Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

On Wednesday, Jan. 21, the crypto market is stuck between geopolitics and leverage disruptions as the U.S. threatens up to 25% tariffs on EU imports tied to Greenland negotiations. With this background, Bitcoin collapses under $90,000, Ethereum slips under $3,000 and over $1 billion in liquidations clear out late longs.

But not everything’s bleeding: Shiba Inu flashes a seasonal comeback pattern, and Ripple’s CEO might have just flirted with XRP’s community with a not-so-cryptic message.

TL;DR

- Shiba Inu (SHIB) hope: Historical data suggests Shiba Inu often rallies in February, potentially reversing current losses.

- XRP's secret message: Brad Garlinghouse’s latest tweet contains a capitalized Easter egg that has the XRP Army buzzing.

- Bitcoin's long squeeze: Overleverage killed the bulls, with a staggering $358.90 million in BTC positions wiped out in 24 hours.

Shiba Inu (SHIB) teases double-digit gains in February

With Bitcoin dropping below $90,000 and the "crypto winter" turning into a real thing, Shiba Inu (SHIB) holders are looking for a lifeline. Luckily, history might just be on their side.

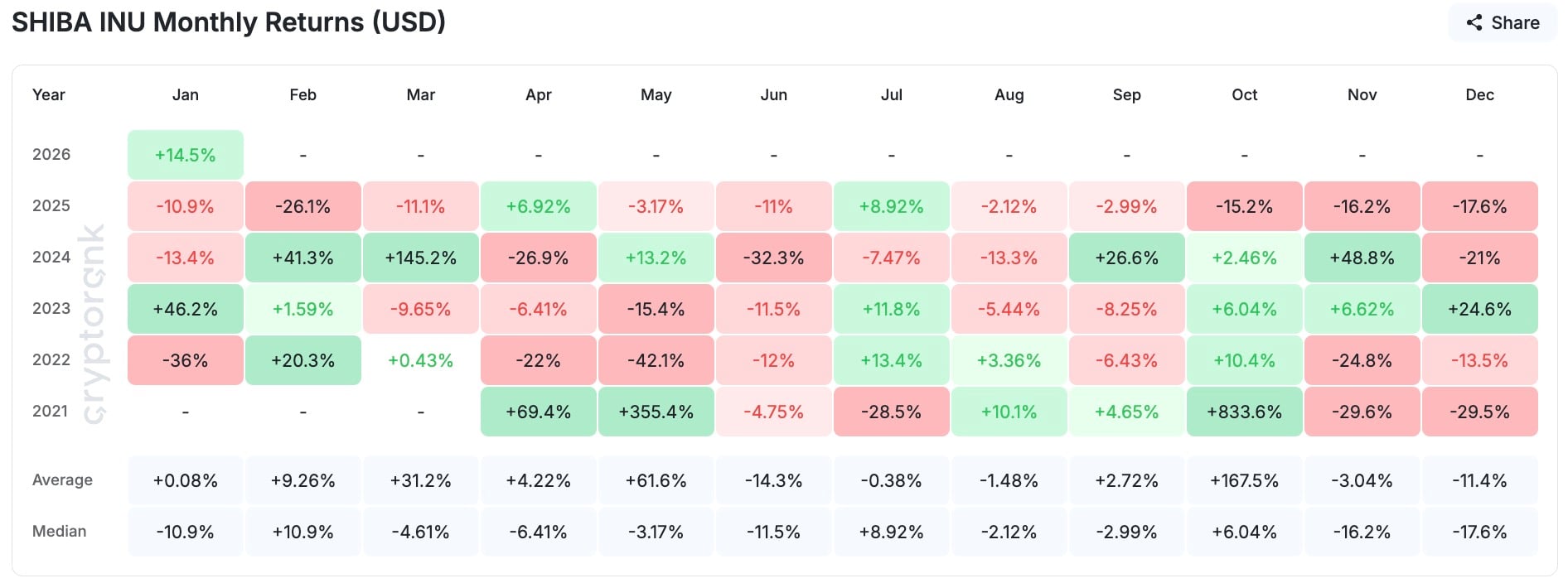

Despite the recent gloom, February has always been a strong month for this popular meme coin. Looking at data from CryptoRank since 2021, it seems that the second month of the year has had good returns in three out of five years tracked.

The stats offer a glimmer of hope. In 2024, SHIB shot up by 41.3%, while two years before that, in 2022, the coin added another 20.3%. On average in February, the Shiba Inu coin is up +9.26%, with a median of +10.9% — which shows that it is not just meme magic.

Even when taking into account down years — like the brutal -26.1% drop in 2025 caused by post-halving exhaustion — February often marks a pivot point where SHIB shakes off its January slump.

Right now, SHIB is trading at about $0.000008, with a market cap of $4.7. It has dropped about 3.74% over the last 24 hours, but it is still up 13.9% for 2026 so far. If history repeats itself, we might see a double-digit reversal in just a few weeks.

Cryptic XRP hint dropped by Ripple CEO

Is it a coincidence, or is it 4D chess? Ripple CEO Brad Garlinghouse got the XRP community's attention with a single, curiously punctuated tweet.

Garlinghouse celebrated the fresh Binance listing of Ripple USD (RLUSD) with the following message. But the XRP Army immediately noticed the unusual capitalization of the letters "X-R-P" in "eXtRemely Positive" as a secret shoutout.

eXtRemely Positive to see $RLUSD listed on Binance

The post came out just as Ripple confirmed that the RLUSD stablecoin will be available for spot trading on Binance starting tomorrow, Jan. 22. They will start with support for Ethereum and then move on to XRPL.

The exchange already shows RLUSD/USDT and XRP/RLUSD as active listings. RLUSD had already hit a $1.38 billion cap last quarter, and this listing is going to expand its utility footprint.

While the market is struggling, XRP is holding strong at $1.89-$1.91, down just 1% despite the recent sell-off due to tariffs. Many see the RLUSD listing — which works with XRP directly — as a key liquidity bridge that could boost the whole ecosystem of XRPL.

Whether or not this Easter Egg by Garlinghouse was intentional, the tweet does what it needs to: get the community's attention during a dull moment — and maybe foreshadow utility momentum to come.

Bitcoin rockets 940% in brutal $359 million liquidation squeeze

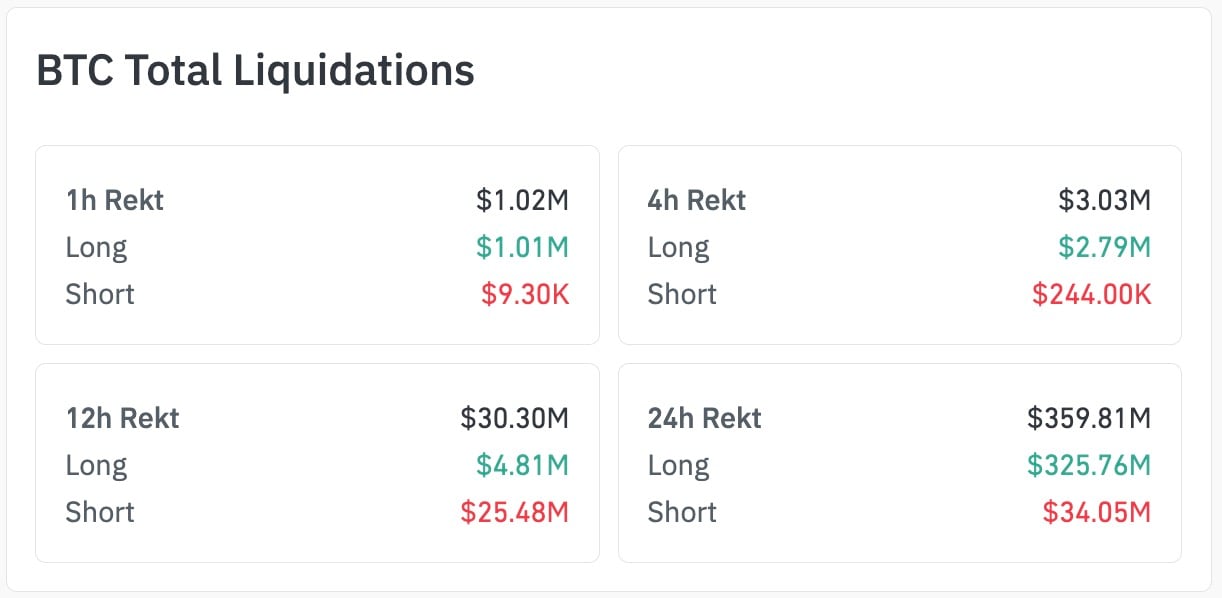

Bitcoin got smoked, almost literally. Over the past 24 hours, $358.9 million in long positions were liquidated, with an overwhelming 940% imbalance against longs. According to CoinGlass, only $34.08 million in short positions were affected, meaning bulls encountered a brutal macroeconomic shock and got completely wrecked.

The worst losses occurred when BTC dropped from $90,100 to $89,100 overnight. The biggest single liquidation? A $13.52 million BTC/USDT position on Bitget. Peak destruction occurred between 2:00 a.m. and 3:00 a.m. UTC, with total BTC liquidations now tracking 2.55 times above the seven-day average.

The culprit is over-leveraged euphoria colliding with a macroeconomic shock. Tariff threats against Europe resurfaced with a Greenland twist, strengthening the dollar, stalling rate cut expectations and draining liquidity from every corner of the market. BTC was at the center of it all, and longs paid the price.

Even shorter-term views show the same pattern. The last 12 hours saw an additional $29.83 million in liquidations, heavily imbalanced against longs. Hyperliquid led the exchange leaderboard with $124.16 million in BTC liquidations, including $107.43 million in long-side casualties.

However, when over 90% of the losses are sustained by bulls, it often signals a blow-off top. Currently, BTC is consolidating in the $89,000-89,300 range, near structural support. The question now is whether this was the flush before a bounce or the start of something worse.

Crypto market outlook for Jan. 21

Watch for further fallout from the U.S.-EU trade standoff, especially if tariffs scale to 25%. But for now, the market is bruised but not broken. The "Greenland Dump" has flushed out excess leverage, potentially setting the stage for a cleaner recovery if macro tensions cool.

Key levels to watch:

- Bitcoin (BTC): Crucial support holds at $88,500. A bounce here is needed to prevent a slide to $85,000. Watch for a reclamation of $90,000 to signal the squeeze is over.

- XRP: All eyes on Binance tomorrow at 8:00 a.m. UTC. The RLUSD listing could provide the volume spike needed to push XRP back toward $2.00.

- Shiba Inu (SHIB): The $0.000008 level is the turning point. If it holds through January, the February seasonality play will be the primary trade to watch.

Tomiwabold Olajide

Tomiwabold Olajide Arman Shirinyan

Arman Shirinyan Gamza Khanzadaev

Gamza Khanzadaev Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin