Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Lead Gate CEO highlights growth of centralized and decentralized exchanges amid surge of digital assets in general

Social .@Gate joins the rapid growth of centralized and decentralized exchanges, highlighted by their CEO

Gate founder and CEO Dr. Han gave a keynote address at WebX 2025 in Tokyo about the changing roles of decentralized exchanges (DEX) and centralized exchanges (CEX) in the growth of Web3. Long-term user growth, the dual development of market structures and the integration of security and compliance were the main topics of his comments. He presented DEXs as catalysts for on-chain finance and innovation and CEXs as international gateways to capital.

Gate's solid market position

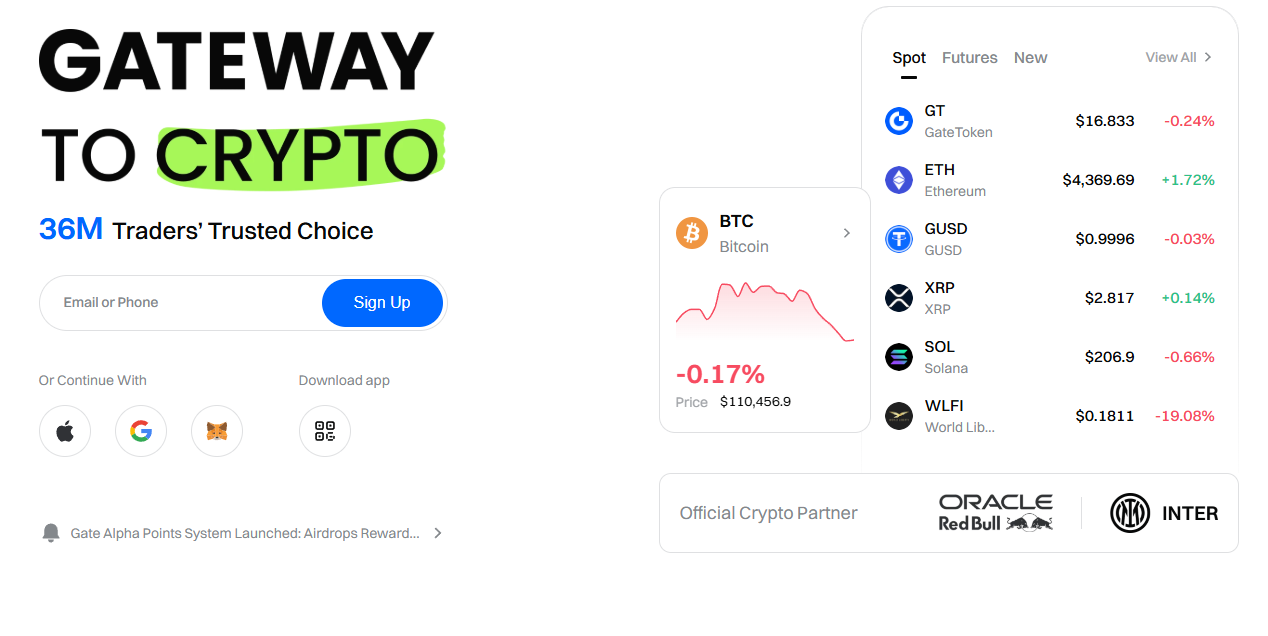

He started by going over Gate’s market position and growth. With over 36 million registered users globally, the platform remains one of the top exchanges for both spot and derivatives trading volume. Gate has made investments in increased visibility outside of trading through sports alliances, such as those with Inter and Oracle Red Bull Racing in Formula 1.

Dr. Han emphasized that the number of people using cryptocurrency has increased from about 1 million in 2013 to almost 700 million in 2025, who account for roughly 10% of the global population. Adoption varies between 10 and 27% in both developed and emerging markets, which is significant but uneven. He credited a range of new use cases that go beyond speculation, including financial inclusion, for this growth.

He maintained that from a macroeconomic standpoint, cryptocurrency has become a unique and significant asset class. Global assets changed between 2013 and 2025, with digital assets and technology companies experiencing comparatively greater growth than gold and silver. While the cryptocurrency industry has grown quickly since 2020, companies like Microsoft and Nvidia have seen significant increases in market value.

Growth of cryptocurrency market

By August 2025, Bitcoin accounted for $2.35 trillion of the $3.02 trillion total market capitalization of cryptocurrencies. After Microsoft, Nvidia and gold, cryptocurrency was now the fourth-largest asset in the world. According to Dr. Dot Han’s projections, digital assets could surpass the value of most asset classes except gold and become a major part of global capital allocation by 2030, increasing to $41 trillion.

In response to the competition between CEXs and DEXs, he pointed out that while centralized platforms used to clearly dominate the market, things have since leveled out. The total value locked on CEXs and DEXs will be almost equal by 2025. DEXs are the industry leaders in token issuance, with platforms such as Pump, PancakeSwap and Uniswap. Tens of thousands of new tokens are hosted every day. Meanwhile, centralized platforms like Gate Alpha and Binance Alpha are catching up in terms of token launches.

DEX takes market share

When wash trading is taken out of the equation, DEXs make up 42% of retail traders’ trading activity, which accounts for 23% of global spot volumes. It was stated that compliance and security were essential to the future of the sector. Five and a half billion dollars have been lost to hackers since 2022, with DEXs and other Web3 platforms being the target of 59% of attacks.

Due to its increasing liquidity, DeFi has also grown in importance as a money laundering vector when compared to CEXs. Gate has obtained regulatory approvals in a number of jurisdictions, including Lithuania, Malta, Italy, Gibraltar, Hong Kong and Dubai, thereby expanding its compliance infrastructure. To increase its regulatory presence, it also purchased a licensed Japanese exchange in 2024.

Dr. Han came to the conclusion that whether CEXs or DEXs win out in the future will depend on how well the two models work together. The innovation will continue to be led by decentralized platforms, while centralized exchanges will offer the required accessibility, security and regulatory integration. He maintained that since on-chain will form the cornerstone of the next financial system, broader Web3 adoption is inevitable.

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk