Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

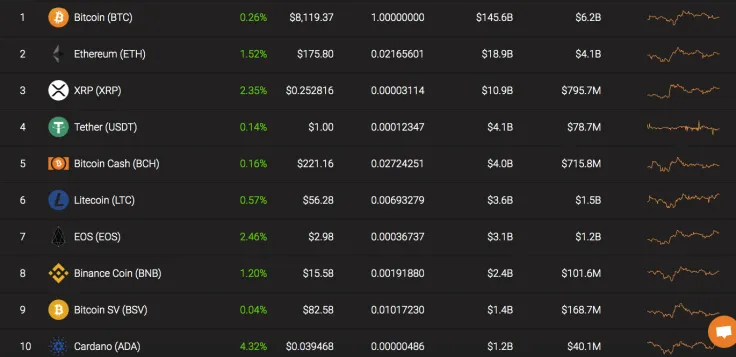

Since October 2, the cryptocurrency market has been located in a sideways against neutral news background. The indicator of the total market capitalization has decreased, and at the current moment, its value makes up $217 Bln.

Regarding Bitcoin, its rate is likely to go down due to both, technical and fundamental factors. Concerning the news background, the launch of Bakkt futures has not positively affected the cryptocurrency market. Moreover, according to the survey, BTC is not an attractive investment for the majority of Americans.

|

Name |

Ticker Advertisement

|

Market Cap |

Price |

Volume (24h) Advertisement

|

Change (24h) |

|

Bitcoin |

BTC |

$147 044 662 154 |

$8 180,83 |

$12 160 402 650 |

0,26% |

BTC/USD: A Sideways Trend Followed by a Possible Decline

Our earlier Bitcoin price prediction remains relevant as the price is still above the crucial $8,000 mark.

On the 1H chart, there was a fixation below the mirror level, which quite often served as a price rebound point. Before consolidation above this level, the priority remains of the downtrend movement. Most likely, the local decline will continue within the lateral descending channel, after which one can expect a price increase.

On the 4H chart, bulls failed to complete the Double Bottom pattern, and the RSI indicator is below the 50 mark. Against these reasons, the market is still dominated by bearish sentiment and, therefore, there is a high probability of falling below the key mark of $8,000.

Bitcoin is trading at $8,143 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov