Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The crypto market is dealing with a lot of issues at the end of the work week. An XRP glitch put a weird $126 price tag on live CNBC TV, Peter Brandt came up with a spooky $25,000 target for Bitcoin and OKX unlocked 41.12 billion SHIB even though there were heavy outflows.

With $1.7 billion in liquidations and BTC testing new two-month lows, sentiment continues to deteriorate into panic and extreme fear.

TL;DR

- XRP briefly hit $126 on CNBC, triggering a social media craze.

- Peter Brandt confirms $25,000 BTC retracement zone, but it is theoretical for now.

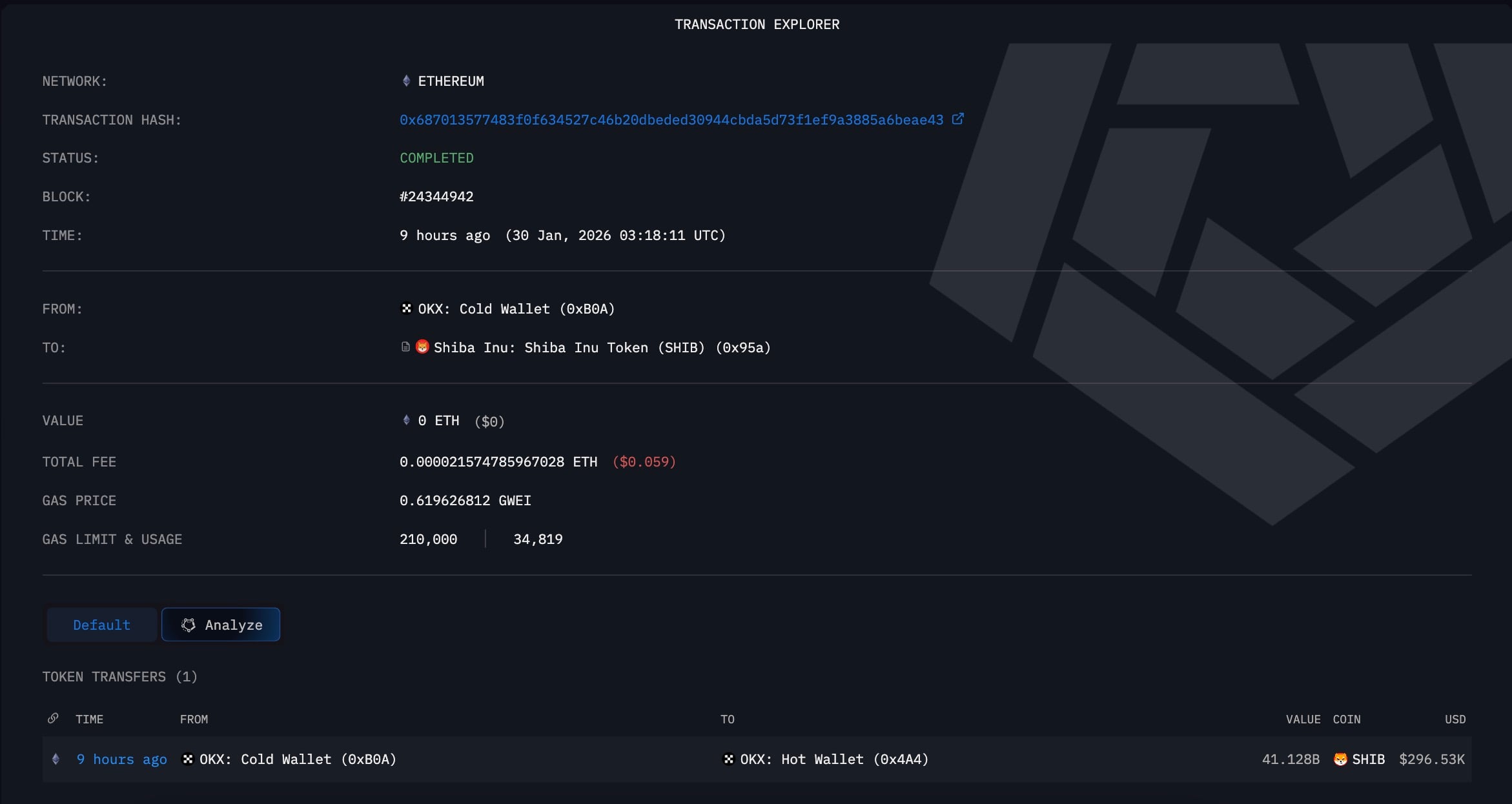

- OKX moves 41,128,246,331 SHIB in major cold-to-hot wallet rotation.

$126 for XRP on CNBC: What happened?

In one of the most surreal visual errors in crypto television history, CNBC’s Crypto World aired a pricing ticker for XRP that briefly showed the token at $126.01 — an astonishing 6,532% higher than its actual market value at the time. The error occurred when Solana's price was mistakenly pasted into the XRP line.

The glitch amused many. It reawakened the XRP community’s longstanding fascination with "ghost prints" and mispriced ticker anomalies, which have fueled speculative narratives about "hidden" XRP valuation paths. CNBC corrected the graphic without comment, but screenshots of the display — showing XRP at $126.01, up $124.32, or 6,532% — rapidly went viral.

This incident occurred when XRP's actual price collapsed nearly 15% from recent highs. It is now quoted near $1.76 after dipping as low as $1.60 after broader market liquidations.

Nevertheless, the glitch was enough to reignite talk of the "three-digit XRP" thesis - a long-standing meme in XRP circles dating back to pre-2020 discussions about institutional utility, settlement layers and cross-border banking rails.

The fact that the mistake came from a mainstream media outlet added fuel to the fire. XRP loyalists immediately speculated whether it was just a slip-up or something more sinister.

The timeline, however, could not have been more ironic, occurring during a week when XRP's actual price broke structure and nearly triggered a 10x liquidation cascade for overleveraged longs.

Legendary trader Brandt updates his $25,000 Bitcoin (BTC) price outlook

Veteran trader Peter Brandt has updated his macro thesis for Bitcoin once again, doubling down on the possibility of a retracement to $25,000 following the breakdown of the previous parabola structure.

In a somewhat humble-yet-aggressive note, Brandt said that "in theory, breaking the last parabola should bring prices back to $25K," but added that "prices in the $50s wouldn't surprise me," and that he thinks they will stay in a sideways "chop" until late summer.

This week, Bitcoin broke below the $84,000-$86,000 support band, dropping as low as $81,000 in one of the sharpest 24-hour declines since Q3, 2025. This coincides with extreme macro uncertainty, including a potential U.S. government shutdown on Jan. 31 and today’s $8.8 billion options expiration, both of which are fueling downside volatility.

Brandt's technical chart includes key resistance at $102,233 and a failed support zone at $98,944, as well as midrange consolidation around $92,000-$95,000. His projected target of $63,254.79, highlighted in a secondary breakdown zone, reflects a worst-case scenario triggered by failed diagonal support dating back to mid-2025.

Importantly, Brandt clarified that he “won’t be ashamed” if he is wrong and emphasized that he is wrong “50% of the time.” However, his legacy of accurately predicting Bitcoin price peaks and troughs still carries weight.

41,128,246,331 SHIB unlocked by major exchange

Late last night, OKX executed a transfer of 41,128,246,331 SHIB from a cold wallet to a hot wallet, equivalent to nearly $296,530 at current market prices. This transaction was recorded on the Ethereum blockchain as funds moved from an OKX Cold Wallet (0xB0A) to a Hot Wallet (0x4A4).

Although the amount seems small, this move coincides with Shiba Inu’s increasing wallet activity amid a declining price trend. On the 12-hour chart, SHIB has broken below $0.00000750 and is approaching $0.00000731, nearing final support at $0.00000699.

This follows an opposite cold storage maneuver by Binance earlier this week, signaling potential market-making reshuffling, hot wallet provisioning for pending withdrawals or unstated liquidity preparation. With sentiment at local lows and on-chain flows showing increasing token mobilization, this combination is making SHIB whales nervous.

SHIB's price setup is still a bit shaky. SHIB did not manage to get back above the 200-day moving average at $0.00001018 earlier this month, and now it is trading almost 32% below that. Unless February brings in some seasonal trading or a surprise event, SHIB might enter another period of slow accumulation.

Viewers are divided between the "unlock equals sell" narrative and the view that it is a backend ops adjustment. But in this market, even routine rebalances spark panic, especially when they coincide with major ETF outflows and system-wide leverage flushes.

Crypto market outlook: Deep fear

Today's $8.8 billion options expiry could cause more volatility depending on how the options are settled and how much hedging is done, while the looming Jan. 31 U.S. government shutdown risk remains unresolved, with prediction markets showing a high chance of disruption.

- XRP: $1.89 is the main structural cap and $2 is the psychological reclamation line. Support starts at $1.60, then $1.53, and $1.45 marks the flush risk area.

- Bitcoin: After the breakdown, the $84,000-$86,000 zone is now resistance. $90,500 is needed to reset the structure. Downside levels are $81,000 and $73,786, with a deeper macro target of $63,254.

- Shiba Inu (SHIB): Upside pressure begins at $0.00000780, followed by $0.00000900, with the 200-day moving average at $0.00001018 as the main trend barrier. Support sits at $0.00000699, with $0.00000655 as the final defense.

The market is still stuck in a bearish mindset with no real reasons to think it will bounce back. Until things settle down and risk levels off, the downside risks are going to be the main focus. February is starting off with a lot of fear and uncertainty, and nothing seems to be moving in a clear direction.

Gamza Khanzadaev

Gamza Khanzadaev Caroline Amosun

Caroline Amosun Arman Shirinyan

Arman Shirinyan Godfrey Benjamin

Godfrey Benjamin Yuri Molchan

Yuri Molchan