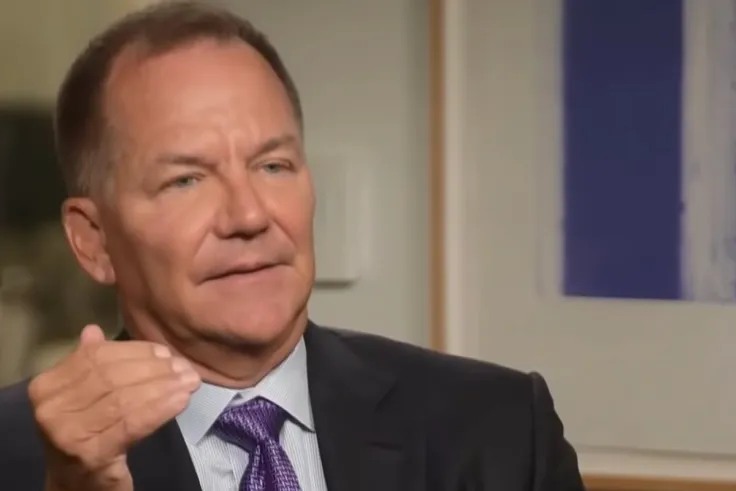

During a recent CNBC interview, billionaire Paul Tudor Jones predicted that a massive rally could take place next year.

However, this blow-off top will likely be followed by a massive 2000-style crash, according to the billionaire.

"Party like it's 1999"

Jones believes that the markets are reminiscent of 1999, the year when the massive dot-com bubble was on the verge of reaching its peak. He recalled that the Nasdaq doubled within just several months (from October 1999 to March 2000).

"So if it looks like a duck and quacks like a duck, it’s probably not a chicken, right?" he quipped.

Tudor Jones is not certain that the same exact scenario will play out this time around, but all the ingredients are already in place. In fact, the current setup is "potentially much more explosive" compared to 1999, the Tudor Investment Corporation founder argued.

Instead of hiking rates with a budget surplus like in 1999, the Fed is set to implement several rate cuts with a 6% budget deficit, which has not been seen since the post-war period," he noted.

Bitcoin among big winners

The current performance of major markets indicates that there are concerns about inflation, according to Jones.

The legendary investor has noted that Bitcoin is currently among the "biggest winners" alongside gold.

"So, it's really what retail jumps on. So, crypto, digital, gold, that's obviously something that's very, very appealing," Tudor Jones told CNBC earlier today.

The legendary hedge fund manager says that the winning portfolio would be some combination of Bitcoin, gold, and the tech-heavy Nasdaq 100 index.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov