Cryptocurrency contracts trading should be referred to as a way of financial contracts trading with digital coins as underlying assets. In general, cryptocurrency contracts represent a form of contract for difference (CFDs).

What are cryptocurrency contracts?

Cryptocurrency contracts (not to be confused with ‘smart contracts') are financial contracts that give their owners a right (not obligation) to buy or sell digital assets (Bitcoin or altcoins) when (or before) its price reaches this or that level.

Futures (contracts with pre-determined expiration dates) and contracts are the two most common types of crypto-pegged CFDs. Contracts can be closed by the buyer whenever he/she finds it profitable in accordance with his/her trading strategy while futures have expiration dates.

What are crypto contracts exchanges?

Crypto contracts exchanges are digital platforms (websites and applications) where the contracts for differences on Bitcoin (BTC), Ethereum (ETH), and other cryptocurrencies can be traded. The exchanges are responsible for ‘know-your-customer/anti-money-laundering’ practices, due diligence policy and fair payouts to clients.

Crypto contracts exchanges offer their clients to trade contracts with leverage. It means that traders can add borrowed funds to their positions. Say, when leverage is set at 5x, a 10-percent price move (in both directions), results in a 50% gain or loss.

For buying/selling contracts, exchanges charge users with small fees proportionally to the size of the opened position.

Introducing VDollar (VD), a multi-purpose crypto contracts platform

VDollar is a one-stop ecosystem for cryptocurrencies contracts trading. Besides offering contracts on various digital assets, it boasts an over-the-counter platform for sophisticated traders, swap modules, community-driven initiatives and a one-of-a-kind ‘Trading Mine’ instrument.

Basics

VDollar cryptocurrencies contract exchange (Vdollar.io) is incorporated in the United States. With its draconic regulation on crypto, this should be interpreted as the recognition of the highest standards of regulatory compliance met by VDollar.

The platform is operated by VDollar Exchange Limited. This firm is properly registered and incorporated in Colorado. Its activity is carried out under the Money Services Business (MSB) license issued by the U.S. Financial Crimes Enforcement Network.

Additionally, it obtained a license of The Accounting and Corporate Regulatory Authority which is a statutory board under the Ministry of Finance of the Singapore Government.

From a big picture perspective, VDollar’s ecosystem comprises three business segments: a digital currency exchange (vdollar.io), and ultra-circular digital currency wallet (vdollarwallet.com), and a unique ‘Trade Mining’ module (vdollar.org).

Derivatives

The most important and popular module of VDollar infrastructure is its derivatives (crypto contracts) trading environment. It boasts 18 USDT-settled contracts on various cryptocurrencies.

The interface of the derivatives section is classic and looks familiar for the majority of traders. At the same time, its design is intuitive and won’t be cumbersome for the traders with various levels of expertise. It includes a cryptocurrency chart, orderbook, order menu with ‘Limit’ and ‘Market’ sections as well as a ‘Recent Trades’ list.

Cryptocurrency chart module is powered by the world-leading resource TradingView, so that all crucial indicators as well as the candles/lines format of chart displaying can be customized in a couple of clicks.

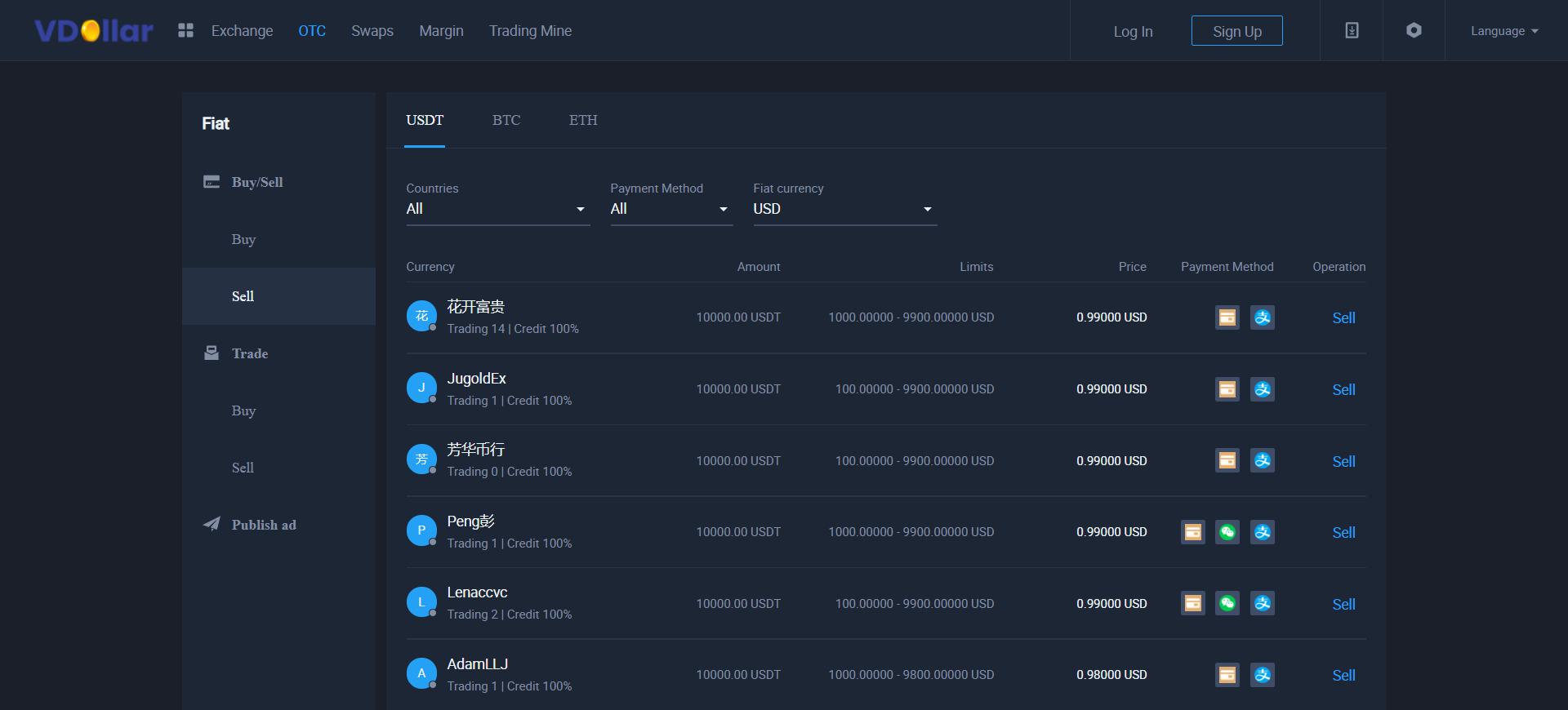

OTC

‘Over-the-counter’ (OTC) desk is a way of exchanging crypto assets without an orderbook. Price for this or that crypto is determined by the seller and isn’t subject to automatically changing due to price swings.

Typically, it is utilized by high-end traders to reduce the exposure to market volatility and mitigate the effects of ‘price slippage’, an unintended sharp price move triggered by high-volume trades.

OTC module of VDollar exchange is located in the upper left corner of its main page. In VDollar’s OTC section, various types of trades are available for Bitcoin (BTC), Ethereum (ETH), and U.S. Dollar Tether (USDT) owners.

OTC also acts as a crypto-to-fiat gateway to the VDollar ecosystem. It supports the most popular payment methods such as bank wires, cards, Alipay, and WeChat Pay digital payment systems.

At printing time, the most popular trading pair on VDollar’s OTC module is USDT/USD while bank cards and Alipay are the top money transferring methods.

Swaps

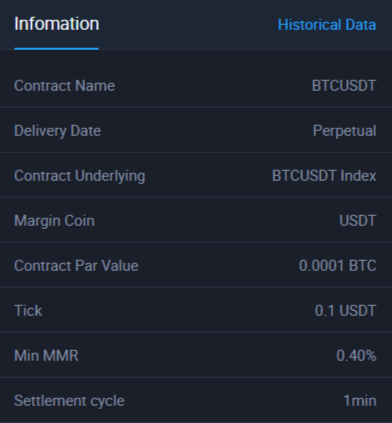

In the ‘Swaps’ module, users can buy and sell perpetual contracts with Bitcoin (BTC) and Ethereum (ETH) as underlying assets. The U.S. Dollar Tether (USDT) stablecoin works as a settlement asset.

The value of one contract is 0.0001 Bitcoin (BTC) which is equal to $3.4 at printing time. This allows even newbie traders with small deposits to experiment with the opportunities provided by derivatives trading tools.

‘Tick’ (step of price customization on VDollar) is set at 0.1 USDT while minimum price move required is 0.4 percent. Settlement cycle (minimum period of contract’s lifespan) is 60 seconds.

Assets supported

The list of supported assets should be treated as the ‘killing feature’ of the VDollar trading engine. Normally, services of such types support Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and XRP while U.S. Dollar Tether (USDT) is utilized as a settlement asset.

The derivatives trading suite of VDollar looks way more impressive. Besides the full list of cryptocurrency behemoths (Bitcoin, Ethereum, XRP) and their most notable forks (Litecoin, Bitcoin Cash, Bitcoin SV, Ethereum Classic, Dogecoin, and so on), it boasts top-notch DeFi assets such as Chainlink (LINK), Yearn.Finance (YFI), Uniswap (UNI), DFI.Money (YFI) and others.

Additionally, it offers plenty of Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS) tokens like Eos (EOS), Tron (TRX) and Cardano (ADA), exchange utility asset Huobi Token (HT), cryptocurrency veterans OMG Network (previously OmiseGO, OMG), Dash (DASH), Filecoin (FIL), Aelf (ELF) and Status (SNT).

Following the increased demands for memetic coins, VDollar listed the contracts on Shiba Inu Coin (SHIB), one of the most significant and overhyped representatives of this segment.

All of the assets are available for contracts trading while for BTC, ETH, FIL, DOGE, BCH, TRX, EOS, LTC, YFII, and SHIB, 3x leveraged margin positions are available in the ‘Margin’ section.

Referral program and ‘Super Representatives’ initiative

The VDollar service has gathered a large and passionate community around its product. To let its users monetize their social exposure, the VDollar team launched a number of promo campaigns focused on social marketing.

First, a user with a large social media influence on different platforms, can request a unique Traffic Monetizing Link (TML) to publish it on his/her resources or blogs.

Once the link is generated, any user who clicks on it or on an associated QR code will be linked to a TML owner’s ID. Depending on the actual number of users clicked and their net transactional volume on VDollar, the rebate rate (from referral’s position aggregated value) can be either 0.15 percent or 0.2 percent.

‘Invite Rebate’ initiative looks more simple and suitable for the majority of users. When a VDollar trader invites a new user to the exchange, the inviter will get a 0.05 VDollar (VD) rebate from the VDollar platform for every 1 USDT processed by his/her invitee. This promotion lasts forever and has no limits in terms of periods and payouts.

The most experienced influencer with a large audience across major social media platforms can apply for the ‘Super Representative’ status.

All ‘Super Representatives’ are elected by the community. The number of their seats is always limited at 32. To be elected, a user needs to pass the entire set of KYC/AML-checks and to verify the ownership of a sufficient audience. Voting days are announced in advance while every referendum lasts for 24 hours only.

For every VD mined by their subordinates (see below), their ‘Super Representatives’ receive a 0.25 VDollar bonus. Every referendum is designed to lay off eight out of 32 ‘Super Representatives’.

VDollar (VD), a new-gen exchange utility token

To deliver an entirely new tokenomics model and ensure a fair sharing of profits with its community, VDollar exchange issued VDollar Coin (VD), a one-of-a-kind core native utility asset.

Basics

VDollar (VD) is a backbone of VDollar exchange tokenomics. It is correlated with the processes of transactional fee collection. 100% of VDollar’s transaction fees go to the URP (USDT Reserve Pool) which is transparent and can be verified on-chain.

VDollars minting process is pegged to URP value dynamics to ensure that each VDollar is anchoring a solid underlying asset. At the same time, the maximum supply of VD is limited and can’t exceed 10,000,000 VD.

To guarantee the deflationary character of VD, its supply is periodically halved (one supply reduction for every ‘Super Representatives’ term).

‘Trade-mine’ campaign

The activity of a particular user is therefore reflected by the value of fees sent to the USDT Reserve Pool. This concept, which is pioneered by VDollar, is dubbed Trading Mining.

By processing high trading volume, every user can increase his/her tier in the system's ranking. This isn’t unlike Binance’s Binance Coins (BNB), but VD has some advantages over the world's top exchange tokens.

To name a few, VDollar sends all transactional fees to USDT Reserve Pool. Also, its team promotes their URP/VD mechanism as a more transparent one than that of Binance.

Bottom line

VDollar, a novel cryptocurrency contracts trading ecosystem, is offering a cutting-edge derivatives trading experience for traders with various levels of expertise.

Its mechanism includes universal, leveraged and OTC modules; the latter supports crypto-to-fiat deals. VDollar supports a large suite of assets including staking coins, DeFi coins, crypto majors and even one semi-memetic ‘dog-coin’.

VDollar’s native token VD is a backbone of the project's tokenomics. It serves as a method of motivation for social media promotions, referral campaigns, and reflects the value of the unique USDT Reserve Pool - the sum of all transactional fees collected by the exchange.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin