Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Stellar (XLM) might witness a price rebound as the asset is witnessing a breakout in a critical metric in the last 24 hours. Stellar, which has recorded massive price slips in the last 30 days, has shed 6.59% of its value within this period.

Stellar's volume spike could catalyze price rebound

As per CoinMarketCap data, Stellar’s trading volume has jumped by over 36% in the last 24 hours. As of press time, volume is up by a significant 36.18% at $302.7 million. The rise in volume suggests that investors could be anticipating a price reversal soon.

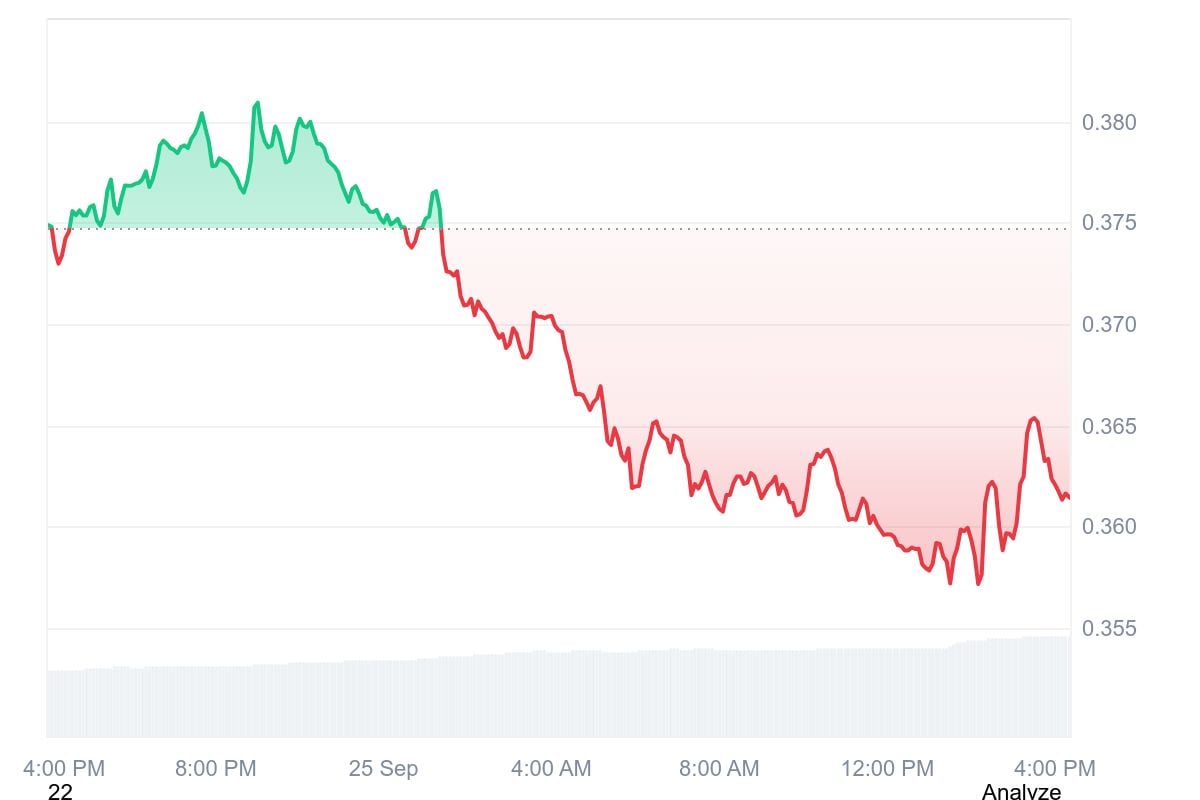

Although the asset continues to experience fluctuations on the cryptocurrency market, it has shown potential to climb out of the red zone. Stellar has, within this time frame, risen from a low of $0.3556 to a peak of $0.3813. Currently, it is exchanging hands at $0.3653, which represents a 1.38% decline.

The good news for XLM holders is that the asset is still trading above the $0.361 support. If the current spike in volume is sustained, it could catalyze a pull on the price along with it.

Additionally, broader market developments such as the institutional adoption of Stellar by Visa could support a bullish rally. Notably, in July 2025, the card payment giant added the blockchain to its stablecoin settlement platform.

The move allows Visa users to settle transactions directly on the Stellar network, thereby increasing the cross-border flow of funds. The model ensures that transactions remain cheap and fast.

Can Stellar rebound to $0.50 before September ends?

At the start of September, Stellar holders were optimistic of a bullish month based on historical precedent. With an average growth rate of 3.08% and having registered a 6.24% growth rate in 2024, many investors looked forward to a repeat performance.

The community targeted a flip of over $0.50, but performance so far has not lived up to the expectations of investors. Stellar has the next five days to align with history and make one final push for a bullish September.

Market watchers will be keen on seeing if the current surge in volume will linger and its possible impact on price.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin