Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Dogecoin’s first spot ETF products have been live since Nov. 24, 2025 in the U.S., but judging by the numbers by SoSoValue, it is fair to say that DOGE has yet to live up to the hype surrounding the ETF.

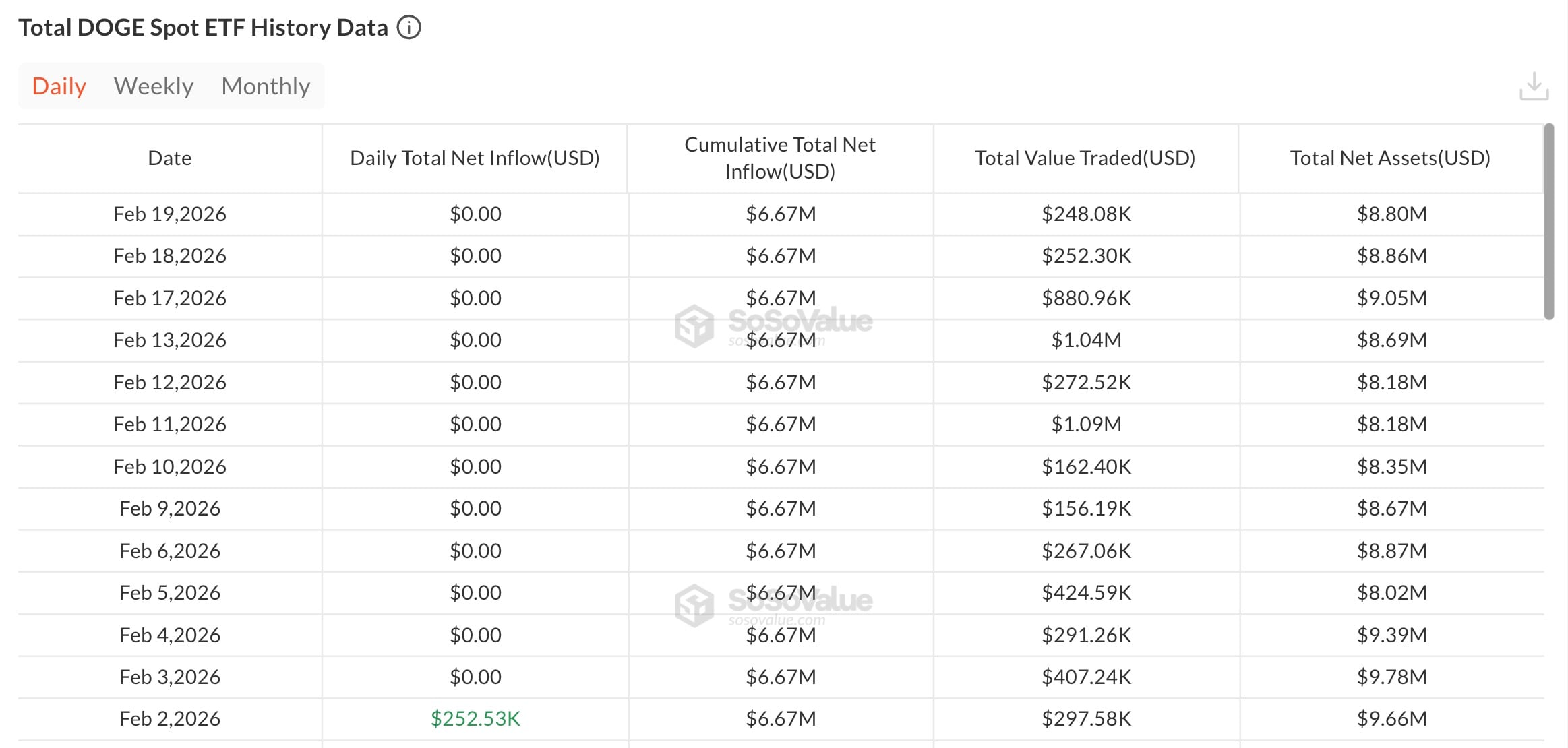

As of Feb. 19, the cumulative net inflows across the U.S. DOGE spot ETFs were $6.67 million, with a 18-day streak of $0 in net inflows and total net assets of approximately $8.8 million.

Under 1% of market cap: Is institutional demand for DOGE just lagging?

The total value traded in the most recent session was nearly $247,000. For context, leading Bitcoin and Ethereum ETFs moved billions in their opening weeks, setting a benchmark that any new crypto fund inevitably faces. This raises the question of whether the demand for this asset born from a meme was overestimated.

Three issuers currently dominate the DOGE ETF table: Grayscale’s GDOG, which has approximately $6.38 million in net assets; 21Shares's TDOG, which has nearly $1.77 million; and Bitwise's BWOW, which has around $641,000. The whole segment itself is so small, it represents less than 1% of Dogecoin’s overall market capitalization worth $16.25 billion, as per CoinMarketCap.

DOGE is quoted at around $0.096 at the time of writing, down by over 1.5% for the day and well below the $0.15 resistance level seen earlier this year. The long-term chart shows a consistent downward trend since September 2025, with recent attempts to reach higher levels failing miserably.

Calling the ETF a failure at this stage may be premature. However, expectations for the institutionalization of meme assets were clearly higher than current flow data for Dogecoin reflects.

A more relevant question is whether DOGE can generate sustained inflows beyond early adopters. If assets under management remain below $10 million and trading activity stays low, issuers could face commercial pressure.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin