Michael Saylor just bought more Bitcoin today, but not everyone's impressed. For those who missed it, the Strategy chairman announced that the company bought another 855 BTC for $75.3 million at an average price of $87,974.

Saylor and Co.'s total Bitcoin stash is now at 713,502 BTC, worth about $56 billion, and just 3% above an average cost basis of $76,052.

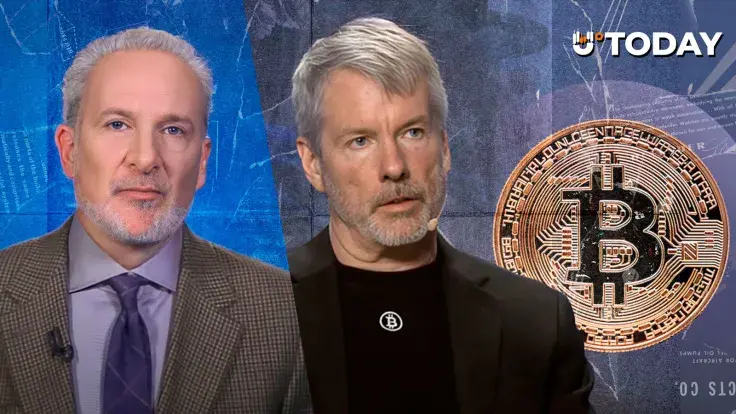

But not long after Saylor said he was moving, Bitcoin dropped below $75,000 for a bit before bouncing back to around $78,000. This did not sit well with Peter Schiff, the gold bug and longtime crypto skeptic, who criticized Saylor in public.

He pointed out that Saylor's purchase price was $10,000 above the spot price and questioned the math of the entrepreneur.

With BTC trading below Strategy's weekly purchase price, Schiff implied that Saylor either misjudged the market or just avoided averaging down. It is not just about how things look. With a super-thin 2.8% profit margin on the BTC stack, any buying mistake can mess with both how the treasury looks and how the stock market feels about MSTR.

Math of Bitcoin Standard

Strategy's Bitcoin position was built for $54.26 billion and is now showing about $1.5 billion in paper gains. All in all, the company's market cap at $52 billion, diluted, still trails the nominal BTC value, giving MSTR shares a Bitcoin premium of 1.15.

So, Schiff's criticism is either a bit of his signature trolling or maybe some legit financial advice. Either way, the question remains: in a market this unpredictable, why buy high and skip the weekend dip? Saylor has not responded yet.

But if history is anything to go by, he will probably respond the same way he always does: with another billion-dollar Bitcoin bet.

Gamza Khanzadaev

Gamza Khanzadaev Caroline Amosun

Caroline Amosun Tomiwabold Olajide

Tomiwabold Olajide Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk