Jurrien Timmer, director of global macro at Boston-based investment giant Fidelity, has opined that Bitcoin might "pick up the slack" now that gold's rally has faltered.

"The price of gold continues to work off what in retrospect looks a lot like a blow-off that was not quite justified by the rise in liquidity," Timmer noted, predicting that the lustrous metal will now experience a prolonged period of churn.

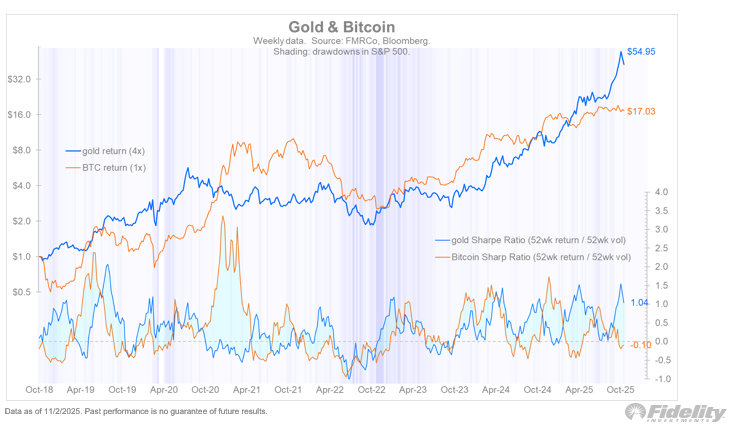

He has noted that their Sharpe ratios, which measure the risk-adjusted performance of the two assets, have been moving in opposite directions for some time now.

"Here is to adulthood!"

As reported by U.Today, Timmer previously claimed that Bitcoin was comparable to Dr Jekyll and Mr Hyde, the characters of the popular gothic horror novella written by Scottish novelist Robert Louis Stevenson, in the sense that it can simultaneously act as a risk-on and a risk-off asset.

In his most recent post, the prominent analyst claims that Bitcoin is "becoming a more mature and less precocious asset class."

He has also noted that the current uptrend is a "normal" exponential one instead of a euphoria-driven parabola, which would be typical for the cryptocurrency's earlier cycles.

Timmer vs. McGlone

At the same time, Mike McGlone, chief commodity strategist at Bloomberg Intelligence, recently predicted that Bitcoin could potentially lose as much as 60% of its value against gold.

In May, as reported by U.Today, Timmer claimed that the yellow metal could pass the baton to its digital rival in the second half of the year. However, this did not happen, and Bitcoin bears have been mostly vindicated.

Despite the recent pullback, gold is still up by a whopping 54% on a year-to-date basis. In the meantime, Bitcoin is barely managing to remain in the green with an extremely modest 2025 gain of roughly 9%.

According to CoinGecko data, Bitcoin is currently changing hands at $103,285 after briefly plunging below the make-it-or-break-it $100,000 level yet again earlier this Friday.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin