Binance, the world's biggest cryptocurrency exchange by trading volume and user count, just published its annual end-of-year report demonstrating the most crucial achievements and breakthroughs.

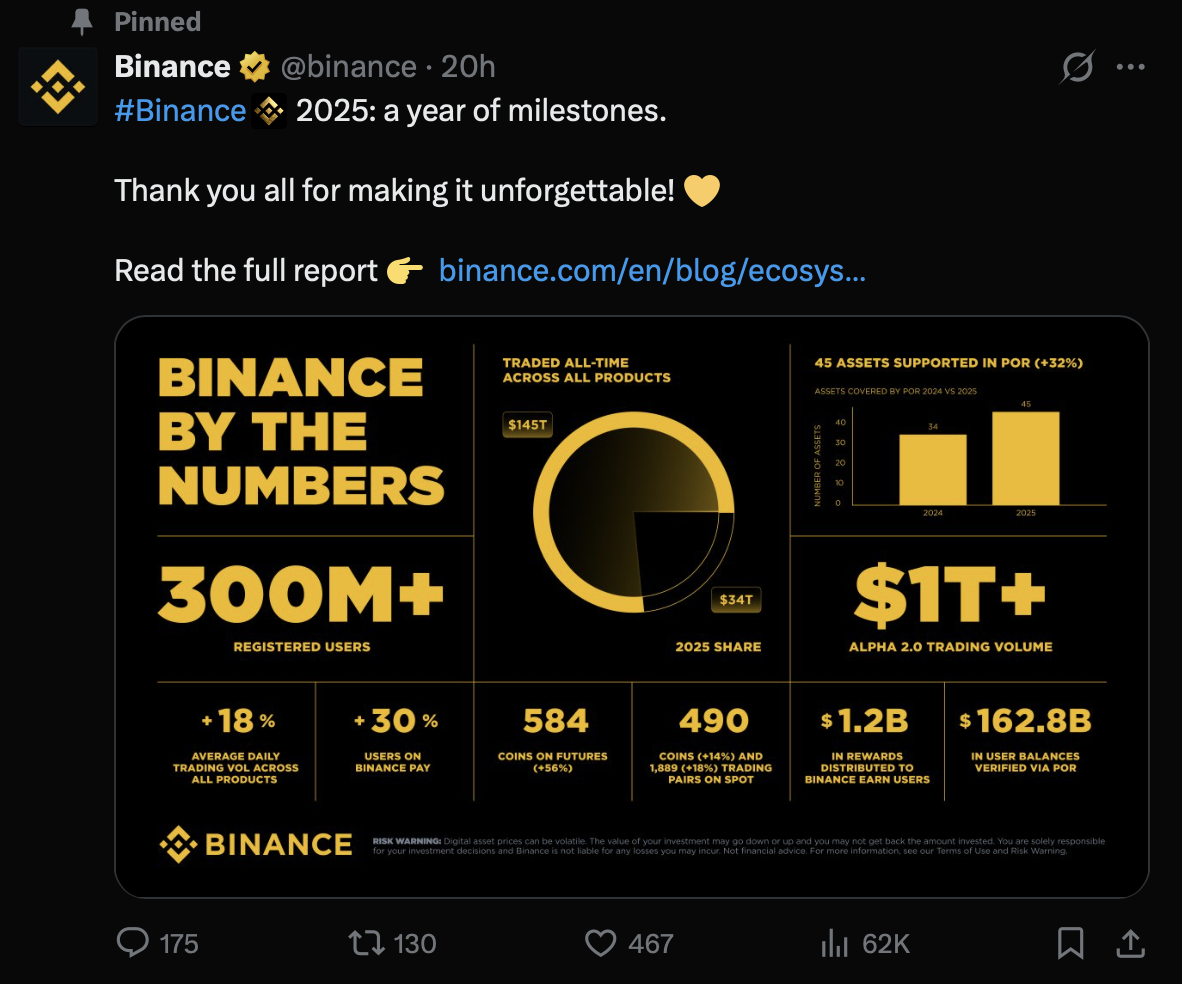

$34 trillion in transactions, 300 million users: Big year for Binance ecosystem

In 2025, Binance became the first global exchange to secure full authorization under ADGM’s internationally recognized framework and crossed 300 million registered users worldwide, signaling a new phase, in which scale and regulatory scrutiny advance together.

In total, Binance (BNB) added support for 490 spot listed assets and almost 1,900 trading pairs. USDC accessibility was boosted by a long-term partnership with Circle.

Crypto Futures' trading toolkit was enhanced by the Smart Money tracking tool. It allows the audience to track and follow the most successful futures traders in real time.

Binance remained a primary venue for global crypto liquidity, with $34 trillion traded on the platform in 2025 and spot volume exceeding $7.1 trillion, alongside an 18% increase in average daily trading volume across all products.

Binance Alpha steals spotlight, makes self-custody trending

Crypto’s center of gravity expanded beyond the order book, as Binance Alpha 2.0 surpassed $1 trillion in trading volume with 17 million users, while Binance’s security, compliance, risk and governance efforts delivered measurable user protection outcomes at scale.

Yi He, co-CEO of Binance, is excited by the role of Binance Alpha 2.0 in the global crypto ecosystem, its endeavors and massive adoption:

Alpha illustrates how the definition of "trading on Binance" has changed from a placing orders on orderbook to discovering new ecosystems, earning rewards for early participation, and moving fluidly between centralized and on-chain environments.

Advertisement

Bringing institutional-focused services was another focus for Binance this year. In 2025, Binance took a major step in institutional innovation by integrating the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) as eligible off-exchange collateral, followed by USYC and cUSDO — among the first solutions of their kind at scale in crypto.

In 2025, Binance and Franklin Templeton — a $1.6 trillion AUM manager and leader in compliant tokenization — began collaborating on digital asset initiatives that bring tokenized securities and institutional-grade blockchain products to a broader investor base.

This year, Binance is going to expand on the basis of all these accomplishments, in the era of AI, RWAs, institutional adoption and self-custody.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov