Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

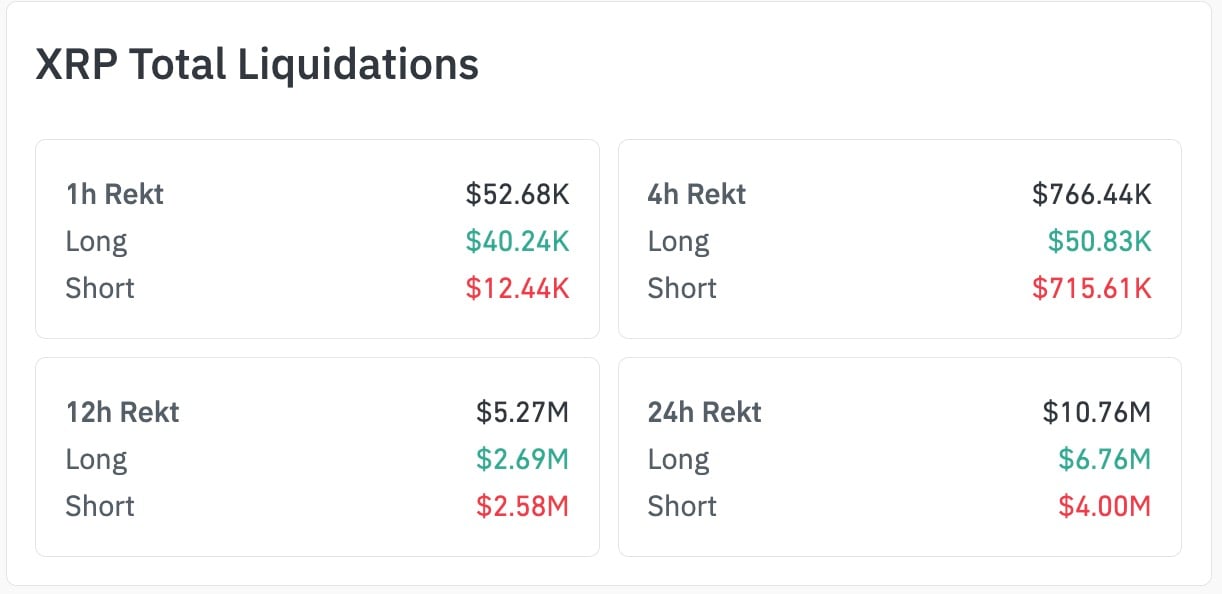

It is not just another red candle; XRP just had one of its most distorted liquidations at the start of February. Short positions got hit hard, with CoinGlass showing a $715,610 short liquidation versus just $50,830 in longs over a four-hour window — a wild imbalance of 1,407%.

This liquidation spike was not an isolated event. It followed a rough few weeks in late 2025 that took XRP from above $3 down to $1.53, before a slight recovery to $1.63. But that bounce might have just been enough to trigger forced closures for short-sellers, who were overleveraged and betting on a steeper flush below the $1.50 zone.

Even across the 24-hour period, $4 million in shorts were liquidated versus $6.76 million in longs — a rare pattern reversal after a weekend of bearish dominance. The four-hour print is still the most surprising; it could be an isolated whale trap or algo-induced short squeeze.

What about XRP price?

The XRP price is up 2.9% today, but the overall downward trend is still running. XRP is still below its December low, and it is not even close to hitting the key resistance at $1.89 or $2. If the squeeze was just mechanical and not fundamental, there is plenty of downside risk still.

The technical setup does not offer much comfort. XRP managed to hold onto a local support level, but the next target is looking like it will be around $1.45. Higher time frame charts still show a bearish trend.

Thus, we have one question to answer here: was this imbalance a reversal signal or a liquidation echo? History shows that short-side wipes usually only result in temporary relief, and they rarely lead to a full cycle bottom.

If XRP does not bounce back above $1.80-$2 soon, it might be a sign that the market is overreacting.

For now, the 1,407% liquidation gap is just a one-time thing, but if the bulls cannot build on it, it will be seen as a short-term, costly misstep by those who are too pessimistic.

Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide Arman Shirinyan

Arman Shirinyan Caroline Amosun

Caroline Amosun