Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

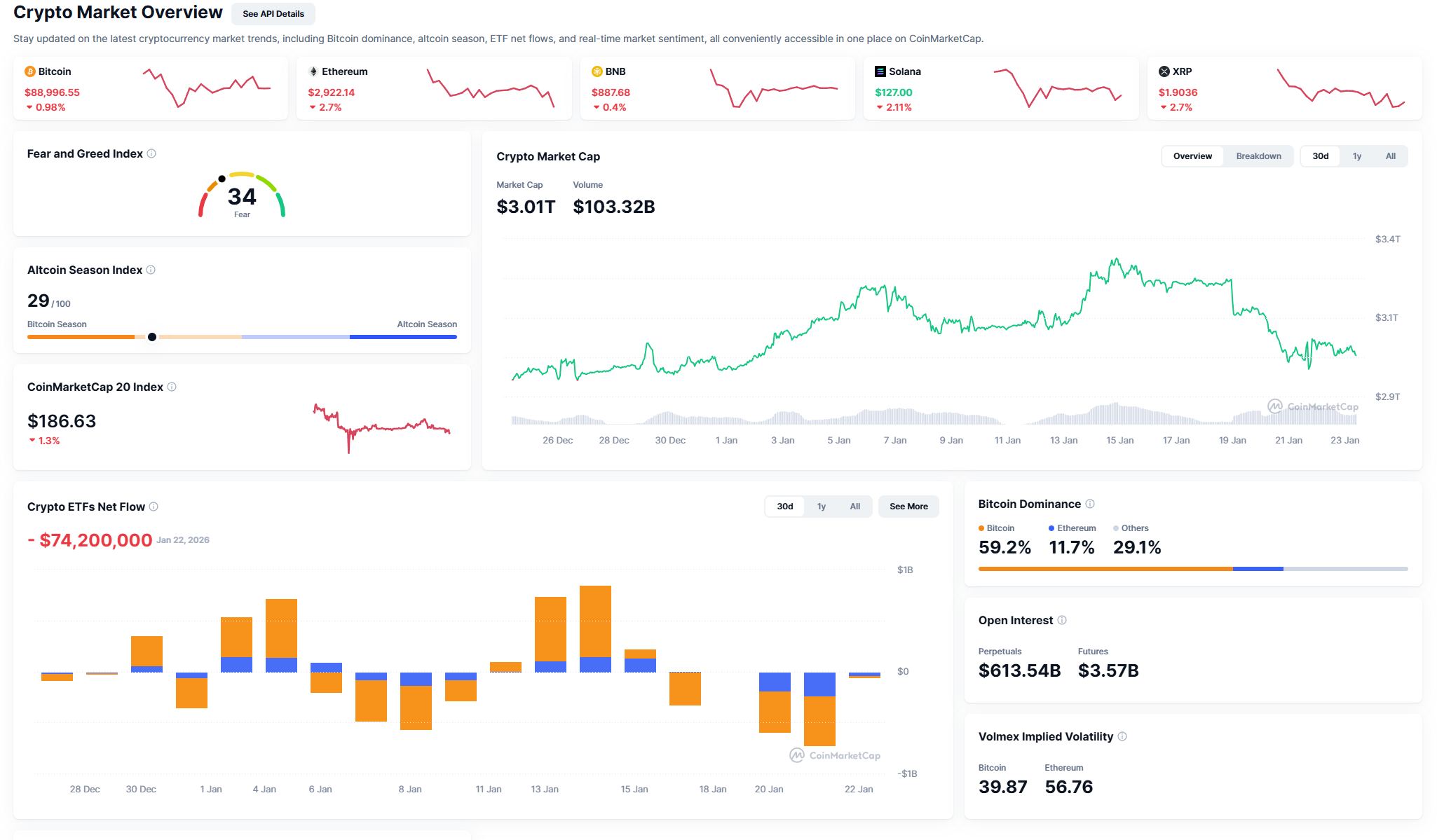

As total market capitalization tries to maintain the $3 trillion level, the cryptocurrency market is on the verge of losing a crucial threshold that determines its long-term health. The majority of major assets have dropped over the last few days due to widespread selling pressure, which has erased a large amount of January's gains and strongly shifted sentiment toward caution.

State of the market

This is a structural pullback rather than a panic attack, which compels investors to reevaluate risk in general. The market's direction is still mostly determined by Bitcoin, and a large portion of the current anxiety can be explained by its chart. The $90,000-$95,000 range, which currently serves as strong resistance, has repeatedly eluded BTC.

The inability to produce follow-through buying above important moving averages indicates waning momentum, and the price is compressing close to local support. Because of its substantial portion of total capitalization, Bitcoin runs the risk of pulling the market as a whole lower if it keeps trading below this range.

Ethereum's troubled state

For the time being, Bitcoin is in a decision zone, where either a recovery will boost confidence or more rejection will quicken the downward pressure. The performance of Ethereum raises additional questions. ETH is having difficulty regaining momentum above short- and midterm averages and has fallen back below the psychologically significant $3,000 mark.

From a market-wide standpoint, Ethereum's inability to take the lead during recovery efforts is concerning. ETH frequently serves as a link between Bitcoin and the larger altcoin market, and its poor performance implies that risk tolerance is still low. It is unlikely that capital rotation into smaller assets will become stronger until Ethereum can recover and maintain important resistance levels.

Market metrics show defensive positioning outside of individual charts. ETF flows and derivatives data indicate less exposure and less conviction, while the Fear and Greed Index has moved further into fear territory. Instead of anticipating a recovery, investors are obviously waiting for confirmation.

Expectations are currently divided: bears view the recent rejection as evidence that the market needs more deleveraging, while bulls are waiting for a technical bounce from current support levels to defend the $3 trillion market cap.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin