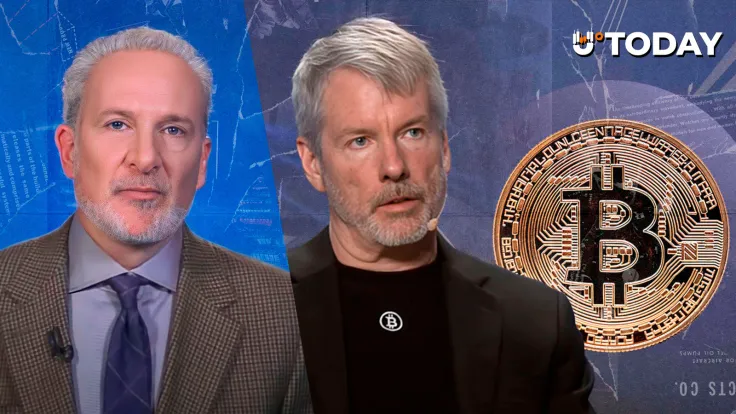

Peter Schiff has slammed Michael Saylor's Bitcoin MENA keynote for declaring that Strategy (formerly MicroStrategy) is going to buy up all available Bitcoin.

This comes after the company recently announced its biggest Bitcoin purchase in months.

Buying it all

During his keynote speech at the Bitcoin MENA conference, Saylor stated that his goal for MicroStrategy is to buy as much Bitcoin as possibleю "We are going to buy all of it," he said.

The address, which lasted approximately 45 minutes, and drew a crowd of over 10,000 attendees, including sovereign wealth fund representatives, bankers, family offices, and hedge fund managers from the Middle East.

Saylor's presentation was supposed to be a blueprint for transforming the region into a global hub for "Bitcoin-backed" financial infrastructure. He framed Bitcoin as digital energy, "a programmable, scarce asset that could power the new era of economic sovereignty.

More criticism

In a separate social media post, Schiff also critiques Michael Saylor's framework of converting Bitcoin as "digital capital" into "digital credit" via MicroStrategy's preferred stock.

The stock yields an 8% perpetual dividend backed by the firm's 650,000 BTC holdings acquired at an average cost of $74,000 per coin.

Schiff insists that Saylor’s 8% yield Bitcoin bank only works in his head.

The yield comes from Bitcoin’s price going up forever. If Bitcoin ever stops appreciating, the entire strategy could collapse. Hence, there is no actual cash-flow-producing asset behind the "yield," which fuels Schiff's criticism.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov