DeFi Yield Protocol has surpassed $63 million in total value locked (TVL). Its users have now earned over $3.8 million worth of Ethereum (ETH) rewards.

The DYP utility token is currently trading at $4.52 after peaking at $4.99 on Jan. 25, 2020, according to CoinGecko data. It is currently available on Uniswap, Bithumb as well as Hotbit.

DYP.Finance’s governance dApp and staking initiative

In late December, DeFi Yield Protocol rolled out its governance dApp to make it possible for the community to work on all proposals.

Its anti-manipulation feature was meant to create a level playing field for individual investors by preventing whales from taking over the network. All rewards get automatically converted into Ethereum (ETH), ensuring a high level of transparency.

By providing liquidity to DeFi Yield Protocol with Uniswap LP tokens, its users are able to earn staking rewards in ETH. All undistributed rewards get handed out based on a community vote after a seven-day period. In case of a volatile move of over 2.5 percent, any amount of rewards that will no affect the market will be swapped to Ether.

There are currently four staking pools (DYP-WBTC, DYP-USDC, DYP-ETH, DYP-USDT). Staking options differ from one pool to another, with the annual percentage rate ranging from 248.66 percent to 692.64 percent. The pool with the highest APY has the highest minimum lock period of 90 days. It is possible to reinvest one’s rewards without paying any additional fees.

There are also four yield farming pools with an APR of up to 35 percent. The lock time ranges from 30 days to 120 days.

The protocol’s new referral system also allows receiving five percent of rewards of new people that you bring in to stake their DYP tokens.

More plans for 2021

Ethereum mining

In the first quarter of 2021, the team behind DYP.Finance also plans to introduce a zero-fee pool for Ethereum mining.

Miners will be able to get a 10 percent bonus every month for interacting with the smart DYP smart contract.

The pool will not be launched until the hashrate of 250 GH/s will be achieved.

The DYP Earn Vault

On top of that, the team behind the DYP Earn Vault will support Ethereum (ETH), Wrapped Bitcoin (wBTC), and serval stablecoins. The maximum lockup period is 120 days.

The lion’s share of the vault’s profits (75 percent) will be automatically distributed to liquidity providers. The remaining rewards will be used for injecting more liquidity into the DYP token.

DYP tools

A suite of DYP tools for analyzing data from numerous decentralized exchanges and Etherscan will also be introduced in the first quarter. This will help uninitiated investors to navigate the rapidly growing decentralized finance scene.

The DYP tools will assign a trust score to projects listed on Uniswap in a decentralized fashion based on such metrics as the token’s liquidity, security, and the degree of transparency displayed by its team.

DeFi Yield Protocol ensures that all its smart contracts are audited not to allow another YAM. Finance-like disaster happen.

Other initiatives

Its roadmap for the second quarter also includes the launch of another Ethereum mining pool as well as the rollout of built-in insurance for liquidity providers.

The decentralized finance (DeFi) boom

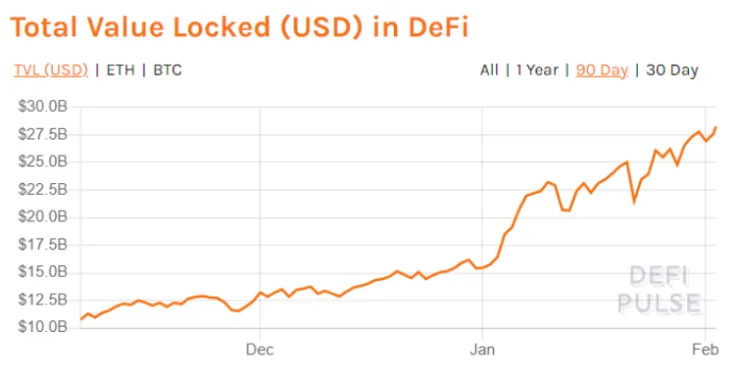

The total value locked in various decentralized finance protocols has now eclipsed $28 billion, marking a major milestone for the entire industry.

Maker.DAO is the largest protocol with over $5 billion worth of locked value. It is followed by Aave and Compound.

Multiple DeFi tokens (UNI, AAVE) are now in the top 20 cryptocurrencies, CoinGecko data shows.

Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk Tomiwabold Olajide

Tomiwabold Olajide