Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

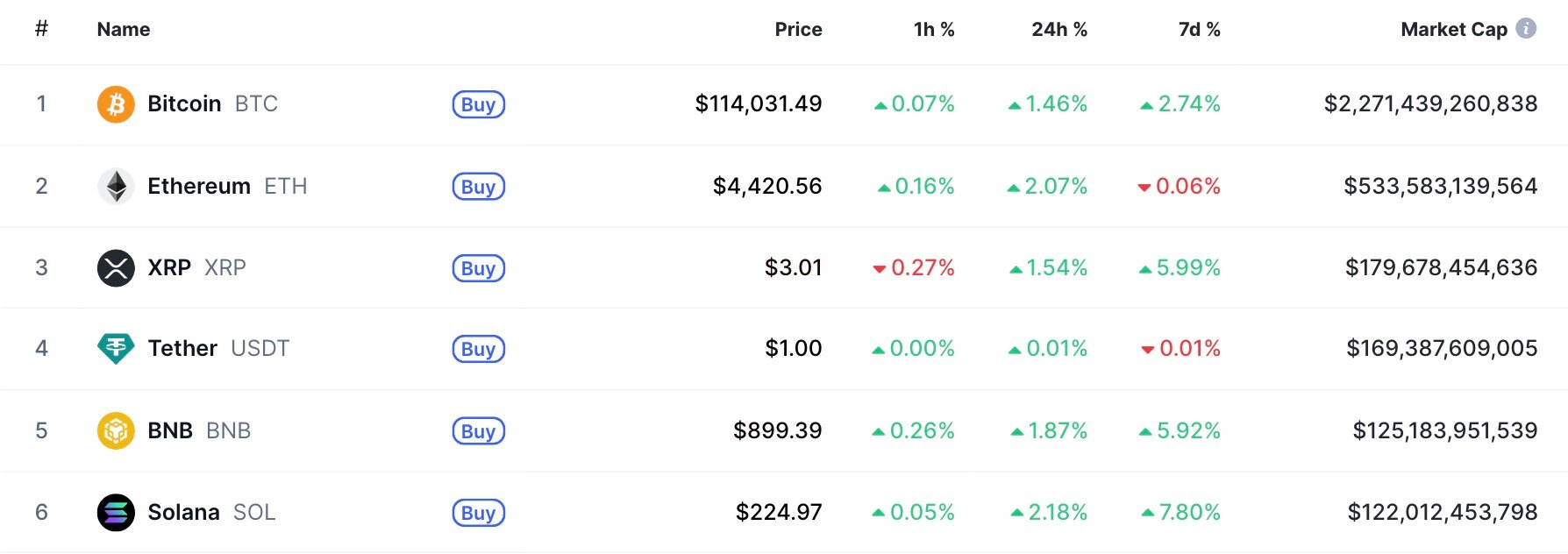

Binance Coin (BNB) is once again in the news, reaching a new all-time high of $903, although it has since fallen back a bit to $899.46. Nevertheless, the rally lifted BNB's market cap above $125 billion, enough to push it past Solana's $121.7 billion and reclaim the number five slot among top cryptocurrencies by CoinMarketCap.

The breakout was backed by BNB Network Company, part of CEA Industries, which confirmed they bought 30,000 BNB, directly boosting the token as it broke through long-term resistance.

Moreover, a recent partnership between Binance and $1.6 trillion firm Franklin Templeton accompanied the price record as well.

What is happening now looks less like a simple change in rankings and more like a clash between two of the biggest crypto businesses. BNB has the price action and corporate demand in its favor, while Solana is the more actively traded token by a wide margin.

Thus, in the last 24 hours, BNB had $2.86 billion worth of trades, which is much less than Solana's $8.43 billion. However, market capitalization — the ultimate way to measure size — has now moved in BNB's favour.

BNB or SOL?

The main difference is that SOL is a native token of one of the most active blockchains right now, while Binance Coin represents a sort of exposure to the world's biggest crypto exchange.

Ironically, one represents the centralized exchange and the other is more about the decentralized side of crypto.

Solana (SOL), on the other hand, made the news on its own. It just became known that Forward Industries raised $1.65 billion in a private round, a mix of cash and stablecoins, to fund Solana's treasury management strategy.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov