Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

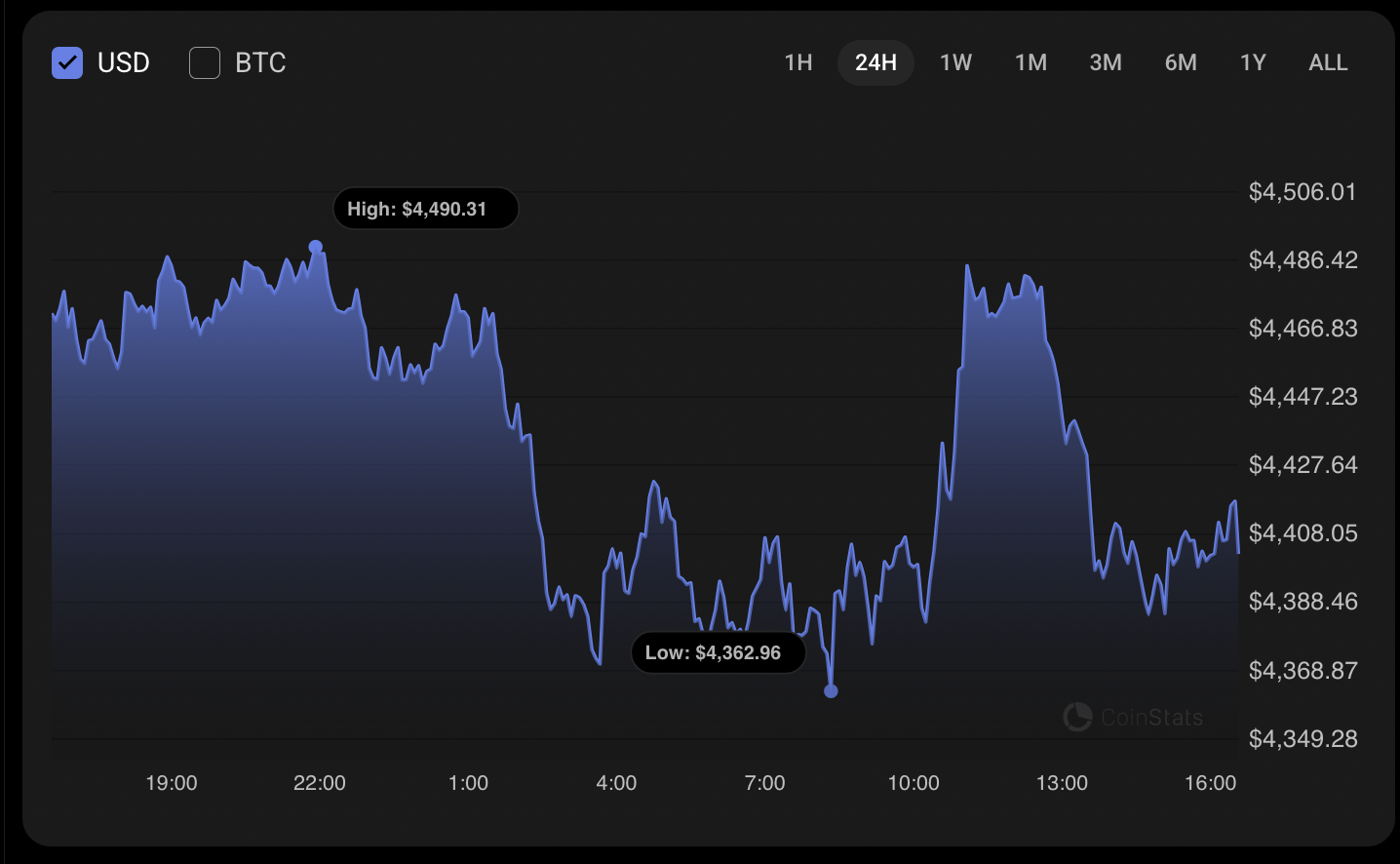

The market is mainly bearish on the first day of the month, according to CoinStats.

ETH/USD

The rate of Ethereum (ETH) has dropped by 1.34% since yesterday.

On the hourly chart, the price of the main altcoin is near the local support of $4,360. If the daily bar closes around that mark or below, there is a high chance of a test of the $4,300 zone by tomorrow.

On the bigger time frame, the situation is less clear. The rate of ETH is far from the key levels, which means neither side has enough energy to seize the initiative.

The volume is going down, confirming the absence of bulls' and bears' energy. All in all, sideways trading around the current prices is the more likely scenario.

From the midterm point of view, the picture is similar. The week has just started, which means it is too early to make any far predictions. Buyers may only start thinking of a further upward move if a breakout of the vital $5,000 zone happens.

Ethereum is trading at $4,394 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov