Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

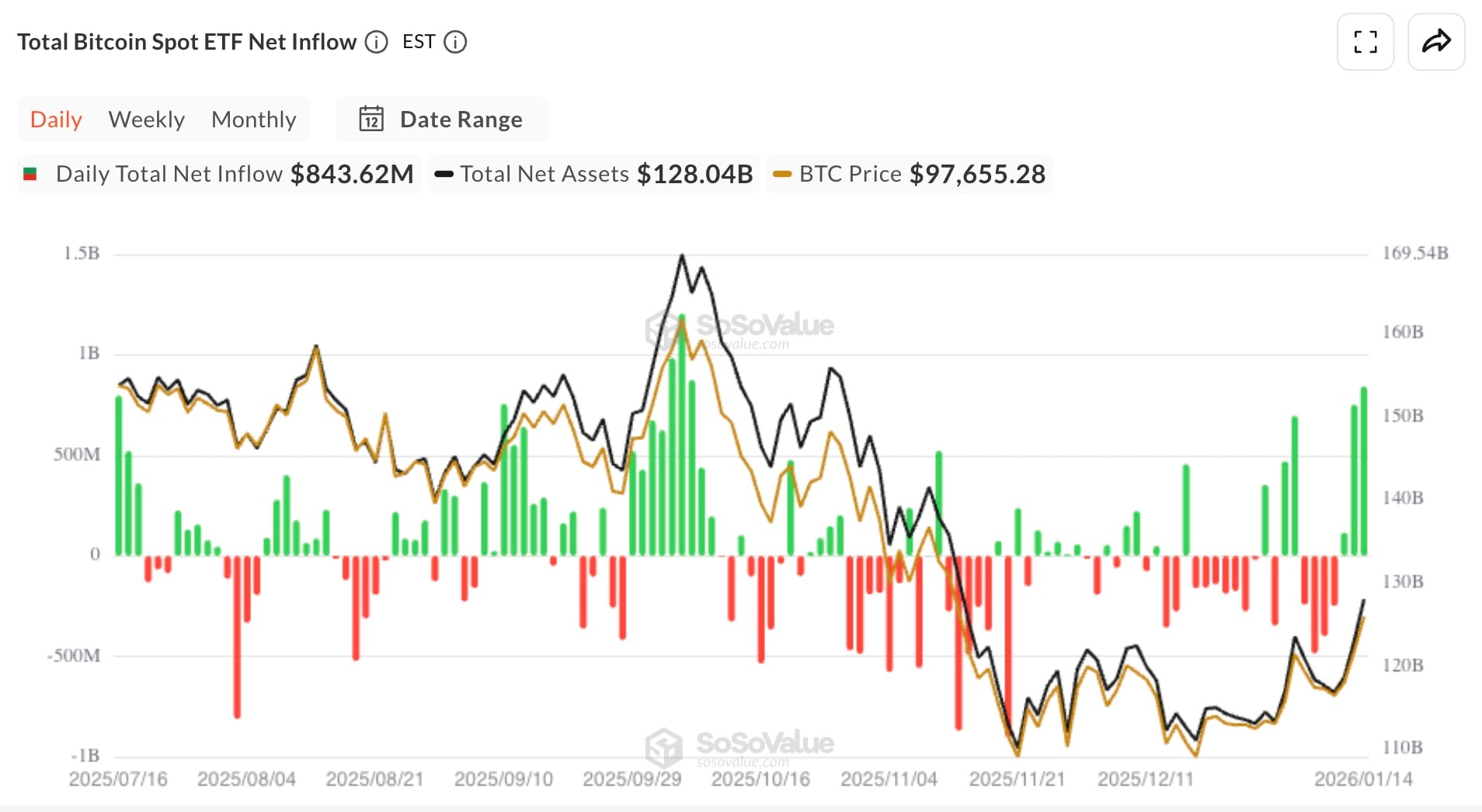

It looks like Bitcoin has finally found its real support level, and it is not from price charts but from institutions. According to SoSoValue, on Jan. 14, spot Bitcoin ETFs got a net inflow of $843.62 million. This was their second-largest daily intake since launch, and it wiped out a week of outflows in a single shot.

The total cumulative net inflow is above $58.1 billion, while total assets across all funds hit $128.04 billion, now accounting for 6.56% of Bitcoin's market cap.

The BlackRock iShares Bitcoin Trust (IBIT) alone absorbed $648.39 million, setting a new daily record for the fund as its net assets surged past $76 billion. Fidelity's FBTC came in second with $125.39 million, and Ark 21Shares' ARKB brought in $27 million.

Even smaller players like Valkyrie and Franklin had good flows, despite tighter fee compression across the board.

2 triggers behind $840.6 million Bitcoin ETF surge

This aggressive capital rotation comes after a volatile early January, when outflows exceeded $1.3 billion between Jan. 7 to 9. Last week, we saw a total net inflow of $1.71 billion, which is a complete reversal from earlier trends. This suggests that institutions are starting to accumulate again, possibly because they are anticipating further Q1 CPI relief and a rate cut.

At the same time, the Bitcoin price hit $96,951 before pulling back a bit, keeping the $100,000 mark in play. If ETF inflows keep up this pace for a few more sessions, BTC's total spot ETF ownership might go over 7% for the first time, with implied liquidity pressure pushing toward the next psychological ceiling at $107,000 per BTC.

Bitcoin's ETF-backed attempt is now doing what demand and excitement could not: pushing supply-side exhaustion into a market structure that is wearing thin. This might not just be a bounce; it is beginning to look like a proper breakout with backing.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov