Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

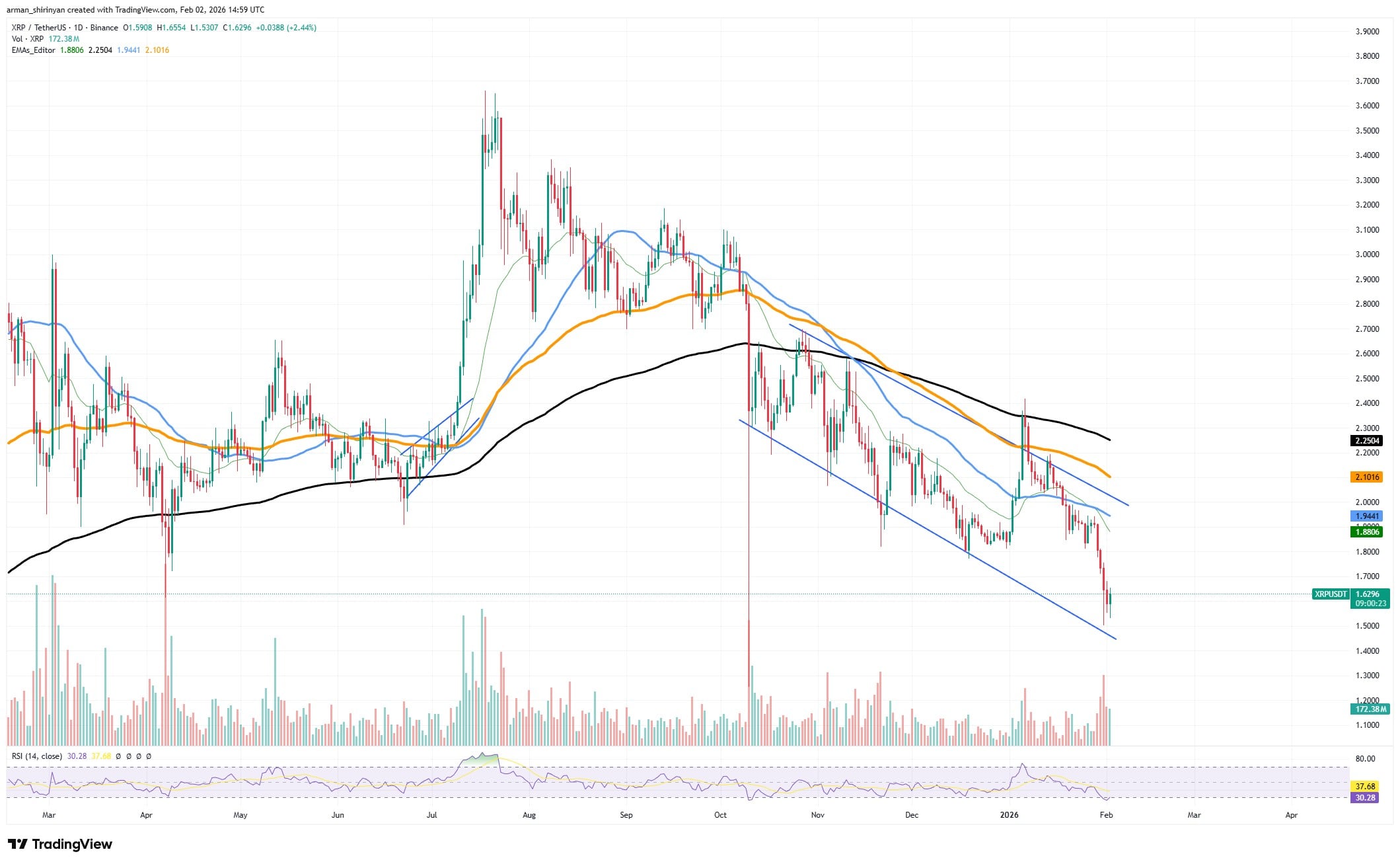

The most recent price movement for XRP indicates that the bullish momentum has mostly vanished, making the asset vulnerable as the market is still dominated by selling pressure. XRP now seems to be firmly in the hands of sellers, with bulls demonstrating little capacity to defend important price zones following multiple unsuccessful attempts at recovery in recent weeks.

The buy side is clearly exhausted. As seen by the daily chart, XRP remains trapped in a persistent downtrend, consistently forming lower highs and lower lows. Each rebound attempt has been weaker than the previous one, indicating declining confidence among buyers. Additionally, the asset has fallen significantly below its key moving averages, such as the 50-day and 100-day levels, which now serve as dynamic resistance rather than support.

XRP is now at levels not seen in months thanks to recent price action that delivered yet another steep decline; even brief rallies are unsuccessful and soon face pressure to sell. Volume spikes that coincide with declining trends provide additional evidence that market players are still selling rather than buying. Technically, XRP also broke out of a descending structure only to collapse again, showing that attempts to reverse momentum have repeatedly failed.

Such false recovery signals often accelerate bearish sentiment as traders who entered expecting a breakout are forced to close positions at a loss. In comparison to some major assets, XRP's relative performance indicates even stronger selling, but the overall weakness of the cryptocurrency market has only increased pressure.

Unless bulls quickly reclaim key resistance levels and rebuild upward momentum, XRP risks drifting further lower. The next battlefield might be psychological support zones, but these might also be difficult to maintain in the absence of fresh purchasing interest.

Ethereum's market shock

Ethereum has suffered a sharp market shock after a sudden explosion in trading volume triggered a heavy price decline, wiping out key support levels and sending ETH tumbling within hours. The move reflects what appears to be the forced liquidation or the rapid exit of several large whale positions, amplifying selling pressure across the market.

After weeks of steady declines, Ethereum had been having trouble staying stable above the $2,800 support area on the daily chart. Price action repeatedly failed to reclaim major moving averages, and bullish attempts were consistently rejected. When a huge spike in sell-side volume hit the market, that brittle structure finally gave way, driving ETH firmly below support and quickening the downward momentum.

Large leveraged positions were probably liquidated as prices broke lower based on the volume spike, and automated liquidations and panic-selling exacerbated the decline once important support zones fell, pushing ETH quickly toward the $2,300-$2,400 range.

These actions frequently show that whales, or major institutional players, were compelled to sell their positions either as a result of margin calls or deliberate de-risking in the face of general market weakness. Technically speaking, moving averages are becoming overhead resistance, and Ethereum is currently trading well below crucial trend levels.

While momentum indicators also remain weak, sellers still maintain control in the short term. Oversold conditions may encourage brief rallies, but recovery may take some time due to the harm done to the market's structure.

Shiba Inu's sad start to 2026

Shiba Inu has experienced its worst decline in 2026 so far, essentially destroying all hopes of investors for a proper market retrace instead of a weak movement upward.

On the daily chart, SHIB recently broke down from a consolidation structure, triggering another wave of selling that pushed the token toward fresh local lows. During the decline, trading volume spiked, suggesting forced selling and panic exits rather than gradual distribution. The price now sits well below key moving averages, confirming that the broader trend remains bearish.

However, one important signal is particularly noteworthy: the Relative Strength Index (RSI) is now in extremely oversold territory. The market typically sees at least a brief relief bounce; whenever SHIB's RSI has fallen to these levels in the past, sellers grow weary and shrewd buyers intervene. Oversold conditions often precede stabilization periods or brief recovery attempts, but they do not ensure an instant reversal.

Psychological positioning is an additional significant factor, and investors should remain cautious as the overall trend is still negative and recovery will require SHIB to reclaim nearby resistance zones and hold above them. However, the extreme oversold readings mean downside momentum may be losing strength, opening the door for a rebound or consolidation phase.

After such a sharp drop, many weak hands have already exited the market, reducing immediate selling pressure, which creates conditions where even moderate buying activity can push prices higher, especially if broader crypto sentiment begins to improve.

Arman Shirinyan

Arman Shirinyan Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide