Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin just had a -17.4% crash in late 2025, followed by a weak +1.36% bounce in January. But if history repeats itself as the real alpha trigger for Bitcoin, the next big move might be in February, and it is not a bearish one.

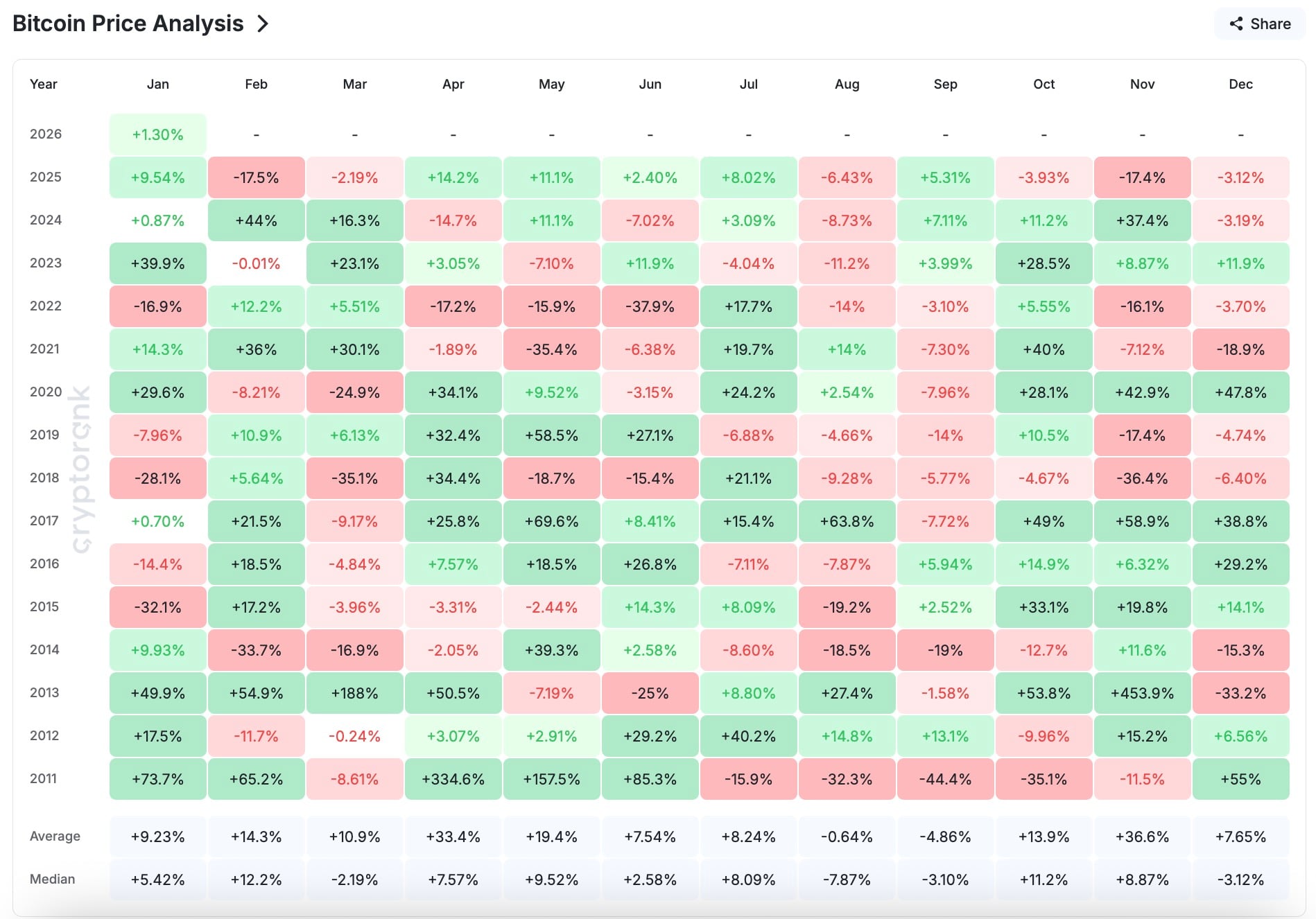

Over the last 13 out of the last 15 years, February has been one of the best months for Bitcoin, as per CryptoRank. On average, it has seen a 14.3% return, with gains in 11 different cycles. In key rebound years like 2023, 2021, 2017 and 2012, February was not just a good month for the market — it was a game-changer, leading to multimonth rallies.

The setup is classic pre-rally panic. On Jan. 21, BTC plunged under $89,000 after peaking near $97,000 earlier this month, wiping out $359 million in leveraged longs over four sessions.

But this kind of pre-February dip has historically acted as fuel. In 2020, a -8.21% February came right before Bitcoin's breakout. In 2014 and 2018, midcycle resets preceded major April surges.

How much will Bitcoin be worth in February 2026?

Thus, it looks like Bitcoin being back in the $88,000-$86,000 support it hit in November sets up a possible double-bottom pattern. If the bulls defend this zone and February performs anywhere close to the median at +12.2%, price targets stretch into $99,500-$101,000 per BTC at minimum.

Should the leading cryptocurrency repeat the 2023 February scenario, the $109,500 price tag will be shining on the chart as early as next month.

The February bullish base rate is legit. Add in ETF flows, early tax-driven accumulation and the hope for a macro pivot, and the next $100,000 target could hit sooner than most expect.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov