Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

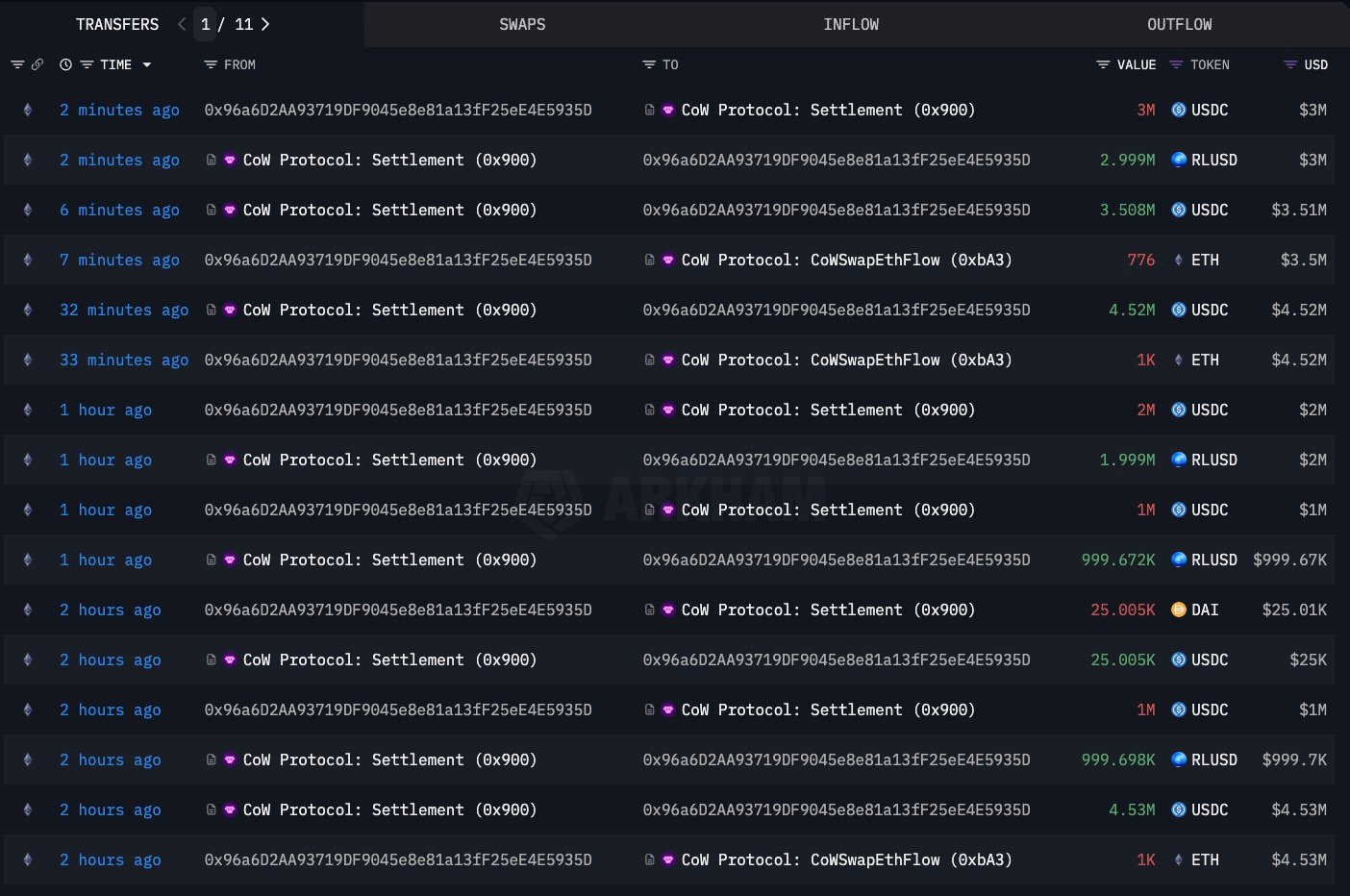

An old Ethereum wallet that had not moved a coin in three years has suddenly decided that now is a good time to act, sending 2,086 ETH into stablecoins worth $9.48 million, spread across such stablecoins as DAI, USDC and RLUSD, with the sales executed through CoW Protocol.

The interesting part is that this was not a full exit as the Ethereum OG still holds 2,779 ETH, valued at about $12.6 million.

The move looks less like someone leaving ETH behind and more like someone who believes the $4,544 level is strong enough to justify locking in profit, while still keeping enough exposure in case the rally has more room to run.

It falls in line with another story from just a few days ago, when an Ethereum address tied back to 2017 made headlines for shifting 8,310 ETH worth $41.4 million onto exchanges, a sale that brought total realized profit to nearly $32.9 million, considering that the original 16,830 ETH had been acquired at a laughably low $181 each, which translates into a return of 2,100% on the early bet.

Ethereum (ETH) price opportunity

Price behavior on Ethereum explains part of the logic, with the altcoin around the $4,500 zone, where weekly charts have shown hesitation in breaking past $4,600-$4,700, making it a natural area for long-term holders to reduce risk.

From their point of view, after holding through crashes, regulatory battles and a new all-time high this year, the decision to sell here is not about timing the exact top but about crystallizing gains that most traders can only dream of, while still keeping enough coins in the wallet to participate if the story continues upward.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin