Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

A small 1.43% dip in the price of XRP was enough to blow up long positions and print a wild 1,694,200% liquidation imbalance in just one hour, showing how euphoric bullish traders became on the bounce.

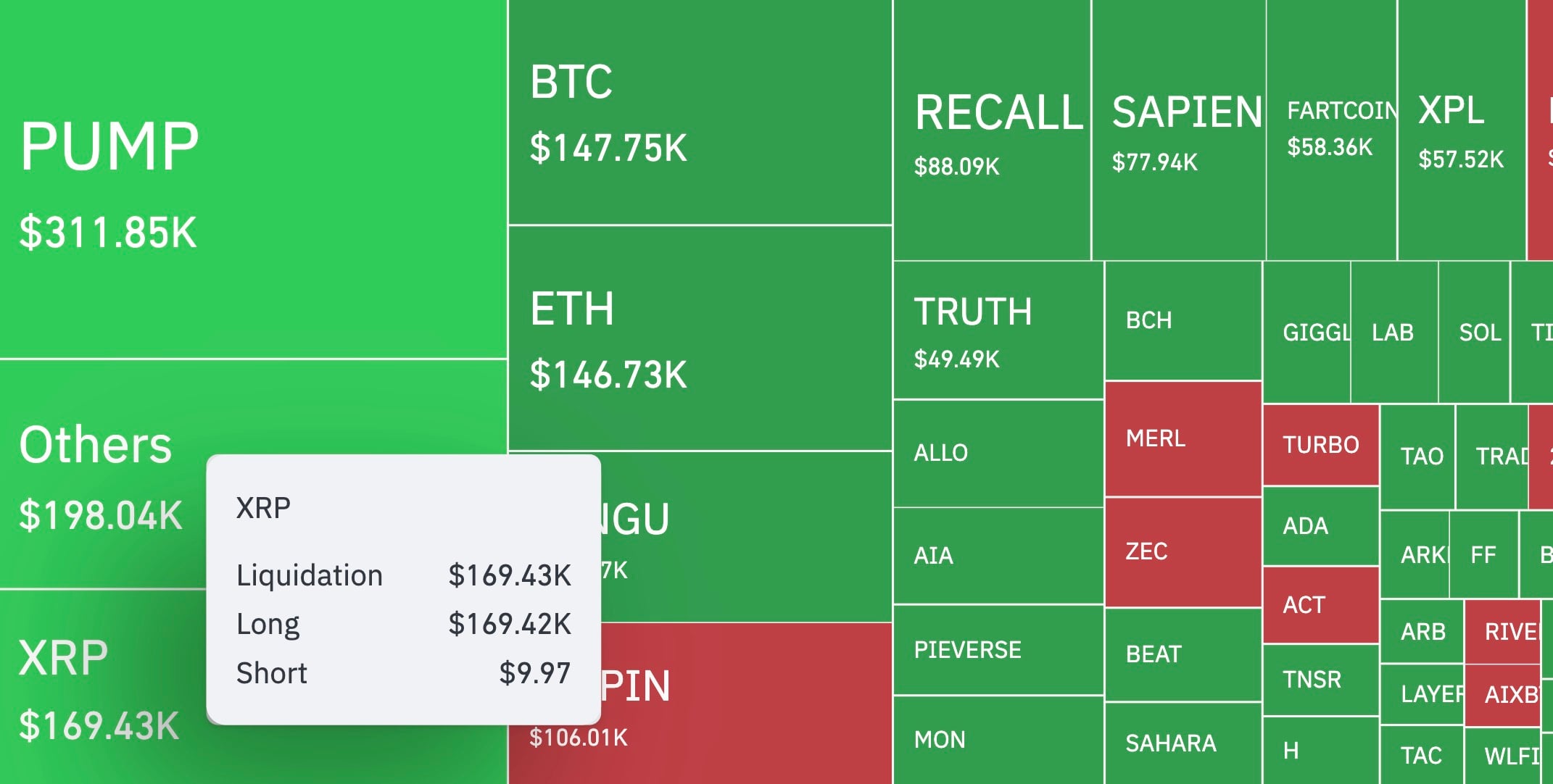

Despite the overall uptick in the price, the cryptocurrency market remains in a fragile state, as evidenced by the Fear & Greed Index, which currently sits at 27 — fear. The derivatives market, especially the liquidation heatmap, is perhaps the best indicator of what is happening in crypto right now. CoinGlass's heatmap recently demonstrated the pitfalls of positioning, with XRP emerging as a stark example.

Over the last hour, the total liquidated leveraged positions on XRP derivatives amounted to $169,430, which is not a large sum compared to the $4.52 million liquidated overall during this period. However, the breakdown is astonishing: less than $10 came from liquidated shorts, and longs lost every other cent. That is an imbalance worth 1,694,200% printed in just the last hour.

What caused such an abnormal disruption in the XRP derivatives market was a slide in the token’s price of about 1.43%. The number itself is not large, but it demonstrates how recklessly overleveraged long-side traders were. A move of less than 1.5% in XRP’s price was enough to produce a 1,694,200% imbalance in liquidations.

XRP upside down

This tendency is evident on the broader heatmap for the last hour, where liquidated longs prevailed over shorts at a ratio of 3:1. The wider 24-hour picture, however, indicates the opposite: $203.17 million in liquidated shorts and $107.42 million in liquidated longs.

Judging by this, it can be thought that bulls became too euphoric on the rebound and increased risks to the point where even a small dip was enough to flip the situation upside down in just hours.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov