countries offer well-defined regulatory frameworks that strike a balance between consumer protection and innovation, making them increasingly attractive to crypto start-ups.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov