Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

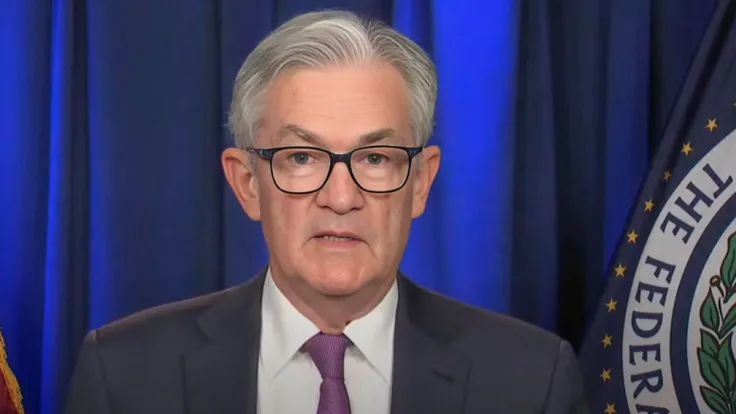

Jerome Powell, Chairman of the Federal Reserve, recently made statements that carry substantial weight for the financial markets, including cryptocurrencies. His comment, "I would not note we have achieved a soft landing yet," reflects ongoing caution from the central bank amid economic recovery efforts.

Additionally, Powell's admission to being in "risk management mode" to avoid acting too hastily or too belatedly, coupled with the expectation to dial back the policy rate this year if the economy evolves as projected.

These remarks from Powell are critical for the cryptocurrency market because they indicate that the Federal Reserve is still striving to navigate the economy toward a state where inflation is under control without triggering a recession.

The implications for risk assets, like cryptocurrencies, are significant. Cryptocurrencies are often viewed as a hedge against inflation and can be sensitive to interest rate changes, which influence the cost of capital and risk appetite on the broader market.

If the Federal Reserve is successful in managing this economic balancing act, we could see a positive impact on the cryptocurrency market. On the flip side, if investors perceive central bank policies as too restrictive or not sufficiently preventative against inflation, it could lead to increased volatility and potential bearish trends for risk assets, including Bitcoin.

Bitcoin review

Bitcoin is currently facing resistance at the $42,500 level, with key support at approximately $39,000. A break below this support level could signal a short-term bearish outlook, potentially testing further support near $35,975. The moving averages suggest a consolidating market, and the RSI, hovering around the midline, points to a neutral momentum.

A dial-back in policy rates might lead to an increase in risk appetite, potentially driving Bitcoin's price to retest resistance levels. The next resistance stands near the $42,500 level, and a breach here could see Bitcoin targeting the $46,000 zone.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin