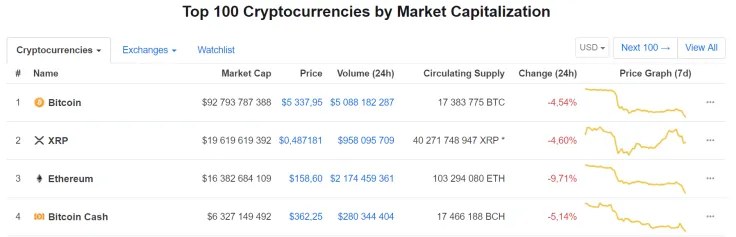

The week of Nov. 19 - Nov. 23 starts with a strong selloff for the market’s four major cryptocurrencies, which all saw significant declines during the last day. The largest decline was noted for the Ethereum at 7.76% and the smallest one for the Bitcoin at 2.74%. It is noteworthy that the valuation of Bitcoin fell below $100 billion for the first time since last November.

What caused this selloff during the past days?

Mainly two reasons:

- The first one was the monthly expiration of Bitcoin futures at CBOE.

- The second possible reason for the slide in cryptocurrency markets is the recent fork in Bitcoin Cash, the world’s fourth most valuable cryptocurrency, into Bitcoin ABC and Bitcoin SV.

Technical Analysis for the four major cryptocurrencies

Bitcoin

The major support level near $6426 did not last and was broken. Now Bitcoin price is at $5335 and a strong downtrend is dominant, supported by the ADX/DMI indicator. Traders should be very cautious trying to catch the bottom.

There is not any significant support at these levels, and there should be resistance at the levels of $6000, $6230, $6630.

The Stochastic indicator with values (14,3,3) on the daily chart is now at oversold conditions below the 20 level but has not made any cross to confirm a possible trend change. The daily 20-period and 50-period exponential moving averages are at $6093 and $6332 respectively, pointing down and confirming the strong downtrend. Preferable positions are to trade with the trend and sell any bounces to the level of $6300, aiming at possible lower levels than $5300.

XRP

A different story for XRP as it trades within a range of $0.42 and $0.57 for several days. On the daily chart the 20-period and 50-period exponential moving averages are at $0.4930 and $0.4753 pointing up, but the strength of the trend is weak with a value of 17.66 for the ADX/DMI indicator.

The Stochastic indicator (14,3,3) is at neutral level and there is strong support at $0.4375 and strong resistance at $0.5490. Preferable positions are to trade the range of daily Bollinger Bands at $0.4324-$0.5513 until a breakout occurs.

Ethereum

Ethereum has a daily chart looking like Bitcoin’s chart. As the strong support of $190 did not last, the selloff drove the price, currently at $157.

The downtrend seems to gather momentum supported by the ADX/DMI indicator with the daily 20-period and 50-period exponential moving averages respectively at $194.31 and $209.99 pointing down.

Trying to catch a bottom is too risky, with preferable positions selling any strength towards the $190-$195 levels for a continuation of the trend lower. There is not any significant level of support and strong resistance at $190 and $195 levels.

Bitcoin Cash

The cryptocurrency tried to form a bottom at $408, but the support did not last and a new low at $347 is now formed. The daily 20-period and 50-period exponential moving averages are at $456.90 and $477.27 respectively, pointing down.

The Stochastic indicator (14,3,3) is now an oversold level below the 20 level but has not confirmed any cross yet. The downtrend seems to gather momentum.

There is not any significant support at this price, currently at $350.79, and there is strong support, now resistance at $410-$415. Preferable positions are to short any bounces towards the level of $415 for resuming the downtrend.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov