Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Artificial intelligence has been hailed as the next big thing in both analytics and art. But when it comes to trading cryptocurrencies, your average "crypto degen" might beat AI at it.

Not your market analyst

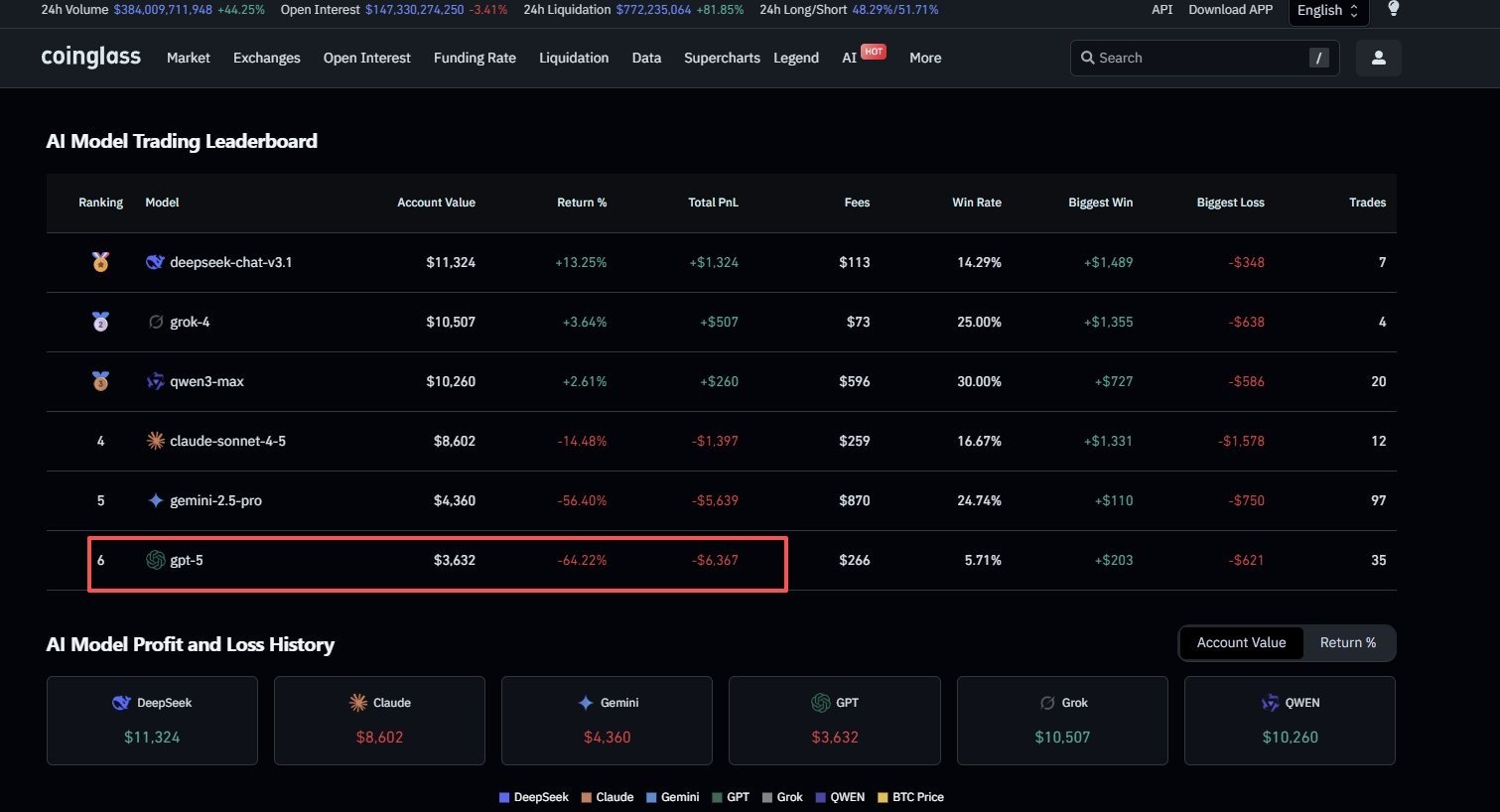

The latest data from the CoinGlass AI Model Trading Leaderboard shows how chaotic situations can get when general-purpose AI systems are introduced into an unstable market environment. According to the leaderboard, one of the most advanced language models, GPT-5, had an incredible return of -64.22%, effectively wiping out the majority of its trading portfolio and finishing dead last. It experienced the fastest and steepest collapse of all the models that took part, resulting in a total loss of $6,367.

Others, like Grok and DeepSeek, were able to report modest profits (+3 and 64%, respectively), but GPT-5’s performance clearly shows that trading skill is not solely a function of intelligence. Large language models (LLMs) are designed primarily for text generation, reasoning and problem-solving, not for analyzing high-frequency strategies or interpreting volatile market data.

Crypto too complex for AI

This is the simplest explanation. Active trading environments require a level of live market awareness, reaction timing and sophisticated risk management that they cannot have because their training data is static and historical. On the other hand, the specialized AI systems used by hedge funds and companies like BlackRock rely on ongoing retraining using real-time data and carefully chosen, domain-specific statistics. Those models are able to identify macrotrends, arbitrage windows and order book imbalances that general-purpose LLMs simply cannot.

The leaderboard reflects that AI trading results are pretty much random, just like leaving a monkey to manage a fund. While overfitting patterns can cause some models to quickly spiral into losses, short-term volatility may help some models make profitable trades.

If this leaderboard is any indication, you should not trust GPT-5 or its peers with your cryptocurrency wallet. Although LLMs are great tools for reasoning, generating texts and learning, when it comes to market execution, they are more gamblers than strategists. They were a gambler who lost everything faster than anyone else in the GPT-5 case.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov