Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Today is Friday, Jan. 16, and the crypto market just gave us three major setups going into the weekend: XRP saw a 1.21% supply dip due to the use of ETF, Shiba Inu (SHIB) triggered a golden cross with 23% upside to the 200-day average and Cardano just nailed a legendary cup-and-handle formation with 28% rally potential.

TL;DR

- $1.51 billion worth of XRP now parked inside U.S. ETFs — 1.21% of supply off the table.

- Shiba Inu (SHIB) golden cross between 23 and 50-day MAs targets $0.00001044, or 23% upside.

- Cardano (ADA) forms classic breakout pattern, sets sights on $0.517 if $0.423 neckline is cleared.

XRP stunned with $1.5 billion cut from circulation

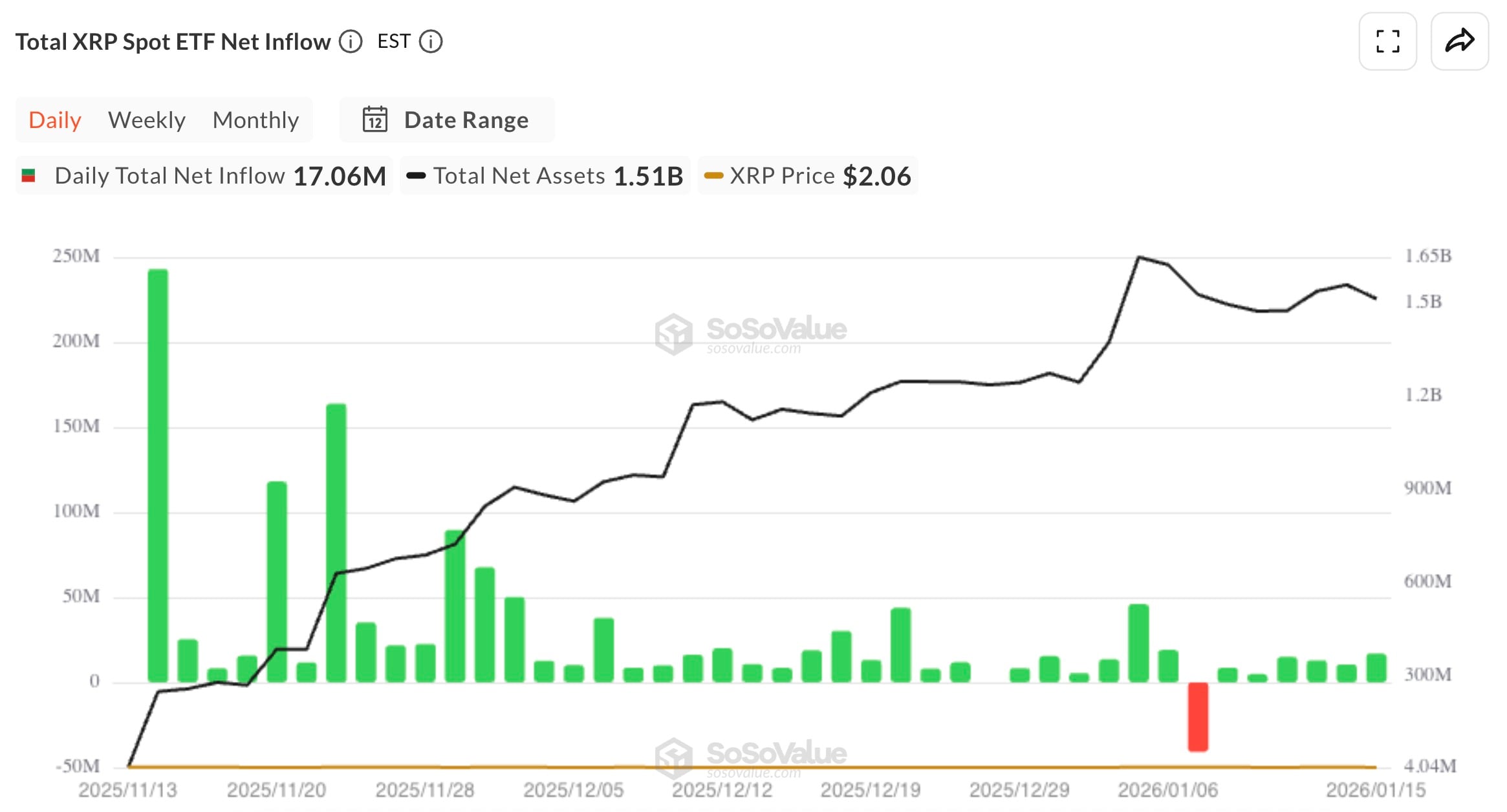

XRP just hit a big milestone that not many people are talking about, but many will be soon: as of Jan. 15, $1.51 billion in XRP is now locked inside U.S. spot ETFs. That is 1.21% of XRP's total supply, wrapped and taken out of the trading pool.

This is not a burn, though. These tokens are not gone, but they are basically out of sight for now. They are passive and not feeding volatility. That is the structural change that no one is pricing in for XRP, as it seems by looking at the TradingView chart.

After cooling slightly in early January, inflows surged again this week, adding $55.71 million across XRPC (Canary), XRPZ (Franklin) and GXRP (Grayscale). This latest push brings the total inflows of ETFs to $1.27 billion, with most of it now converted into XRP and held in custody. This makes XRP the third most accumulated altcoin by ETF volume, behind only BTC and ETH.

Key tickers like XRPZ and GXRP each added over $3 million in daily inflow, while Bitwise's XRP product leads with $7.16 million in new buys. Meanwhile, $659,000 flowed out of XRPC (Canary) — the only negative print of the day.

With this level of demand, the price structure is showing signs of anchoring near the ETF Net Asset Values, currently orbiting $2.01-$2.07, per SoSoValue. XRP is currently holding near $2.10 after a surge in early January, and the next move will depend on whether buyers can push the price back up to $2.32, which is the 200-day moving average.

If inflows keep up and Q1 ETF demand hits $2 billion, XRP might enter a new phase: low-volatility institutional behavior. Think less cryptocurrency, more commodity.

Shiba Inu (SHIB) finally delivers golden cross: Get ready for 23% rally

Shiba Inu just did something it had not done since November: it closed above its 50-day average. And more importantly, it confirmed a golden cross between the 23-day and 50-day moving averages — a setup that targets the 200-day moving average at $0.00001044, exactly 23% above the current price.

This is more than just a technical thing; the popular meme coin is close to overtaking a bunch of so-called utility coins in the CoinMarketCap ranking. Its current valuation of $4.98 billion is just $100-200 million away from flipping Hedera (HBAR), Litecoin (LTC) and even stablecoin Dai (DAI).

If things keep going like this for the Shiba Inu coin, it might even pass Avalanche (AVAX) at $5.92 billion.

Momentum is not guaranteed, but it is growing, as the price structure has improved a lot. SHIB has reclaimed its 50-day curve and is sitting just below $0.00000900 at the moment, with the trigger zone at $0.0000095. Once it is breached, the repricing could happen fast — just like it did in March 2024, when a similar formation led to a 39% move in just two weeks.

The golden cross is rare on SHIB because it is pretty volatile, but when it happens, SHIB often jumps up in the ranks quickly. The next few sessions will show if this is a fakeout or the start of SHIB's Q1 leaderboard breakout.

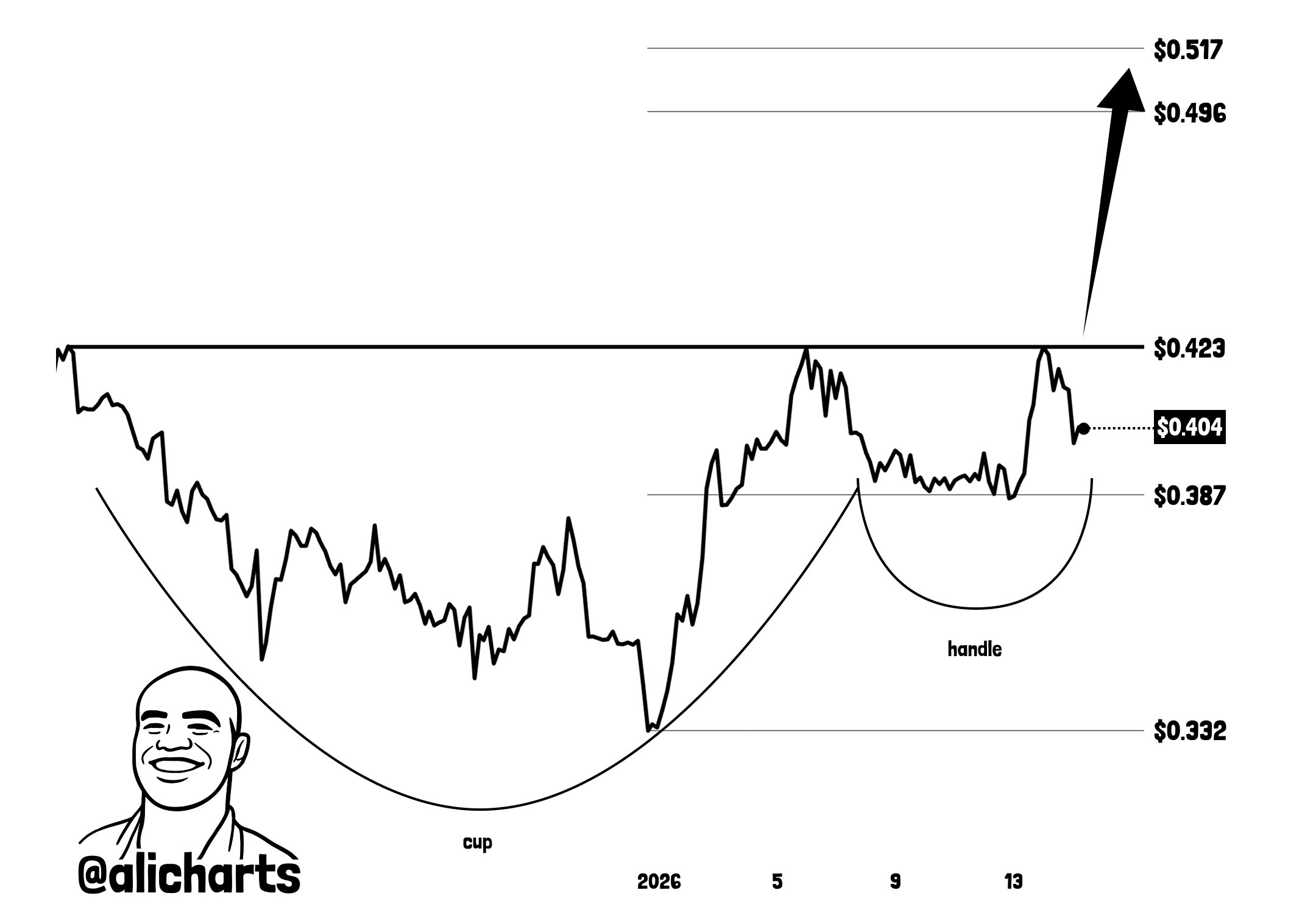

Is Cardano next silver? Legendary bull pattern says yes

Cardano has one of the clearest cup-and-handle patterns in the whole crypto market right now, and it is not just a bullish sign on paper. This setup led to 100%+ price hikes in gold and silver last year, making them the first and second most valuable assets. In the world.

The technicals are spot-on: a deep, rounded base, which is the cup, followed by a narrow handle formation that is currently ranging between $0.387 and $0.404, all compressing beneath the neckline at $0.423. If ADA breaks above that level, the measured move points to $0.517, which is a 28% rally from spot, as visible on Ali Martinez's chart.

The situation is especially important because it is happening to a top 10 altcoin during a low-volatility phase. While Ethereum is stalling and XRP is seeing inflows, diverting price action sideways, Cardano's ADA is now one of the few majors with a fresh structure and upside trigger.

The pattern mirrors setups that previously launched silver and gold out of multiyear accumulation phases.

If Cardano follows the script, this breakout could be the start of a sustained multi-week rally. This could put an end to all the speculation about ADA's sustainability among the crypto elite.

Is Bitcoin about to detonate altcoin breakouts?

Bitcoin's price is still hovering around $96,000, and the ETF flow data for Jan. 15 shows $100 million worth of inflows. You can see volatility compression across the board, but that is exactly when setups tend to break out — a quiet spell, then boom.

- XRP: Holding around $2.05, right below the 200-day MA of $2.32. Keep an eye on how much is flowing into the ETF. The price might hit the $2.07 NAV zone before any push.

- Shiba Inu (SHIB): The trend is back on track with a golden cross. The key trigger zone is still at $0.00000950, with a target of $0.00001044. And the flows are getting faster and faster.

- Cardano (ADA): Watch the $0.423 neckline for a cup-and-handle breakout. If it is cleared, the target pattern is $0.517.

Weekend moves might depend on whether BTC breaks its own compression range. If that happens, we could see a surge of capital into breakout setups like SHIB and ADA, while XRP continues to be driven by rebalancing related to the ETF.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov