Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

It is Monday, Jan. 12, and the crypto markets are kicking off the week with the usual volatility and some new signals popping up in the charts, transaction ledgers and liquidation boards. XRP hit its best Q1 performance in three years just 12 days into 2026. A viral Bitcoin whale theory popped up on the exact day of cryptocurrency's 17th birthday. Meanwhile, Cardano is seeing something really rare: four-hour short liquidations printing exactly $0.

TL;DR

- XRP is +10.8% in early 2026, outperforming all Q1 starts since 2023.

- 17 years after Satoshi’s first transaction, a wallet holding 26,916 BTC triggers wild speculation.

- Cardano (ADA) shows abnormal liquidation data with $0 shorts in the key window.

XRP scores best Q1 since 2023

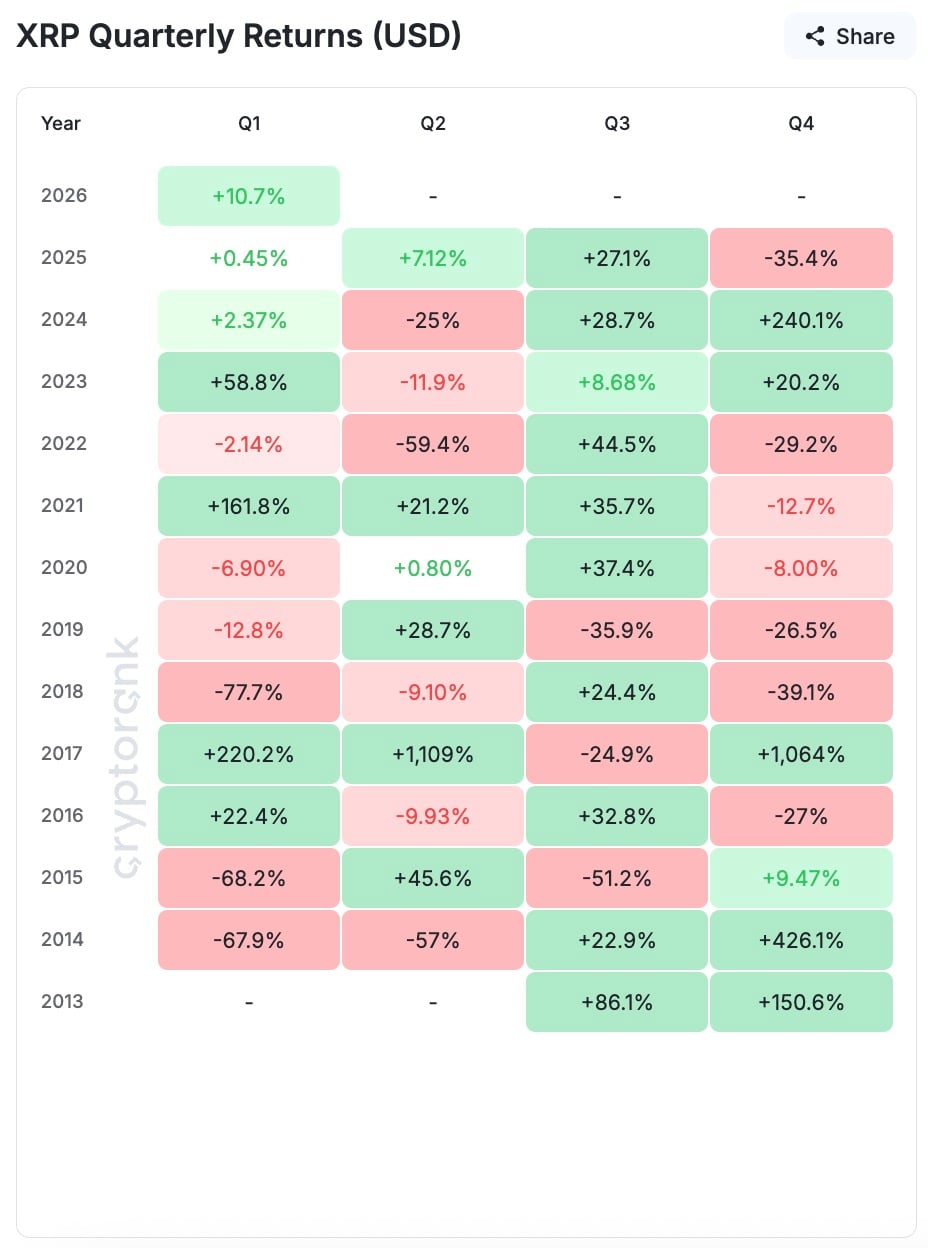

XRP started 2026 with a +10.8% surge, marking the strongest Q1 kick-off since 2023, according to data from Cryptorank. It is early in the year, and there are only 12 trading days, but the move is a bit surprising, considering how weak Q1 performances usually are.

By comparison, 2025 opened with a modest +0.45% gain in Q1, and 2024 fared marginally better at +2.37%. The current uptrend has already eclipsed both years and trails only 2023's explosive +58.8% surge.

On the charts, XRP broke above $2.35 in the first week of January before sliding back toward the $2.04-$2.07 zone by Jan. 12. Even after the spike, things are still within the usual range of volatility, which suggests that the trend is still going strong for XRP, not slowing down.

Whether XRP can keep up its early lead or grow depends on people buying consistently above the $1.98 support zone, which lines up with the short-term Bollinger median. If this momentum keeps up, XRP might be heading into its first positive Q1-Q2 combo since 2021.

Satoshi's first ever Bitcoin transaction turns 17, but then this happens

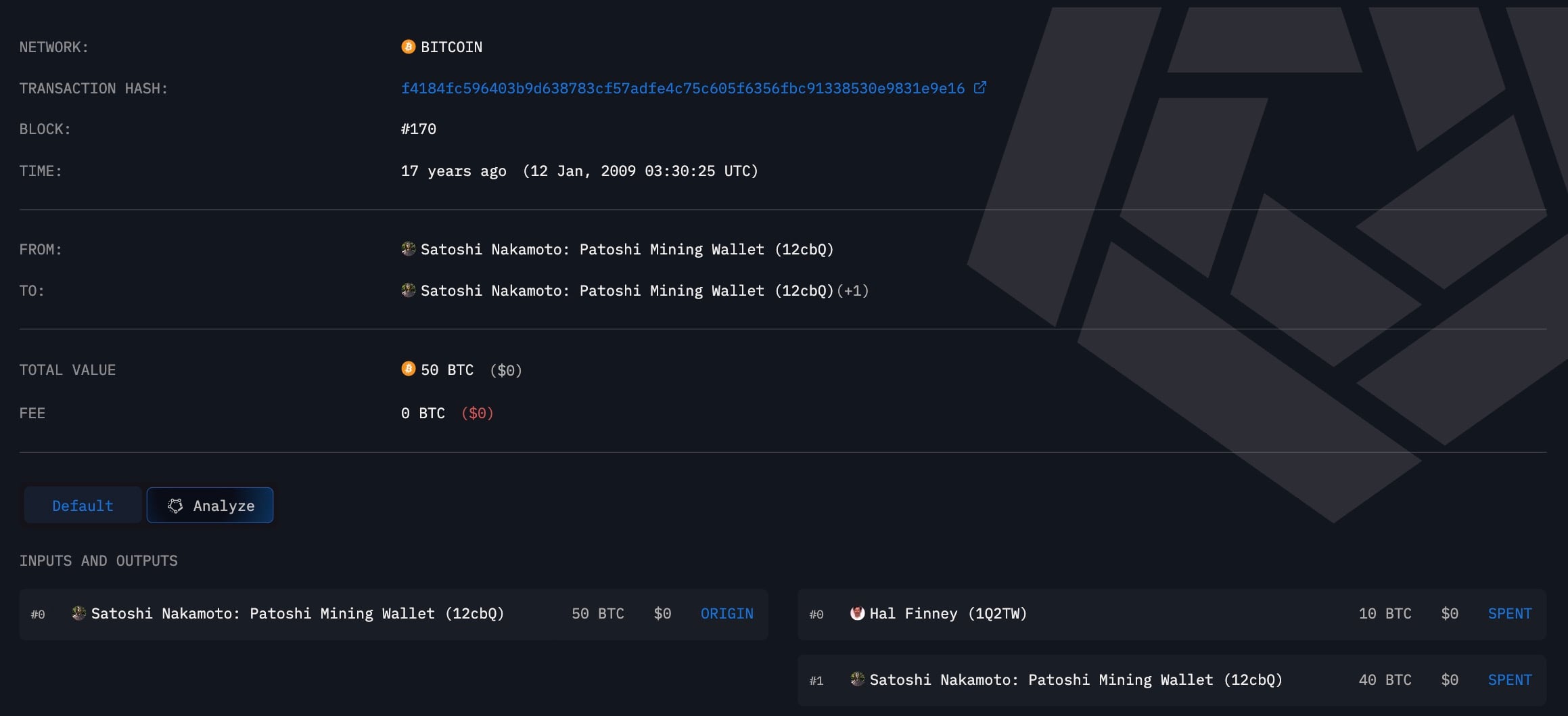

Almost 17 years ago, Satoshi Nakamoto sent 10 BTC to Hal Finney. The transaction (TXID: f4184fc5...) was the first time peer-to-peer electronic money was used in practice. The day was already special, but it got even more interesting when a mysterious wallet transfer allegedly happened involving exactly 26,916 BTC — worth over $2.44 billion at current prices.

Screenshots started spreading this weekend, showing a BTC wallet labeled "Satoshi Whale" holding the whole 26,900 BTC stack. The transfer seemed to come from an address that had not been active before, which led to speculation that a whale from 2011 had returned and gone "all in" again.

The story spread quickly when Binance founder Changpeng Zhao reposted one of the viral images.

But the facts do not back up the hype. There is no record of a 26,900 BTC purchase on the blockchain. The wallet just got a one-time inbound transaction, and a little more digging shows it is probably just consolidation or some internal reshuffling — not a $2.4 billion buy-in from some dormant whale that has been around for a decade.

Even so, the timing of the story's release matched up with the original Hal Finney transaction, which gave it enough symbolic power to trend across social networks and X. Meanwhile, the actual Satoshi stash remains untouched — over one million BTC sitting dormant and never moving.

Cardano prints stunning $0 in short liquidations: What just happened?

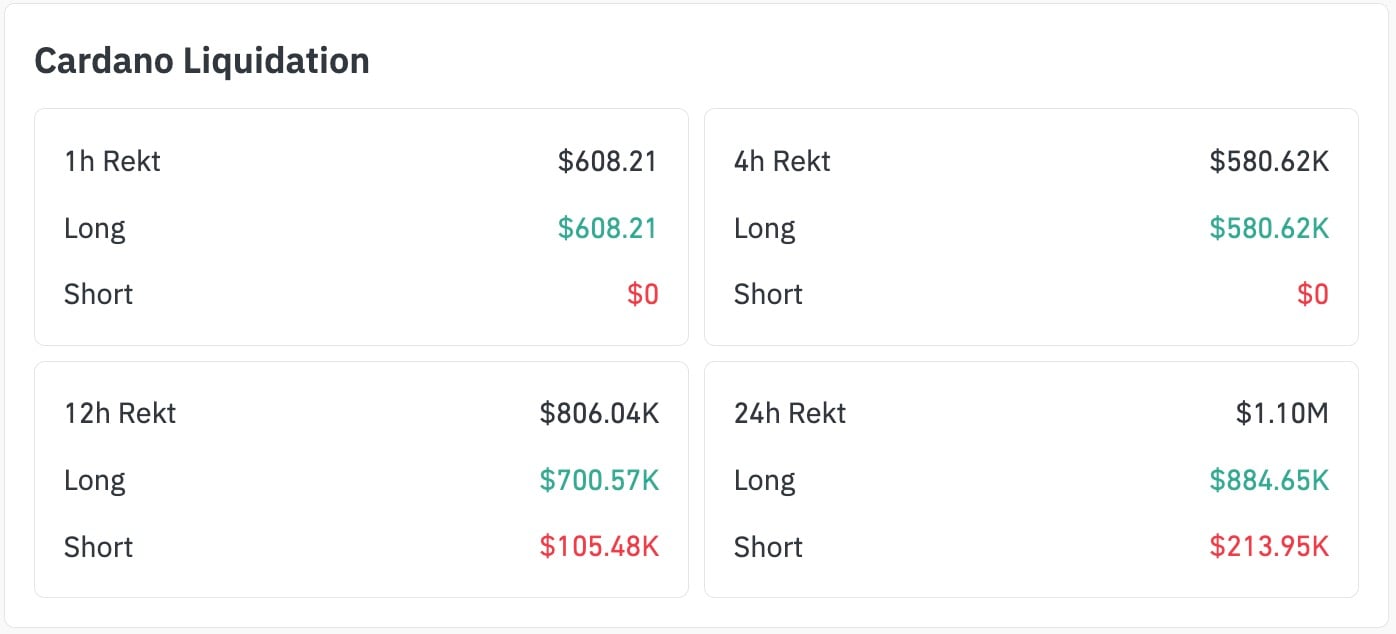

Cardano (ADA) had some unusual liquidation activity recently. According to CoinGlass's data, ADA shorts liquidated exactly $0 over the past one and four hours. At the same time, longs absorbed hundreds of thousands in losses — including $580,600 in just four hours and $884,600 over 24 hours.

It is not unusual for one side to take the lead in liquidations, but it is rare to see zero short liquidations over several periods. This could be a sign to pay attention, depending on how you look at it.

Price action confirms that the market is currently consolidating after an earlier breakout. Cardano surged from $0.33 to $0.43 in early January before slipping back under $0.39, where it is currently trading in a narrow band.

The current imbalance suggests that bearish positioning is almost done or temporarily put on the side, with most of the risk focused on long exposure. Any extra dip could wash out weak long positions, especially if ADA drops back toward the $0.375 liquidity gap.

Crypto market outlook

The crypto market starts this week with BTC at $90,496, down 0.94% over the last 24 hours, while altcoins struggle to sustain early January gains.

Key levels to watch:

- Bitcoin (BTC): Needs to reclaim $92,000 to resume upside, while the support sits near $88,500.

- XRP: Holding $1.98 keeps the Q1 run alive, but $2.35 remains the resistance ceiling.

- Cardano (ADA): $0.375 is the key liquidation trigger with upside capped near $0.42 without volume.

This week is also a CPI one, so it may decide whether early 2026 optimism is justified or premature. With liquidation skews, fake whale narratives and Q1 charts heating up, the crypto market continues to blur the line between signal and noise.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov