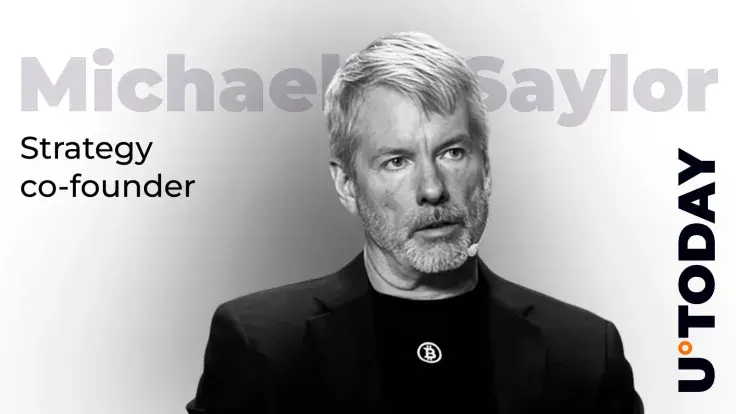

Michael Saylor, executive chairman at Bitcoin treasury firm Strategy, recently addressed the recent S&P 500 snub, predicting that the leading Bitcoin treasury firm will eventually be able to join the much-coveted stock market index.

Saylor does not think that there is a "bias" against crypto, adding that he did not actually expect Strategy to be added during its very first quarter of eligibility.

"This is a brand-new novel concept. Every quarter, we make some new believers, we get more support from banks, from politicians, from credit rating agencies," Saylor told CNBC's Becky Quick. He predicts that this will continue for the foreseeable future.

"Bullet-proof balance sheet"

When asked the specific price level at which Strategy would have to "sell things," Saylor noted that the company had constructed a "bullet-proof" balance sheet.

"I would say that we have a PhD in leverage by now because we have lived through the last crypto winter," Saylor said.

He added that the cryptocurrency went from $66,000 to $16,000 during the last cycle, and Strategy ended up buying at the bottom.

Saylor claims that his company is "fine" because the leverage comes from its preferred stock rather than debt.

He noted that the Bitcoin price will keep going higher if more companies end up embracing it: "The more people know about it, the more they get educated on it. The more companies embrace it, the higher it goes," Saylor said while addressing Bitcoin's $200,000 prediction.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov