Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

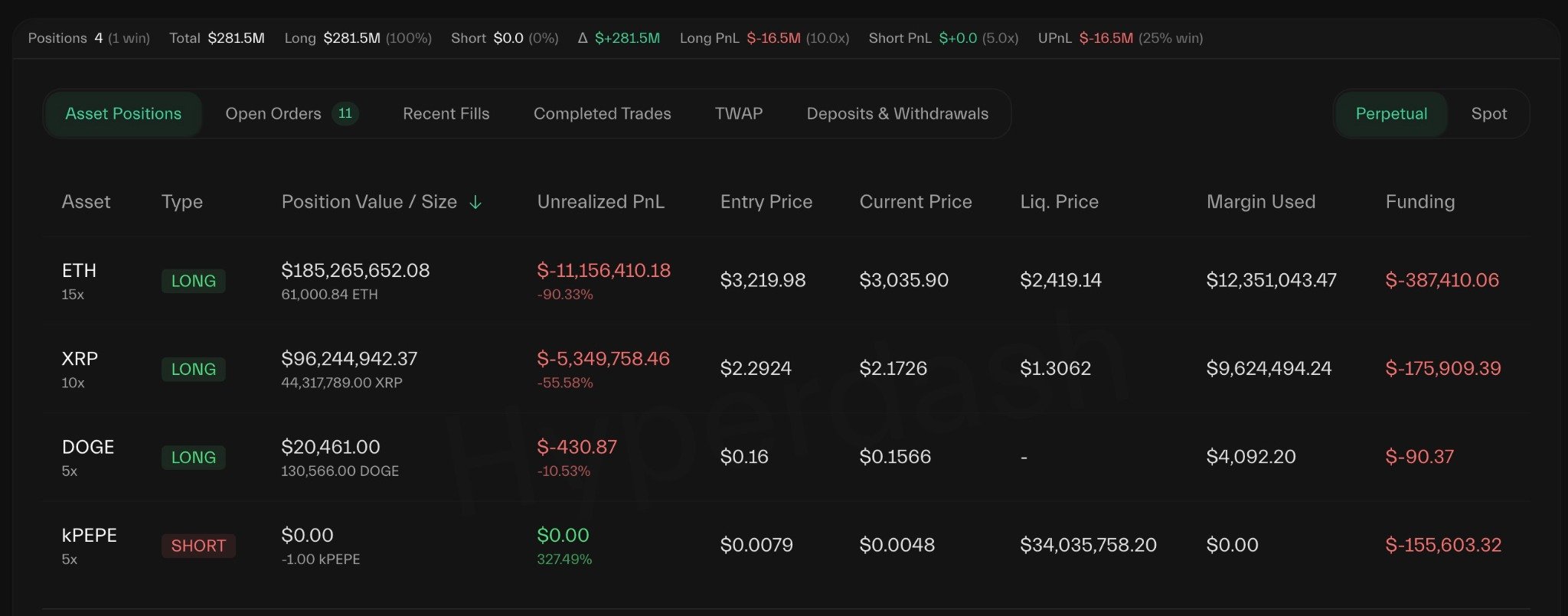

Anonymous $96 million leveraged long on XRP came into the spotlight thanks to HyperDash data. The trader is now sitting on a loss big enough to ruin the entire account, dropping more than 50% from entry and dragging margin usage into a zone where a cross-position bleed poses a bigger threat than the liquidation level itself.

The trader entered XRP at $2.2924 with 10x leverage and technically maintains a liquidation line deep below the market at $1.3062. But the real danger is not the price tag on that line, it is the way the rest of the portfolio is collapsing and eating into shared collateral at a speed that can force-liquidate well before XRP ever gets close to that number.

ETH is down over $11 million, DOGE is red, funding is negative across the board and the account shows a combined unrealized drawdown of more than $16.5 million. Cross-margin engines do not wait for the textbook liquidation price when total equity is melting; they simply track whether the remaining buffer can cover risk across all baskets.

When the entire book is stacked on the long side and every leg is bleeding simultaneously, the liquidation of one asset can trigger another, even if its own chart still trades miles from its critical threshold.

XRP trader faces brutal drawdown

For XRP specifically, the current range around $2.17-$2.24 keeps the long alive, but the margin cushion is already fractured: $9.62 million consumed, 55% loss on the position itself and a combined $12.98 million account loss over 24 hours.

At that point, the liquidation math becomes dynamic: if ETH slides further or if the account prints another multimillion loss streak, the XRP long can be auto-closed long before the market ever touches $1.50, let alone $1.30.

So, the path forward is not about whether XRP dumps straight into the lower range. It is whether the trader can survive the systemic pressure of synchronized losses across all open longs.

The liquidation line is $1.3062 on paper. In real cross-margin terms, it can arrive at any moment the account equity breaks under the combined weight of the rest of the portfolio.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov