Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

XRP just had one of the most extreme liquidation imbalances the market has seen in the last 24 hours in what has been a brutal display of unequal market exposure.

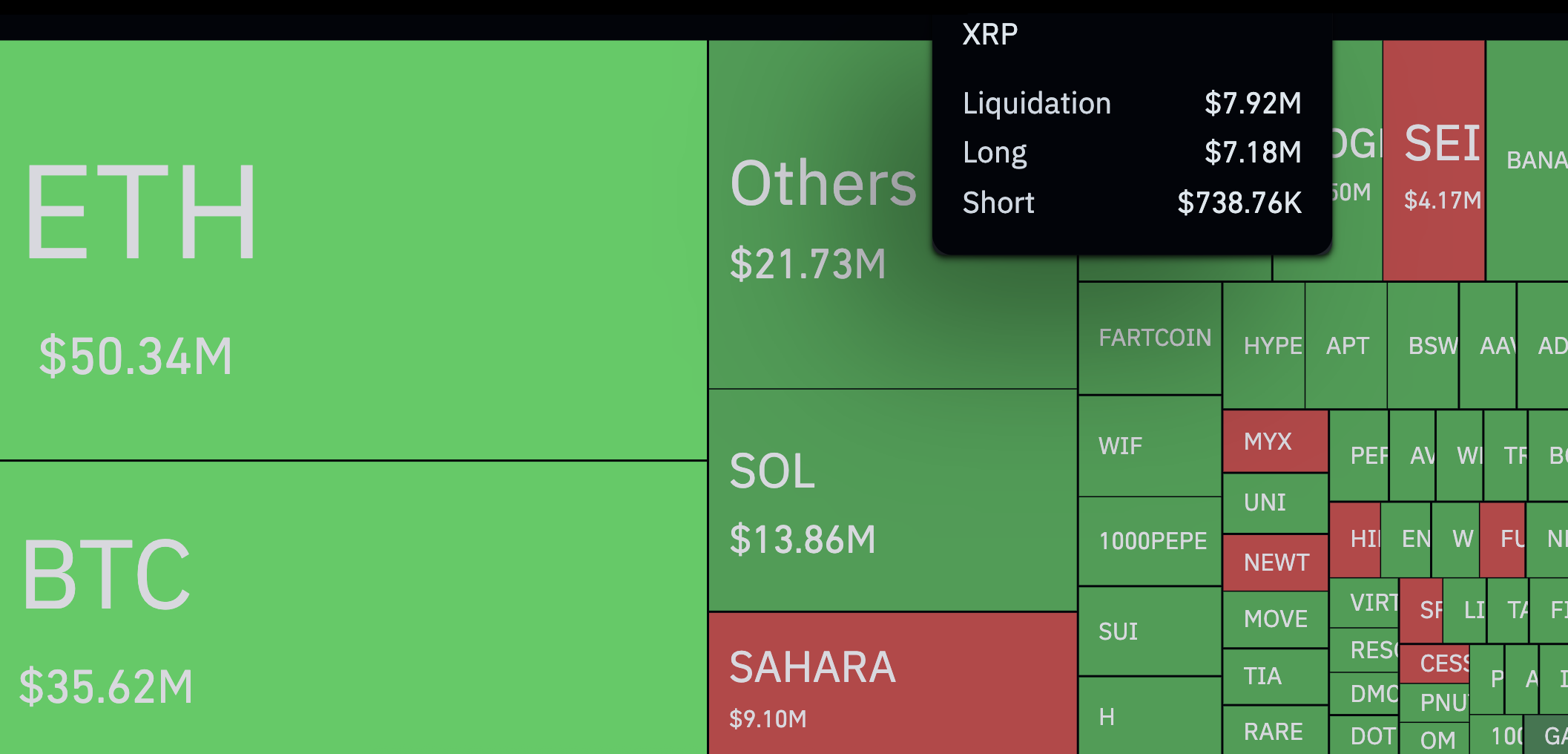

While $7.18 million in long positions were liquidated, according to CoinGlass, shorts walked away almost untouched at just $738,00. That is not just uneven — that is an almost 1,000% imbalance, with long traders taking nearly the entire hit.

It did not take a full-scale crash to trigger it. Yeah, XRP dropped around 4% at the same time, but for crypto it is hardly a big deal.

Still, for a market that is flooded with bullish bets, it was more than enough. When the price pulled back, it was just enough to trigger a wave of liquidations among a crowd that had clearly misread the market's momentum.

Other major cryptocurrencies saw higher liquidation volumes too — ETH and BTC were at $50.34 million and $35.62 million — but none of them came close to XRP's imbalance. If you look at the charts showing the XRP market, it is clear that it is a one-way street.

The long-side exposure was built up, and when the market moved a little against them, there was no support to stop the losses.

The setup was textbook, characterized by heavy optimism, little downside protection and no follow-through. The 1,000% liquidation gap occurred not because of extreme volatility but because traders were overexposed in the same direction, and the market could not support this. XRP did not have to crash.

The bulls were already overexposed — the market just needed to shrug and they would have fallen under their own weight.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov