Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

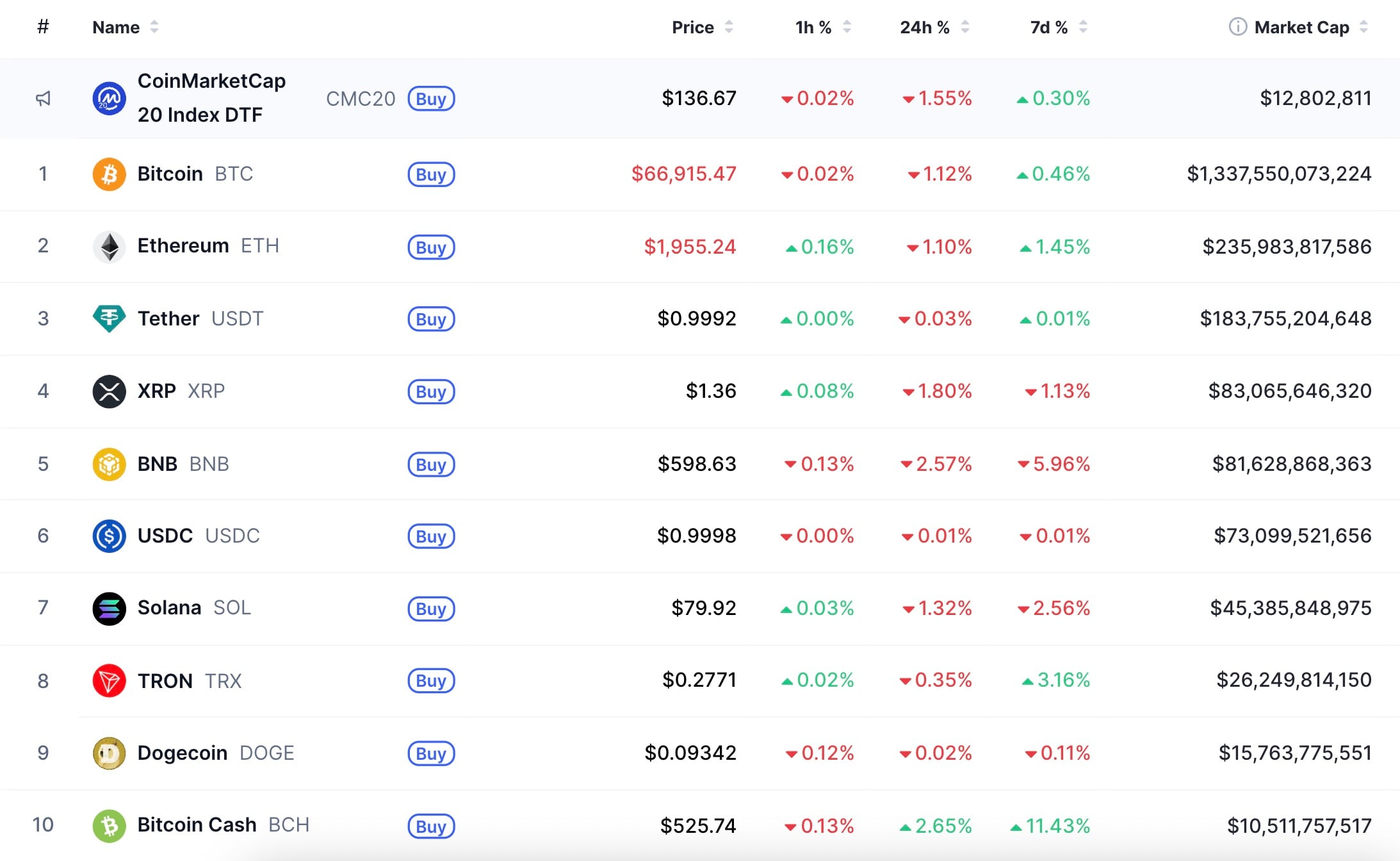

It is Friday, Feb. 13, and in today’s top stories XRP gains stronger exchange depth with a new Binance listing, Bitcoin Cash extends its dominance among the top 10 tokens amid a revived “Bitcoin without Saylor” narrative and Charles Hoskinson outlines values-based criteria as Cardano’s privacy chain, Midnight, enters the final launch stage.

TL;DR

- Binance opens XRP/U spot trading, adding the United Stables liquidity layer.

- Bitcoin Cash holds a $10.55 billion market cap and sustains its top 10 ranking.

- Hoskinson calls for ethics-driven blockchain development as Cardano ecosystem prepares Midnight launch.

Binance expands stablecoin options for XRP with XRP/U pair listing

According to a new X post, Binance launched a new XRP/U trading pair, introducing United Stables (U) as a new liquidity layer for XRP.

Binance remains one of the largest spot markets for XRP, according to CoinMarketCap data, with the XRP/USDT pair generating $154,548,191 in recent 24-hour volume. Even the USDC pair there worth $52,776,085 in daily volume is more than most other exchanges have in main USDT or USD pairs.

It is an interesting detail that Korean crypto exchanges like Upbit and Bithumb have the equivalent of $185,369,440 and $154,892,350, respectively, for XRP/KRW pairs."

United Stables (U), listed on Binance in January 2026, is a meta-stablecoin backed by a reserve model accepting USDT, USDC and USD1. As the first native stablecoin on BNB Chain using a multiasset reserve structure, it aims to standardize settlement and liquidity flows across DeFi, CEXes and payments rails.

XRP’s integration into the U trading pair lineup reflects increasing focus on stablecoin-agnostic trading and cross-reserve fungibility.

Bitcoin Cash solidifies top 10 status as "Bitcoin without Saylor" narrative gains steam

While Binance continues to expand the market share for XRP and U, Bitcoin Cash, in its own lane, is holding a position in the top 10 cryptocurrencies by market cap on CoinMarketCap, with a figure of $10,553,475,202 at the time of writing. After a breakthrough earlier this year and dethroning Cardano (ADA), BCH’s presence in the top 10 has drawn renewed attention to this once-forgotten Bitcoin fork.

Now that its top 10 status appears sustainable, public figures like “thedefivillain” have labeled it “Bitcoin without Saylor” in an attempt to frame its relative strength within a broader narrative.

If that is an expression of the opinion that Saylor and the Bitcoin Standard he implemented at Strategy are toxic to Bitcoin, or an attempt to explain why Bitcoin Cash may be superior to its original counterpart is open for debate. One could say that both of these explanations have a right to life. The fact is, the crypto community seems open to finding an idea within the digital assets space that will not have such a heavy entity tied to it.

It is no surprise really, considering that Bitcoin's success was mostly attributed to the disappearance of its creator, known as Satoshi Nakamoto, and with Saylor absorbing 3.4% supply of the cryptocurrency and being the main topic of almost all discussions around BTC, this may spoil the appeal for some.

All things considered, some may attribute the resilience of Bitcoin Cash to its wide presence in the online casino and gaming sectors. Others may argue that its strength comes from mining being more profitable than Bitcoin. Another group of people may call it "Bitcoin without Saylor." The truth, one may argue, lies in the price chart, while narratives and news tend to be constructed afterward.

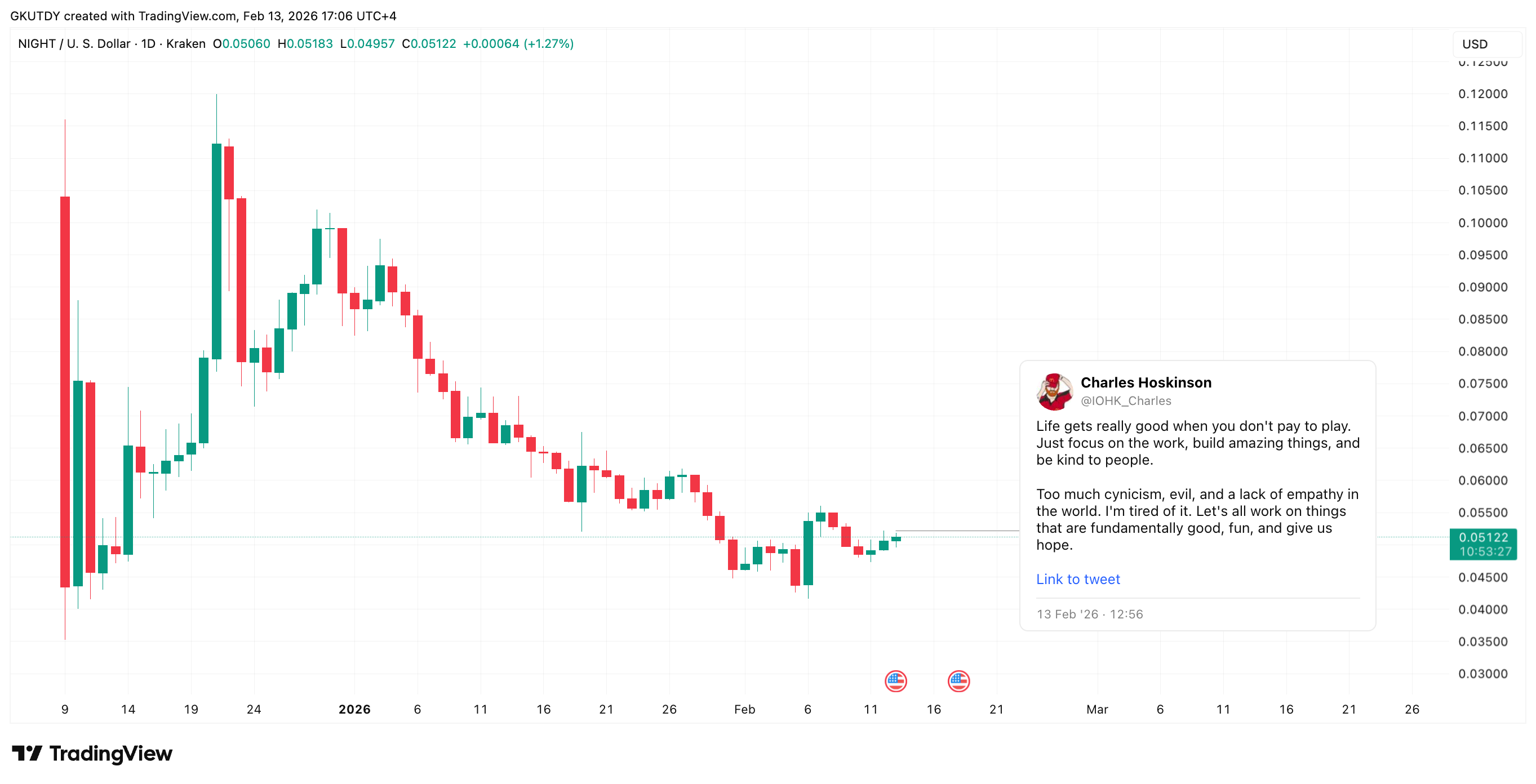

Hoskinson defines "anti-cynicism" criteria as Cardano's Midnight prepares March launch

XRP and BCH stories aside, Charles Hoskinson used social media this Friday to talk about a values-driven framework for development as the Cardano creator seems to be tired of "pay to play." For him, meaningful work should not rely on such structures and should focus on building fundamentally good and hopeful systems. These thoughts of Hoskinson's appear to be a reaction to a "lot of cynicism" and a lack of empathy in the crypto industry.

Beyond all the talk, there are real steps being taken to make that happen. Previously this week, Hoskinson confirmed that Midnight, a blockchain focused on privacy and built on Cardano, will launch in the last week of March 2026.

Midnight's architecture is all about making sure transactions are private by default, and it only discloses the information it needs to through something called zero-knowledge proofs. The goal is to find a middle ground between privacy and compliance, avoiding the simple choice of privacy vs. compliance.

So, the "anti-cynicism" approach lines up with real-world action, like privacy infrastructure, simulation tools, cross-chain expansion and ecosystem integration. Whether this approach will lead to capital inflows depends on how well it is adopted after launch, not just on the overall Cardano ecosystem's position on the matter.

Crypto market outlook: Key levels to watch for BTC, ADA, XRP

This week’s price action was driven mostly by macro data, with NFP and CPI releases setting the tone across risk assets, and digital ones especially. Crypto responded with brutal sell-offs, random pumps, extreme fear and more uncertainty.

Though the infrastructure and environment around the digital assets market continues to evolve, with new CFTC assembling 35 key figures of the market for a new advisory panel.

Key levels to watch:

Bitcoin (BTC): BTC is trading near $67,069 after rebounding from a washout to $60,000. Immediate resistance now sits around $72,000. On the downside, $64,000 acts as short-term support, while a loss of that level would reopen downside risk toward the $60,000 liquidity pocket.

XRP: XRP is currently trading near $1.365 on the daily time frame. After the early February capitulation wick toward the $1.10-$1.15 zone, the price rebounded but remained structurally below prior consolidation ranges. Immediate resistance is now located at $1.50. On the downside, $1.30-$1.32 serves as short-term support. A loss of that area reopens risk toward the February low near $1.10.

Cardano (ADA): ADA is currently trading near $0.2627 after prolonged downside pressure. Immediate resistance is located at $0.30, followed by a broader supply zone near $0.35. On the downside, $0.25 is the key structural support. A decisive reclamation of $0.30 would signal short-term recovery potential ahead of the late-March Midnight launch, while continued compression below that threshold keeps momentum neutral to weak.

Overall, Bitcoin remains the directional anchor. As long as BTC holds above $64,000, altcoin stabilization remains possible. A breakdown below that level would likely pressure the ADA and XRP support zones in tandem.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin