Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

- Bitget TradFi kicks off Universal Exchange experience: Highlights

- Siloed liquidity, sophisticated interfaces: Why do we need TradFi assets on crypto exchanges?

- Introducing Bitget TradFi: Gold, FX, indices on familiar CEX

- Approaching Universal Exchange, holistic trading ecosystem vision

- Bonus: Two campaigns for Bitget TradFi traders, $88,888 at stake

- Wrapping up: Why will the TradFi experience in the Bitget ecosystem be a highlight of 2026?

While the cryptocurrency community is guessing whether we are already in a bear market, gold (XAU), the oldest and biggest investment asset, hits a fresh price ATH over $4,600. The capitalization of the yellow metal almost tripled in five years amid increasing geopolitical uncertainty.

Meanwhile, the infrastructure for gold futures trading — just like that of commodities, indices, FX and so on — is still lagging. Bitget, a tier-1 universal exchange, offsets the gap with Bitget TradFi, a brand new platform for evergreen assets.

In this review, U.Today walks you through the most interesting features of Bitget TradFi, its "unfair advantages," its first milestones reached and ways that early birds can benefit.

Bitget TradFi kicks off Universal Exchange experience: Highlights

Bitget TradFi, a pioneering major launch of the Bitget ecosystem in early 2026, pushes the barriers of the trading experience for both crypto and commodities traders.

- Bitget TradFi launches as a unified trading platform that combines cryptocurrency, precious metals, commodities, indices and foreign exchange (FX) pairs within a single interface, eliminating the need for traders to manage multiple accounts across different platforms.

- The platform addresses three core market problems: siloed liquidity across fragmented services, operational friction from managing multiple trading accounts and reliability concerns associated with traditional commodities and forex platforms that often lack proper regulatory compliance.

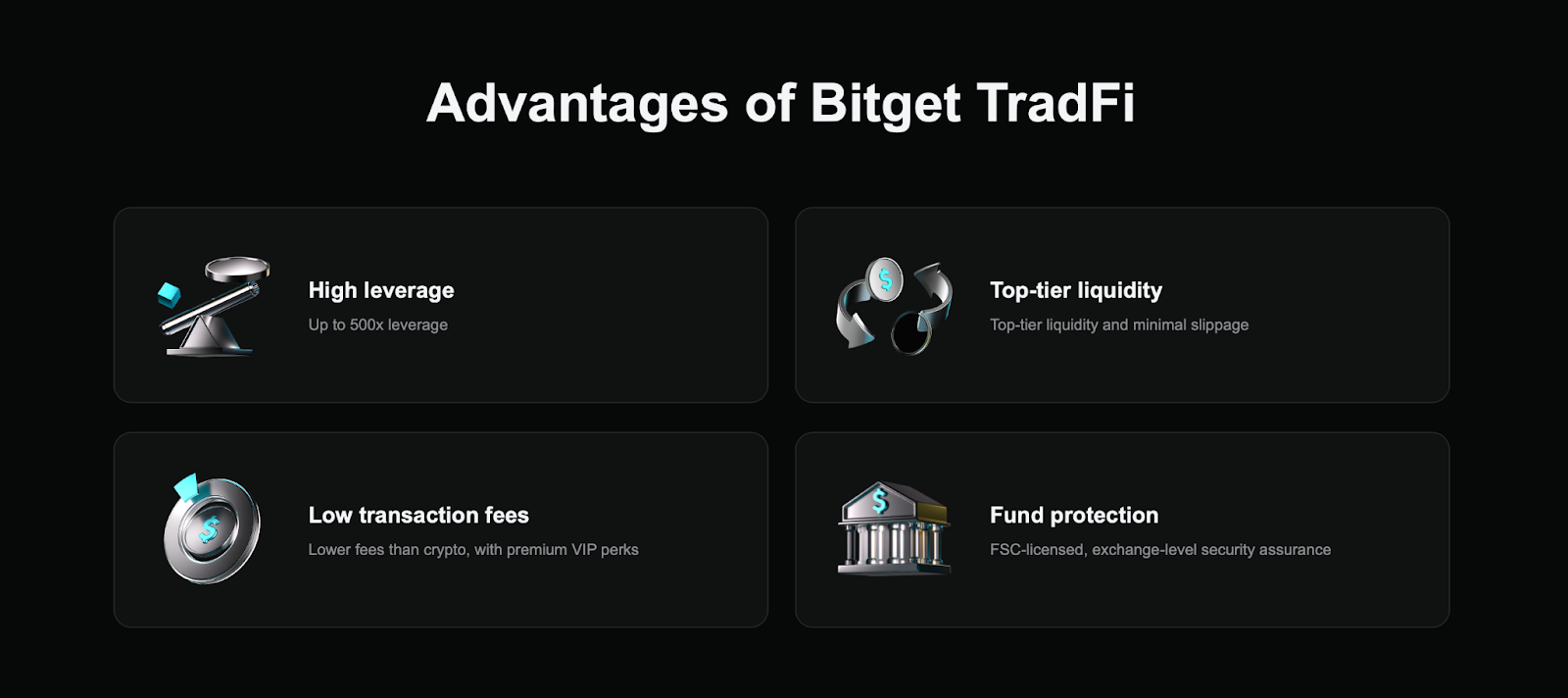

- Bitget TradFi supports 79 trading instruments at launch, including Gold CFDs (XAUUSD, XAUAUD, XAUEUR), major FX pairs, trending global indices and commodity futures, all settled in USDT with up to 500x leverage and zero additional brokerage commissions.

- The platform achieved $2 billion in trading volume within three days of its January 2026 public launch.

In the broader context, Bitget TradFi represents a key feature in Bitget's "Universal Exchange" vision, an ecosystem designed to make global finance programmable, instant and accessible from one interface without requiring users to choose between crypto platforms and traditional brokerage accounts.

Siloed liquidity, sophisticated interfaces: Why do we need TradFi assets on crypto exchanges?

The release of Bitget TradFi in 2026 addresses at least three market problems that traders of various classes and jurisdictions are facing.

- Siloed liquidity: When a trader attempts to allocate their portfolio between various platforms — one for crypto trading, one for Forex, one for indices and one for commodities futures — they obviously have worse opportunities compared to traders on a hypothetical service that has it all at once.

- Multiple services instead of a single one: The constant switching between different services adds unnecessary friction, brings up more security and efficiency problems, and creates infrastructure and UX/UI overhead.

- Shady reputation of commodities and forex trading platforms: Many such services work with zero KYC/AML awareness, lack reliable customer support and may easily go offline or even steal users' funds.

As such, the release of (1) a one-stop platform for CFDs on all types of digital and traditional assets (2) within a reliable highly reputed regulated finance services ecosystem is a breakthrough for the trading segment and the digital economy as such.

Introducing Bitget TradFi: Gold, FX, indices on familiar CEX

Launched in private beta in December 2025, Bitget TradFi hit public release on Jan. 5, 2026. Designed for secure, fast, frictionless and cost-effective CFD trading on gold (XAU), indices and commodities, Bitget TradFi hit $2 billion in trading volume just three days after launch.

Bitget TradFi: Basics

Introduced by tier-1 exchange Bitget, Bitget TradFi is a one-stop trading platform for CFDs (contracts for differences, futures contracts, derivatives and so on) on precious metals — starting with gold — commodities, indices and foreign exchange (FX) pairs.

Bitget TradFi is designed to combine the trading experience for traditional and digital assets, removing infrastructural, liquidity and operational friction.

Bitget TradFi platform offers settlements in U.S. Dollar Tether (USDT), the largest stablecoin by market cap, with no extra brokerage commission. The service offers up to 500x leverage for maximum capital efficiency, deep liquidity and the industry's fastest trade execution for all users regardless of their deposit sizes.

Immediately upon public launch, Bitget TradFi supports a total of 79 trading instruments across the mentioned asset classes, including gold CFDs: XAUUSD, XAUAUD and XAUEUR.

Bitget TradFi: Rationale

Bitget TradFi is introduced with a new type of trader in mind. Simply put, it is focused on cryptocurrency traders interested in gaining exposure to contracts on new classes of assets. While seeking the new tooling for trading strategies, such customers are unlikely to leave familiar interfaces.

From a trading perspective, Bitget TradFi enables users to translate global market developments into actionable opportunities across asset classes. Whether responding to shifts in commodities such as gold (XAU) or navigating currency movements following central bank decisions, traders can move with speed and flexibility. This capability is underscored by the recent strength of gold, which has continued to attract interest as investors seek stability in an evolving macro environment.

At the same time, the approach of Bitget TradFi reinvents the role of evergreen traditional assets themselves. With a compliant, secure, fast, CFD trading platform with a thick orderbook and impressive 500x leverage, they outgrow the status of purely long-term investing instruments and become lucrative short-term trading tools.

Bitget TradFi: Opportunities

At its core, Bitget TradFi is organized into four sections: Forex, Metal, Index, Commodity, while on the "All" dashboard, traders can explore all the opportunities in a single list.

- In the Forex section, users are invited to trade futures in the U.S dollar, Australian dollar, Swiss franc, Singapore dollar, Canadian dollar, Japanese yen, New Zealand dollar and British pound in dozens of combinations.

- In the Metal section, users can trade CFDs on gold and silver in pairs with the U.S. dollar, euro and Australian dollar.

- In the Index section, the Bitget TradFi audience gets exposure to all trending indices of East and West, like Japanese Nikkei Index Cash (JP 225), America US100, US500, US30 (combinations of stocks of top tech companies) and many more.

- In the Commodities section, traders can buy and sell CFDs for palladium, platinum, copper, gas, cocoa and many more.

All contracts are eventually settled in U.S. Dollar Tether (USDT), with up to 500x leverage available.

Approaching Universal Exchange, holistic trading ecosystem vision

As stressed by the strategy statements of Bitget, the launch of Bitget TradFi is a cornerstone of the Universal Exchange vision. It extends the exchange beyond crypto-native markets and makes global finance programmable, instant and accessible from one interface.

Instead of asking users to choose between crypto platforms and brokerage accounts, Bitget collapses that divide — placing macro, commodities, FX and digital assets into a single trading environment.

Universal Exchange — the key midterm focus for Bitget — is a bold attempt to reconsider the way people trade and invest.

Not unlike what Bitget Wallet did for transacting — introducing a self-custody crypto wallet as the everyday app — Universal Exchange is focused on reimagining the accessibility of CFDs trading, be it futures on crypto or gold (XAU).

Universal Exchange is set to be a standard for cryptocurrency, commodities and FX traders in years to come.

Bonus: Two campaigns for Bitget TradFi traders, $88,888 at stake

To celebrate the launch of Bitget TradFi and introduce its opportunities to users, Bitget is running a Gold Trading Competition — two newbie-friendly incentive campaigns.

Event 1: Mystery Box Special ($22,222 pool)

Users are encouraged to complete daily trading-volume tasks to earn draws (daily reset at 12:00 a.m. UTC+8). Limited quantity, first come first served principles apply. The more trading volume, the more draws one trader can claim.

Event 2: Daily Check-in for Points ($66,666 pool)

Traders can earn points based on daily cumulative trading volume (stackable, no daily cap). For the event, a simple reward formula has been introduced:

"Your reward = (Your points / Total qualifying points) × Points pool"

All users who earn points are eligible to share the pool.

Both programs are intended to lower friction for first-time TradFi users and encourage experimentation with instruments such as gold (XAU) futures contracts.

Wrapping up: Why will the TradFi experience in the Bitget ecosystem be a highlight of 2026?

Bitget TradFi, launched publicly in January 2026, is a unified trading platform that brings CFDs on traditional financial instruments — starting from gold, commodities, indices and FX pairs — together with cryptocurrency trading in a single interface.

The platform addresses critical market inefficiencies by consolidating siloed liquidity, reducing operational friction from managing multiple accounts and offering a regulated alternative to less reliable commodities trading platforms.

Supporting 79 trading instruments with USDT settlement and up to 500x leverage, Bitget TradFi achieved $2 billion in trading volume within three days of launch. The platform embodies Bitget's "Universal Exchange" vision, transforming how traders access global markets by making diverse asset classes immediately tradable from one ecosystem.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin