Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

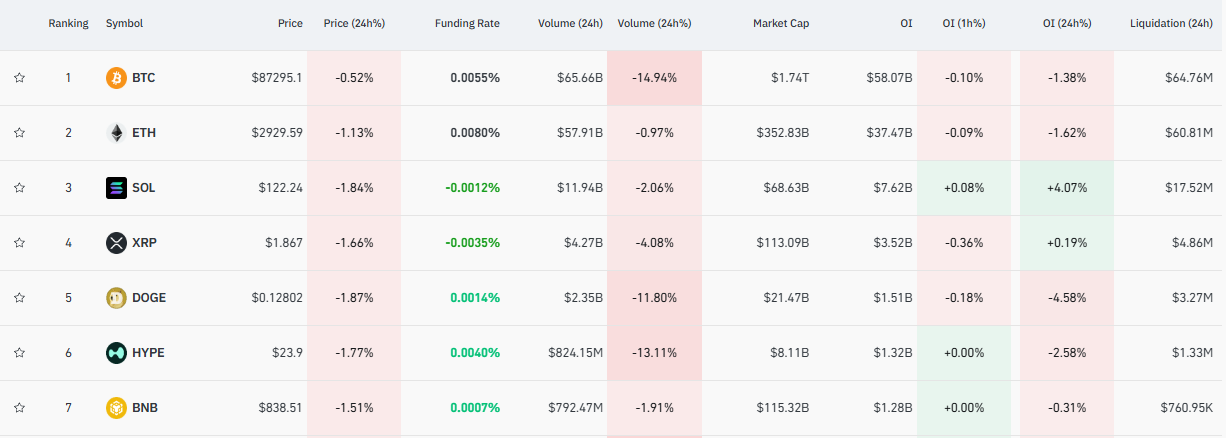

Funding rates provide a clear window into the positioning of leveraged traders, and at the moment they help to explain why assets like Solana and XRP are still struggling despite sporadic attempts at recovery.

Funding rates are in place on perpetual futures markets to maintain contract prices in line with spot prices. Long traders signal bullish positioning and a willingness to hold exposure at a premium when funding is positive by paying shorts. Shorts pay longs when funding turns negative, indicating bearish dominance and a market that anticipates lower prices.

Funding rates in favor of bulls

Although this mechanism does not directly cause price changes, it has a significant impact on how long-lasting those changes are. Funding behavior is consistent with the current price structure for both Solana and XRP. With prices trading below important moving averages and failing to recover broken support levels, both assets exhibit ongoing weakness over longer time periods.

Funding rates typically compress or drift negative during these periods, suggesting that traders are no longer aggressively pushing the market higher. This is evident in the speed at which rallies end and are followed by fresh selling pressure. In a downtrend, negative or flat funding typically denotes controlled bearish positioning rather than panic. Longs are unwilling to pay more to remain in trades, while shorts are at ease with exposure.

XRP's growth chances

In such an environment, the price is locked in corrective ranges and upside momentum is suppressed. This explains why, in the case of XRP, even powerful network narratives or brief inflows do not result in long-term price growth. Shallow recoveries following sell-offs and lower highs are reinforced by the same dynamic for Solana.

The reason why the decline does not happen right away is also explained by funding rates. There is no immediate need to unwind short positions when funding is not too negative. Instead of plummeting, the price drifts downward. Both sides of the market become irritated by this slow grind, which also postpones any significant trend reversal.

The main conclusion is that the bearish bias already apparent on the charts is currently confirmed by funding rates. Rather than accumulation, they show cautious, defensive positioning. XRP and Solana are likely to continue to be under pressure until funding either turns sharply negative enough to cause short-covering or flips decisively positive alongside strong spot demand. Although the market is not broken, it is also obviously not prepared to become extremely optimistic.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov