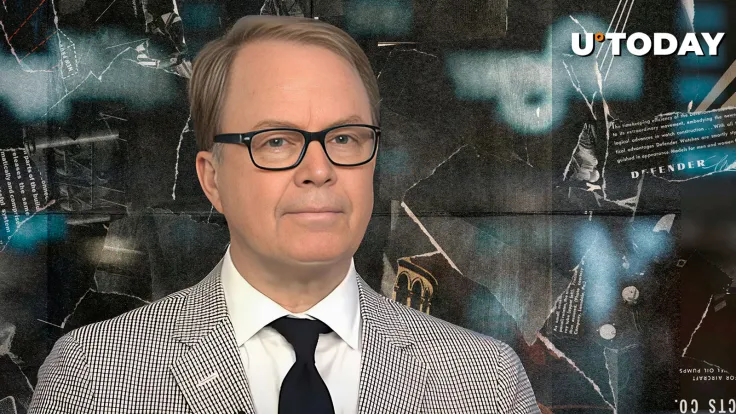

Jurrien Timmer, director of global macro at Boston-based investment giant Fidelity, claims that it makes sense for Bitcoin to sit at the top of the table of investment returns alongside gold and international equities.

Meanwhile, bonds remain at the very bottom amid US fiscal dominance that is boosting domestic assets.

He argues that the ongoing artificial intelligence (AI) boom continues to fuel US large caps.

Bitcoin, which mainly stands out due to its scarcity, tends to benefit from weakening fiat.

Not passing the paton (so far)

In May, Timmer predicted that gold might end up passing the baton to Bitcoin in the second half of the year.

However, this has not happened so far as the lustrous metal keeps outperforming its digital rival.

In late August, Timmer opined that Bitcoin and gold were "right in balance" with each other after the former reached a new record high. However, Bitcoin's rally stalled, and gold continued vastly outperforming it in September.

Earlier today, gold reached yet another all-time high, surging above $3,650, as investors are increasingly betting on the yellow metal ahead of the Fed's widely predicted rate cuts.

Timmer recently predicted that the Fed could potentially restart quantitative easing (QE) engines, which is expected to boost Bitcoin (BTC) and gold.

Cycle top?

While there are still debates about whether Bitcoin's halvening-driven four-year cycles are still a thing due to the growing influence of institutional money participants, Timmer believes that the leading cryptocurrency continues to follow them.

In July, he opined that both Bitcoin and gold were still "in the middle innings" of the hard money trade, pointing to the size of the global money supply and the dollar's strength.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov