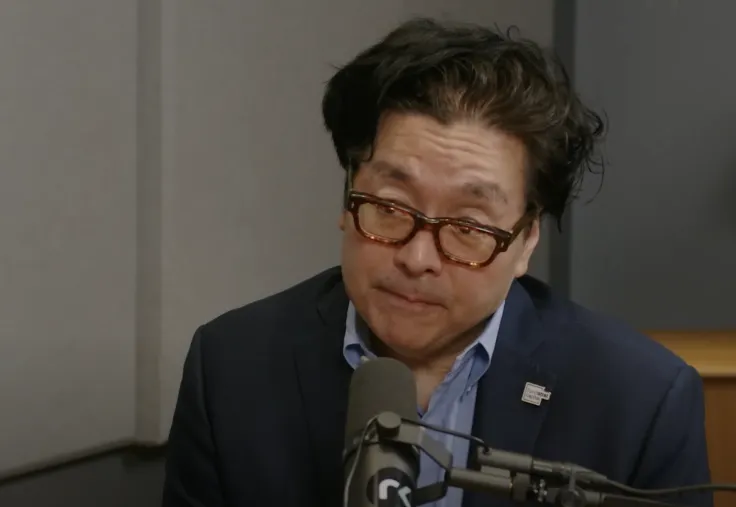

Tom Lee is staring down a $7 billion hole in his balance sheet, but Wall Street's most famous permabull appears to be unfazed (at least on social media).

The Fundstrat co-founder and vocal crypto bull took to X (formerly Twitter) on Tuesday to defend BitMine (BMNR), the Ethereum treasury company he champions, against scathing criticism regarding its massive unrealized losses.

BitMine’s aggressive accumulation strategy has left it underwater by approximately $6.6 billion. However, Lee still believes that ETH is the "future of finance."

"Exit liquidity" accusations

The defense came in response to a viral post by crypto trader "Flood" (@ThinkingUSD). The chartist argued that the sheer size of BitMine’s underwater position could actually threaten the Ethereum ecosystem due to massive potential selling pressure.

The fear is that the company effectively created a "future ceiling" on ETH prices.

"BMNR is now sitting on a -$6.6 Billion dollar unrealized LOSS on the ETH they've accumulated," Flood wrote. "Tom Lee was the final exit liquidity for OG ETH whales to get out of their worthless token."

"It's not a bug, it's a feature"

Lee, who was credited with reviving ETH last year, attempted to frame the gargantuan losses as the natural mechanics of an asset-tracking vehicle.

He argued that critics were fundamentally misunderstanding the purpose of an Ethereum treasury.

"These tweets miss the point of an Ethereum treasury," Lee countered. "BitMine is designed to track the price of $ETH... crypto is in a downturn, so naturally ETH is down."

He went on to deliver a memorable soundbite regarding the billions in red ink: "It’s not a bug, it’s a feature."

Lee further challenged the double standard applied to crypto companies, asking, "Shall we call out all index ETFs for their losses?"

As reported by U.Today, Lee recently admitted that crypto had performed worse than expected. Lee partially attributed the meltdown to uncertainty surrounding the new Fed pick, Kevin Warsh, spooking the market.

Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin Denys Serhiichuk

Denys Serhiichuk