Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

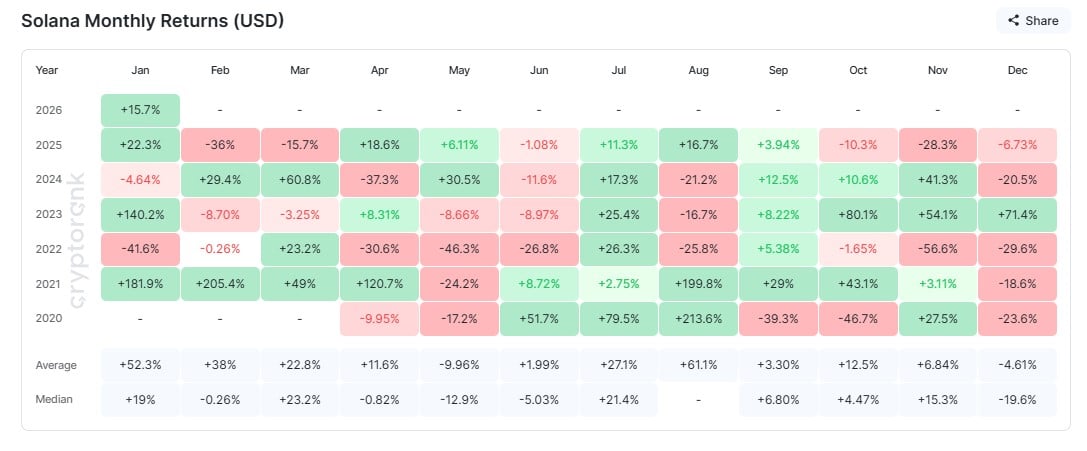

Solana (SOL) might be up for a bullish rally to the $200 price level. According to historical precedence, Solana has every likelihood to surge past the $200 price mark. Cryptorank data reveals a unique pattern that shows that each time SOL closes negatively in December, it picks up the following January.

Solana and historical January surge

Notably, in January, Solana boasts an average growth rate of 52.3%. The asset has one of the highest growth figures in the month, with January 2021 recording an 181.9% increase. In the last six years, Solana has closed positive in four of those years.

As of press time, Solana exchanges hands at $144.52, which represents a 1.87% increase in the last 24 hours. The coin jumped from a low of $141.30 to peak at $147.31 before it settled at the current market price.

If history repeats itself and Solana reaches its historic monthly average of 52.3%, then the asset could surge to $219. The coin is likely to add much more moving forward given increased interest from market participants.

Over the weekend, Solana exploded by $8 billion in open interest as traders positioned for active trading ahead of what might be a bullish week.

Activity around the asset suggests that despite the technical challenges, with the spike in open interest, SOL could rise to higher levels.

Institutional momentum adds support

In the broader cryptocurrency space, institutional interest is adding to the bullish potential of Solana. The Solana exchange-traded fund (ETF) outperformed both Ethereum and Bitcoin as institutional exposure shifted away from the top two leaders in the industry.

In a related development, a Solana whale recently rose from dormancy by withdrawing 80,000 SOL from Binance exchange into a private wallet.

The move is considered a bullish bet on the asset. The holder is likely expecting the value of the coin to hit its monthly January average of over 52%, which could yield massive profit.

Meanwhile, CEO of Helius Labs, a Solana infrastructure service, Mert Mumtaz opines that the blockchain’s program model is much safer for artificial intelligence (AI) interactions. Mumtaz compared Solana to Ethereum Virtual Machine (EVM) and noted that Solana dApp developers have more opportunities to reuse codes.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov